Eurex has been a leader in responding to customer input to sensible margining. Eurex's portfolio margining process allows for risk-netting of futures and options on highly correlated underlying markets or assets that share industry characteristics. Eurex assigns various products into groups to achieve this, allowing for more comprehensive risk calculations to implement portfolio margining across positions.

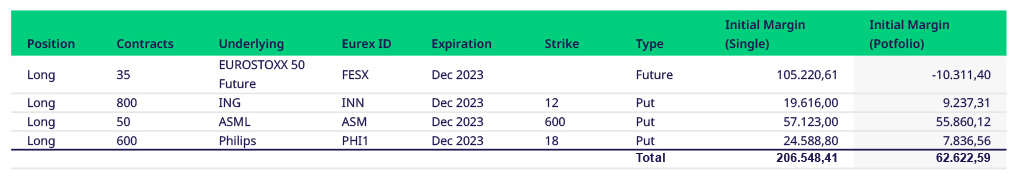

For example, a long position in EURO STOXX 50® futures could be combined with long put positions on individual stocks, reducing margin. The example in Table 1 demonstrates approximately a 70% reduction in initial margin when portfolio margining is applied instead of margining each position.

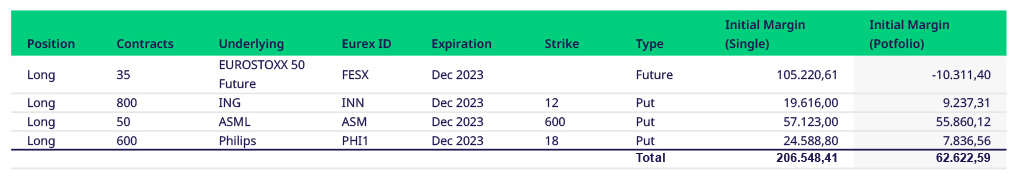

Table 1: Single vs. Portfolio Margin – Long Index Futures / Long Individual Stock Puts

This first example of portfolio margining benefits combines long equity futures with a long put option position in blue-chip securities. The initial margin for all four positions is over €206,000 without portfolio margining. When portfolio margining is considered, this figure drops by about €144,000 or 70%, as noted above. All three put positions are on blue-chip stocks that are expected to move in sync with the EURO STOXX 50®, allowing for a dramatic reduction in initial margin.

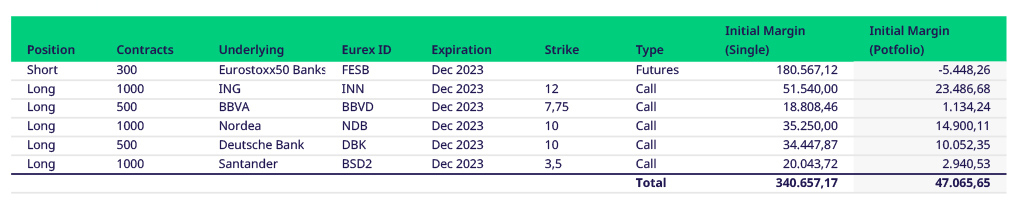

Table 2 is a second example of combining positions to achieve capital efficiency through portfolio margining. This will greatly benefit traders who like selling calls against long positions. However, calls are sold on individual stocks against broad-based index futures in this case.

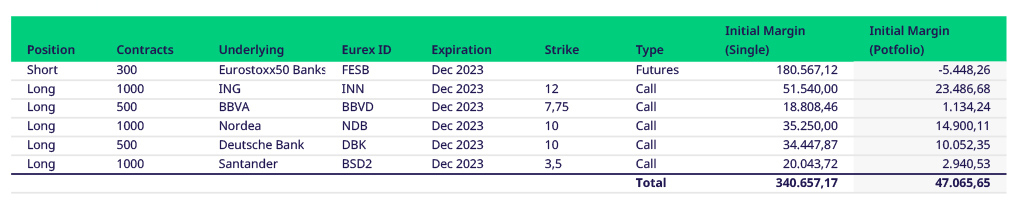

Table 2: Single vs. Portfolio Margin – Long Index Futures / Short Individual Stock Calls

This second example could be seen as a covered call with the long futures position replacing the individual stocks. The net result is a reduction of about €176,000 or 59% of the original single margin amount.

Astute traders may realize there are secondary benefits to this second example. First, by selecting short calls on individual stocks, a portfolio manager could select stocks they expect to underperform the EURO STOXX 50® over the trade’s lifespan. Typically, a call will be sold against the underlying security. However, with portfolio margining, a manager can be more strategic when choosing individual calls to sell. Finally, this creates more choices when selling calls, as the manager is not limited to the stocks they own.

Another benefit is that the implied volatility of individual stock options is typically higher than index options. For example, the 30-day at-the-money implied volatility average for the EURO STOXX 50® was about 12.00% over the first five months of 2024. That same figure is 19.58% for TOTB and 24.64% for MOH. ASM tops those stocks with an average of over 37%.1

A final example of the benefits of portfolio margining combining futures and options appears in Table 3. In this case, EURO STOXX 50® Banks futures were sold short, and this position is combined with long call positions on five individual bank stocks.

Table 3: Single vs. Portfolio Margin – Short Sector Futures / Long Individual Stock Calls

The margin reduction in the final futures-related case totals over €293,000 and a margin savings of 86%. This figure exceeds the regulatory cap of 80%, resulting in an initial margin of about €68,131. The risk for the short futures position is higher bank stock prices, a scenario that would likely result in a value increase of the long calls on individual bank stocks. In addition to a more favorable margin, this is another case of a manager having the ability to choose specific components of an index versus using index options in combination with futures. Here, the difference is that the long calls act as a pseudo-hedge against an index increase. A manager could choose calls on stocks where they expect an index outperformance when the market moves up.

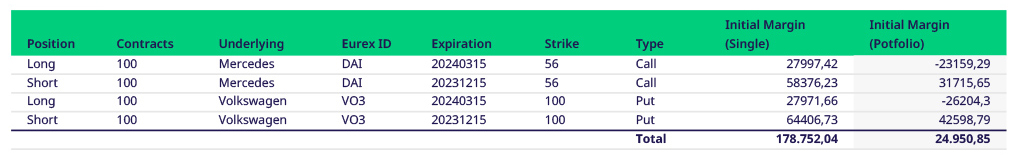

Finally, portfolio margining can be used when taking offsetting positions in stocks in the same industry. Table 4 shows this example by combining a bullish and bearish calendar spread on two automobile manufacturers.

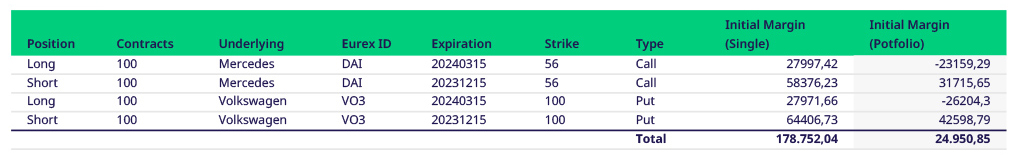

Table 4: Single vs. Portfolio Margin – Bullish / Bearish Calendar Spread

In this calendar spread example, a trader owns longer dated calls and puts than their short positions; specifically, the December options will expire before March. The initial margin for individual option positions totals €178,752.04. This drops to €24,950.85 when portfolio margining is applied. Note that this case involves two stocks in the same industry, which offers efficient use of capital in cases where a portfolio manager is pair trading stocks with the goal of one outperforming the other.

The previous examples demonstrate how Eurex’s portfolio margining benefits firms taking positions in instruments that share common risk characteristics. Eurex worked closely with all interested market participants (buy side, sell side, and liquidity providers) in developing and updating their approach to portfolio margin.

1 – Implied volatility data downloaded from Bloomberg using 30-Day IVOL at 100.0% Moneyness function