Failure handling

In order to increase settlement efficiency, we have developed robust solutions for dealing with failure handling. These include measures to accommodate late delivery processing as well as a buy-in and cash settlement models.

Late delivery processing

As a central counterparty, Eurex Clearing has the obligation to buy from the original seller and to deliver to the original buyer. If the original seller fails to deliver, Eurex Clearing starts a fail process in order to fulfill this obligation.

Depending on the markets and products cleared, different fail processes apply. The general contractual penalties are defined in Chapter 1, Part 1 of the Clearing Conditions.

Frankfurt Stock Exchange (Xetra®) and Börse Frankfurt – Failure to deliver:

- General buy-in and cash settlement model is applied

- Penalties are charged for late deliveries over dividend reference days (35.0 percent on net dividend)

- Late settlements over corporate actions may cause claims and disclosure of counterparts

- Penalties based on the Settlement Discipline Regime (SDR) of the Central Securities Depositories Regulation (CSDR) are calculated and charged by EU Central Securities Depositories (CSDs).

- In case of net penalty imbalance, Eurex Clearing will allocate remaining net cash amount to the Clearing Members after the booking by the CSDs. For details refer to Eurex Clearing Circular 044/24.

Eurex Exchange – Failure to deliver:

- General buy-in and cash settlement model is applied

- Penalties based on the Settlement Discipline Regime (SDR) of the Central Securities Depositories Regulation (CSDR) are calculated and charged by EU Central Securities Depositories (CSDs).

- In case of net penalty imbalance, Eurex Clearing will allocate remaining net cash amount to the Clearing Members after the booking by the CSDs. For details refer to Eurex Clearing Circular 044/24.

- Deliveries out of notifications/allocation for Government bonds:

- 0.04 percent fines on volume not delivered until 14:15 CET but delivered until the respective Settlement Cut-Off Time on the contractual settlement day.

- 0.4 percent fines on volume not settled on the contractual settlement day per business day.

- Additional interest of delay, meaning an amount per each calendar day on which no delivery of the bonds has occurred, is determined by Eurex Clearing in advance and bases on:

- In case of Euro-Fixed Income Futures contracts, the effective rate for the marginal lending facility of the European Central Bank plus 100 basis points

- In case of CONF Futures contracts, the effective rate for the liquidity-shortage financing facility of the Swiss National Bank plus 100 basis points.

Eurex Repo – Failure to deliver:

- Buy-in and cash settlement model is applied.

Repo Market

- Penalties based on the Settlement Discipline Regime (SDR) of the Central Securities Depositories Regulation (CSDR) are calculated and charged by EU Central Securities Depositories (CSDs) on the Front- and Term-leg.

- In case of net penalty imbalance, Eurex Clearing will allocate remaining net cash amount to the Clearing Members after the booking by the CSDs. For details refer to Eurex Clearing Circular 044/24.

- Failure to Deliver by the delivery day of the Front-Leg:

Eurex Clearing is entitled, or on request of the Clearing Member:

- to set present business day as advanced repurchase date of the term leg.

- to offset obligations and settle the repo rate amount only.

- Failure to Deliver by the delivery day of the Term-Leg:

Eurex Clearing is entitled, or on request of the Clearing Member:

- To perform buy-in attempts according to the buy-in schedule applicable as from the fifth day following the delivery date of the term-leg.

- Failure to Deliver by the delivery day of the Cash-Leg:

Eurex Clearing will assume the Clearing Member’ default according to Chapter 1, Part 1(7) of the Clearing Conditions:

- only if a technical default can be excluded

- consequently, the Clearing Member will be set on hold

- positions will be closed out and remaining obligations will be covered by the margin collateral

GC Pooling Market

- Fines for Non-Delivery by the delivery day of the Front-Leg and Term-Leg

- 0.015 percent of failed value, but not less than EUR 1,500 per day.

Buy-in and cash settlement model

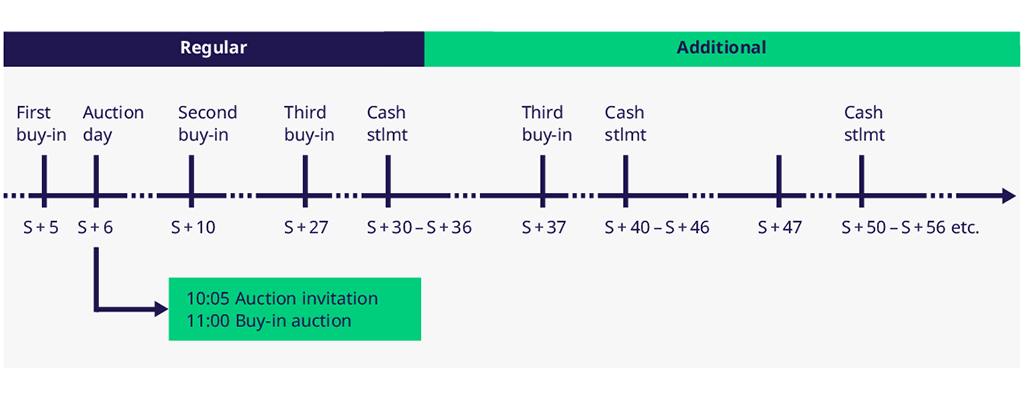

The late delivery management model includes two components:

- Buy-in: Eurex Clearing has implemented an auction process where offers are made. The new buy-in seller replaces the original seller.

- Cash settlement: In case certain buy-in attempts are unsuccessful, a cash settlement may be initiated. In this case the failed seller is debited and the buyer is credited with a cash settlement amount. Hence there is no delivery of securities performed.

The following figure displays the buy-in or cash settlement schedule respectively, applicable to transaction concluded on Frankfurt Stock Exchange (FSE), Exercise & Assignments from Eurex Exchange derivatives transactions, Eurex Repo (optional) as well Eurex Bonds (optional), which do not fall under the EU Short Selling Regulation:

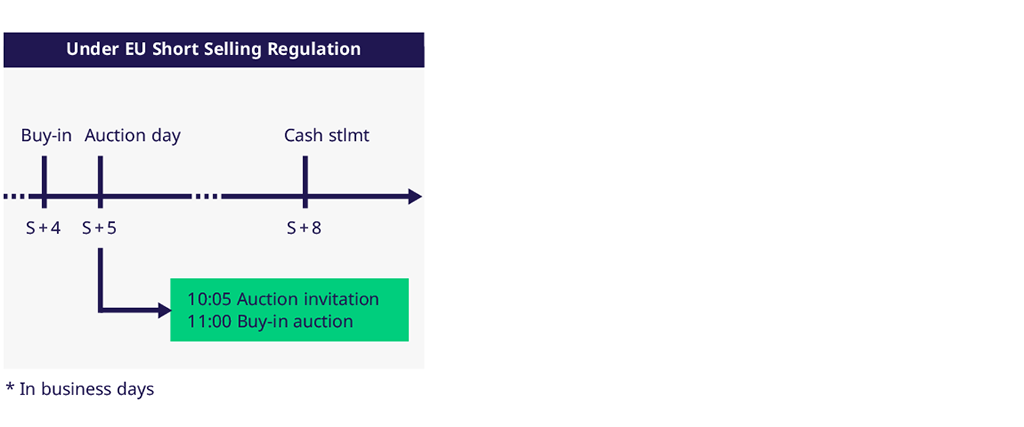

The following buy-in schedule applies for securities that fall under EU Short Selling Regulation, i.e.

- Rules published and supervised by ESMA

- Applicable only for equities having their principal trading venue inside the European Union

- Exceptions can be obtained from the ESMA register Exempted Shares under Short Selling Legal Framework

- Buy-in: Eurex Clearing has implemented an auction, where offers are given. The new Buy-in seller replaces the original seller

- Cash settlement: In case a Buy-in is not successful the failed seller is debited, and the buyer is credited with a cash settlement price. There is no delivery of securities

- All other procedures remain unchanged

Contact

Eurex Clearing AG

Clearing Business Relations