About EurexOTC Clear

Service Offering for PSAs

EMIR 3.0 - active account

CCP Switch

On-boarding

Compression Service

Product Scope

Interest Rate Swaps

Inflation Swaps

Settlement Prices

Clearing Member

ISA Direct Member

ISA Direct Light Licence Holder

Clearing Agent

Client

Jurisdictions

Multiple Clearing Relationships

Segregation Set up

Cross-Project-Calendar

Readiness for projects

C7 Releases

C7 SCS Releases

C7 CAS Releases

EurexOTC Clear Releases

Prisma Releases

Member Section Releases

Simulation calendar

Archive

User ID Maintenance

Clearing Hours

Clearing Reports

Product Specifications

Clearing on behalf

Delivery Management

Transaction Management

Collateral Management

Collateral

Transparency Enabler Files

Segregation Models

Reports

Default Fund

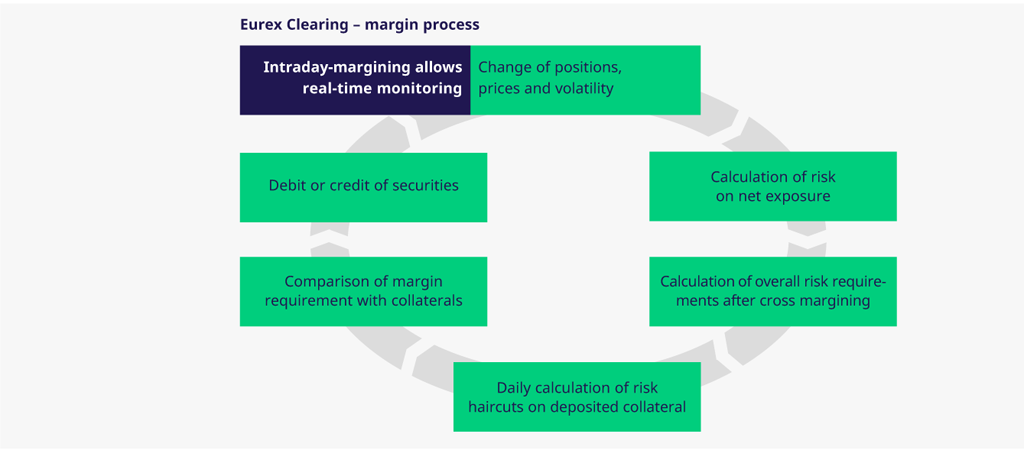

Intraday Margin Calls

OTC Clear Procedures

OTC Clear Tutorials

Cross Margining Support

Supplementary Margins

Default Waterfall

Model Validation

Stress testing

Default Management Process

Client Asset Protection under EMIR

Client Asset Protection under LSOC

Credit, concentration & wrong way risk

System-based risk controls

Pioneering CCP Transparency

Haircut and adjusted exchange rates

Securities margin groups and classes

Prices Rolling Spot Future

File services

Bond Clusters

Listed derivatives

OTC derivatives

Listed securities

Cash management

Delivery management

CCP eligible instruments

Eurex Clearing Rules & Regulations

EMIR 3.0 - active account

SA-CCR

IBOR Reform

Uncleared Margin Rules

Eurex Newsletter Subscription

Circulars & Newsflashes Subscription

Corporate Action Information Subscription

Circulars & Readiness Newsflashes

News

Videos

Webcasts on demand

Publications

Forms

Events

FAQs

Production Newsboard