Jul 13, 2022

Eurex

Eurex Exchange Readiness Newsflash | Fixed Income ESG index futures: Updates of reference data fields in T7 Production

Dear Eurex Participants,

We would like to draw your attention to some updates regarding the following Eurex Fixed Income contracts:

- Bloomberg Barclays MSCI Euro Corporate SRI Index futures (FECX).

- Bloomberg Barclays MSCI Global Green Bond Index futures (FGGI).

With effect of 18 July 2022, Eurex will change the following T7 Reference Data Parameters for the contracts mentioned above:

- Security Description (Tag 107)

- Contract Date (Tag 30866)

- Final Settlement Reference Date (Tag 865, value = 115)

Because the contract date is part of the functional contract key, C7 will distribute public contract change messages via FIXML for the affected contracts on 15 July 2022.

As an example of the change, the existing contracts will be amended as follows:

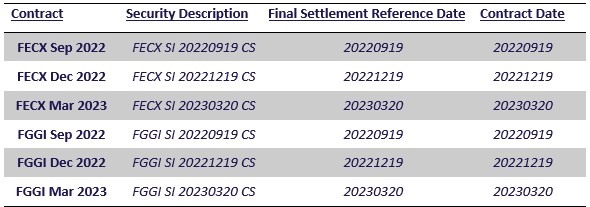

Old values:

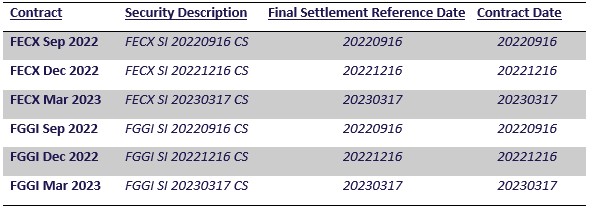

New values:

The change above is of a technical nature; the functional aspects and features of the products, as well as the contract specifications and clearing conditions remain unchanged.

In particular, the fields Maturity Date (Tag 541) and Last Eligible Trade Date (Tag 865, value = 7) will remain unchanged.

The field Expiration Date (cntrExpDat field on Clearing reports) will also not change.

Fixed Income ESG index futures are cash settled derivatives which expire on the third Friday of the quarterly maturity month (March, June, September, December). The reference price used in the cash settlement process is the index price published on the last trading day of the contracts.

However, the index close price of the indices underlying the Fixed Income ESG index futures is published only after the clearing hours.

The change of the fields Contract Date and Final Settlement Reference Date have the purpose to reflect this feature of the products in the T7 Reference Data distributed to Members and vendors.

If you have questions or comments, please do not hesitate to contact your Key Account Manager or send an e-mail to client.services@eurex.com.

Kind regards,

Your Client Services Team

Visit the Next Generation ETD Contracts webpage for all your Trading and Clearing content!

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

Contact: | client.services@eurex.com | |

Web: | www.eurex.com/ex-en/ |