Default Fund

Eurex Clearing maintains one joint Default Fund, covering all asset classes cleared by it. The Default Fund is calibrated to cover all losses resulting from a simultaneous default of Eurex Clearing’s largest two Clearing Member Groups with a confidence level of 99.9%. Therefore, the Cover-2 Default Fund Size is defined as the 60-day average of Gross Stress Loss over Margin (gSLOM) excluding Supplementary Margin for the largest two Clearing Member Groups. SLOM is calculated as the difference of the simulated value of a portfolio under a certain stress scenario and the Total Margin Requirement of the same portfolio to display potential losses not yet collateralized via Margin Requirements.

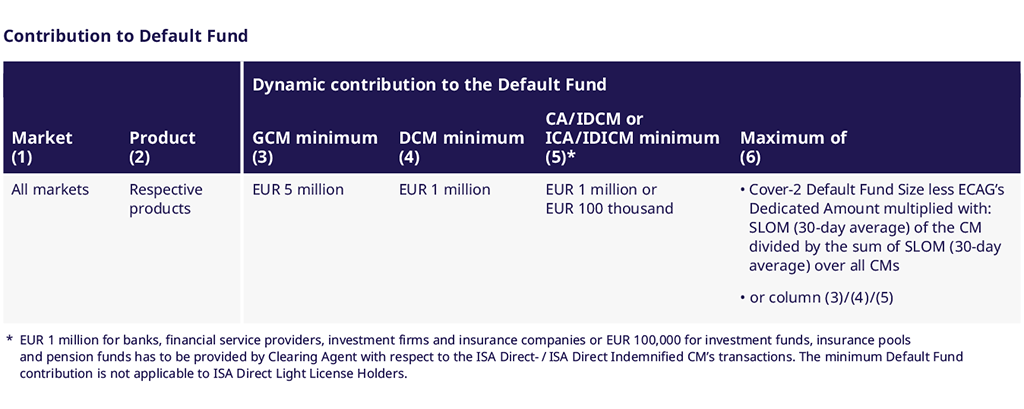

Every Clearing Member (CM) is required to provide a contribution to such Default Fund. For ISA Direct Clearing Members1, the Default Fund contribution is provided by the Clearing Agent2. Each Clearing Member’s contribution to the Default Fund depends on the relative risk exposure brought to the Clearing system by such Member.

As such, Clearing Members are required to deposit the highest of the following amounts:

We recalculate Default Fund contributions on a monthly basis (at the end of each month) for the subsequent month, to ensure that Stress Loss over Margin levels are reflected accurately.

1 The term ISA Direct Clearing Member also comprises ISA Direct Indemnified Clearing Member.

2 The term Clearing Agent also comprises Indemnifying Clearing Agent.

Contact

Eurex Clearing AG

Clearing Business Relations