Eurex Improve

Full execution at best available price

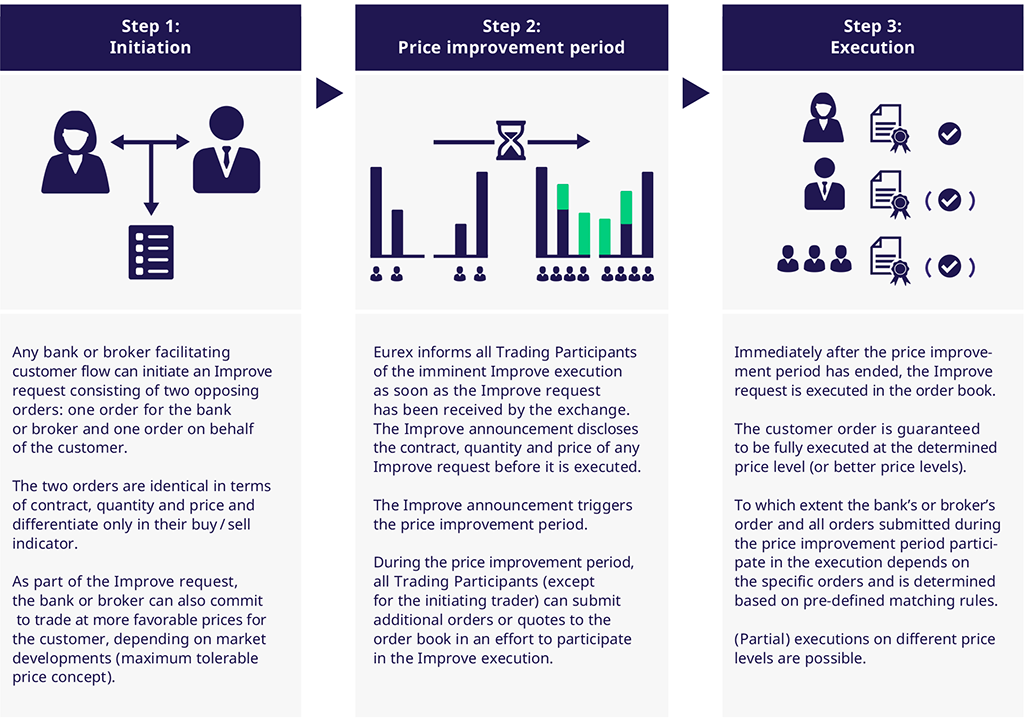

Eurex Improve provides Trading Participants with a tool suited to guarantee their customers complete execution of orders below minimum block trade sizes at the best available price. Execution at this best available price is ensured as Eurex Improve is fully integrated into Eurex’s order book and benefits from the order book’s pricing competition. It is available for all equity and equity index options. Eurex Improve automatically fulfills the best execution standards defined by MiFID II.

With Eurex Improve, Eurex allows flow providers (banks or brokers) to continue offering liquidity to their non-Eurex customers, under certain price conditions. First, the trade is agreed between customer and flow provider and, afterwards, offered for execution into the public order book to check the availability of better prices (from the customer point of view) posted by other market participants. The Eurex Improve mechanism is fully compliant with the transparency regime of MiFID II.

The functionality therefore offers significant advantages to all parties involved:

- Flow providers, who can now benefit from an additional tool to execute transactions requested by its clients, with a size below minimum block trade size

- Customers, who have the possibility to achieve a price improvement

- Whole market and, particularly, to liquidity providers, by encouraging a tightening of the spreads available in the public order book

Buyside electronification and Eurex Improve – a perfect fit!

Industry viewpoint by Andre Eue and Markus-Alexander Flesch in Best Execution magazine

- Benefits

- Functioning

- FAQs

- Tutorial

Eurex Improve adds value to the overall market structure, by providing advantages to all involved stakeholders -

Learn how it works:

- The customer is guaranteed full execution of their order at a determined price level or better price levels.

- Banks and brokers are provided with a tool to generate additional customer flow, as they can ensure full execution of their customers' orders below minimum block trade sizes.

- Liquidity providers have the opportunity to engage with order-flow which otherwise might have been executed without their participation. Once an Improve request has been announced, execution of the customer order is guaranteed.

Tutorial: initiate an Improve request via the Eurex T7 GUI

No content displayed? By accepting our cookies you enable video features, improve your site experience and support our marketing efforts.

Contact

Markus-Alexander Flesch

Market Development & Pricing

T +41-43-430-71 21