Dec 10, 2018

Eurex | Eurex Clearing

The Eurex Euro-Bund / Euro-Bobl / Euro-Schatz Butterfly – What's next?

The Eurex Euro-Bund / Euro-Bobl / Euro-Schatz Butterfly is probably the most monitored Relative Value trade in European Fixed Income Derivatives and given the depth of liquidity in Eurex's German Benchmark Government Bond Futures with the benefit of Eurex Clearing's innovative Prisma portfolio margining system generating significant margin savings, the butterfly offers a very efficient and leveraged means to generate alpha by trading the shape of the German Government Bond Yield Curve.

Structuring a Eurex Euro-Bund / Euro-Bobl / Euro-Schatz Butterfly

Diagram 1: Eurex Euro-Bund, Euro-Bobl & Euro-Schatz Futures

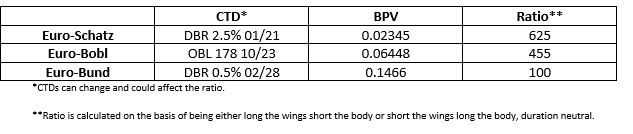

All of Eurex Fixed Income Futures are based on a notional bond and coupon with a defined delivery basket of deliverable bonds with a conversion factor used at delivery to put the deliverable bonds with differing coupons on a common basis of delivery with the seller/short of the Bond Future being able to determine which bond from the delivery basket are delivered. Therefore, the interest rate volatility of a Bond Future, assuming Bond Futures track the cheapest to deliver bond (CTD) in the delivery basket, is, at any moment of time, referred to as being: BPV CTD / CF CTD where BPV CTD is the value of an .01 change of yield of the cheapest to deliver bond in the delivery basket and CF CTD is the conversion factor or price factor of the cheapest to deliver bond. Taking the March '19 Euro-Bund, Euro-Bobl and Euro-Schatz contracts ( delivery date for December '18 delivery month contracts is 10th December 2018), this gives:

Diagram 2: BPV of Euro-Bund, Euro-Bobl & Euro-Schatz - March '19

Margin Efficiencies for Euro-Bund / Euro-Bobl / Euro-Schatz Butterfly with PRISMA Portfolio Margining

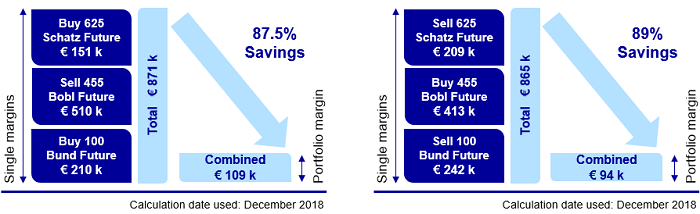

Eurex Clearing's innovative PRISMA margining system seeks to margin products on a portfolio basis within a set Liquidation Group. A Liquidation Group combines products that share similar risk profiles. Liquidation Groups serve as the cornerstone of the Prisma risk margining methodology (and default management) with full margining capabilities per group. For example, the Fixed Income Liquidation Group comprises of Fixed Income and Money Market Futures & Options, OTC IRS and Inflation Swaps. Liquidation Groups are pre defined, each Liquidation Group has a fixed Liquidation Horizon / Margin Period of Risk (MPOR) - for Fixed Income and Money Market Futures & Options it is 2 days MPOR. Within the PRISMA Margin Calculator the optimiser will determine the best combination of trades to calculate the lowest possible initial margin, it will run every possible combination of trade in the portfolio to determine the optimal offsetting pairs. Diagram 3 below looks at the margin efficiencies and savings of a Euro-Bund / Euro-Bobl / Euro-Schatz Butterfly under PRISMA portfolio margining:

Diagram 3: Euro-Bund / Euro-Bobl / Euro-Schatz Butterfly - Portfolio Margining Efficiencies

Conclusion - What's Next?

Diagram 4: Euro-Shatz / Euro-Bobl / Euro-Bund Butterfly - Analysis

Relative Value analysis is commonly used to track the historical performance of the Eurex Euro-Bund / Euro-Bobl / Euro-Schatz Butterfly. While it can be tracked on a forward yield basis to the delivery date, market participants account for carry over seasonal analysis by tracking the underlying CTD performance on a rolling, duration neutral basis.

Over a one year historical period, the Eurex Euro-Bund / Euro-Bobl / Euro-Schatz Butterfly is 93% positively correlated with the generic German government bond 2yr/5yr/10yr cash butterfly. As of market close on December 7th, 2018, the CTD Eurex Butterfly is nearly two standard deviations richer than the cash 2yr/5yr/10yr butterfly.

Generating Alpha in European Fixed Income is extremely difficult. Portfolio Managers are able to find macro and arbitrage opportunities and leverage, liquid Eurex fixed income products to enter into efficient, leveraged relative value / duration neutral strategies by which to generate alpha.

From December 10th 2018 the trading hours for specific Eurex Equity and Fixed Income Futures will be extended and trading will commence from 8am HK/SG/China Standard Time. This will include Eurex's benchmark Eurex's Euro-Buxl, Euro-Bund, Euro-Bobl and Euro-Schatz fixed income futures contracts opening up more opportunities to trade the Euro-Bund / Euro-Bobl / Euro-Schatz Butterfly during the Asia Pacific time zone.