GC Pooling Repo

Eurex Repo's GC Pooling integrates electronic trading, central clearing and triparty settlement for standardized secured funding. GC Pooling is accessed by more than 160 sell-side and buy-side institutions and since its introduction in 2005, it has become established as the European benchmark for efficient cash & collateral management. It uniquely addresses capital market fragmentation in Europe by offering a homogenous funding tool and reliably provided repo liquidity during all major financial crises.

- Principles

- Specifications

- Trading Hours

- Trading Fees

- Value Chain

- Participation

- Rates

It is easy to trade extremely large tickets and deals can be seamlessly completed and then processed automatically without any issues over credit or security allocation.

The compelling advantage of GC Pooling is the re-use possibility of received collateral for further money market transactions, the Eurex Clearing Margining process and refinancing within the framework of European Central Bank (ECB) open market operations via the German Central Bank or the Central Bank of Luxembourg.

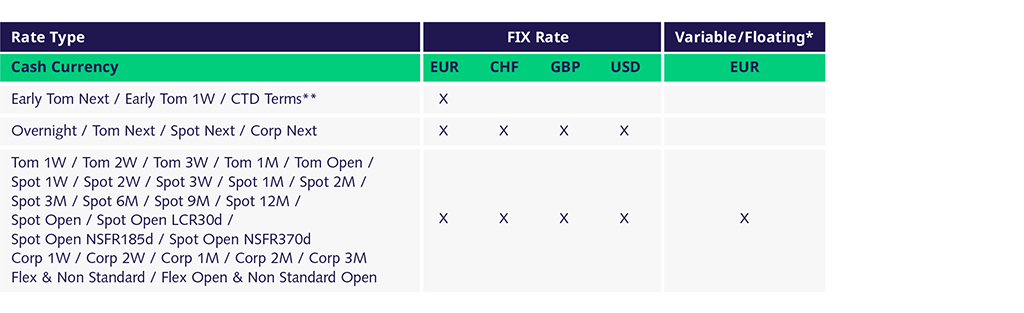

GC Pooling participants can select the various standardized baskets by pre-defined terms per currency.

Multiple standard terms from overnight up to more than two years are offered.

In addition open, variable and open variable terms offer maximum flexibility.

* Variable/Floating Rates:

ESTR = Euro Short-Term Rate

GCPION = STOXX GC Pooling EUR ON Index

GCPISN = STOXX GC Pooling EUR SN Index

GCPITN = STOXX GC Pooling EUR TN Index

GCPIX = STOXX GC Pooling EUR Extended ON Index

** Details are available in Eurex Repo's Terms & Conditions (chapter 6.1.3)

Open Order Book

The quote book contains all quotes entered by the participants with full market depth. The quotes are displayed per term/collateral combination including volume. All quotes are legally binding and will be automatically deleted at market close. Eurex Repo does not offer an automatic matching. The traders have to lift or hit a quote proactively. In addition to entering quotes two participants may agree on a trade bilaterally and enter the repo transaction into the system by using the pre-arranged trading functionality.

Contract Size

Minimum EUR 1 Million

Settlement Specifications

Terms | Trade day | Settlement front leg | Settlement term leg |

EUR GC Pooling OverNight (ON) | T | T via RTS | T+1 in SDS1 |

EUR GC Pooling Tomorrow Next (TN) | T | T+1 in SDS1 | T+2 in SDS1 |

EUR GC Pooling SpotNext (SN) | T | T+2 in SDS1 | T+3 in SDS1 |

EUR GC Pooling Spot Term | T | T+2 in SDS1 | T+X in SDS1 |

EUR GC Pooling Flex Term | T | T+X in SDS1 | T+Y in SDS1 |

USD GC Pooling Tomorrow Next (TN) | T | T+1 in RTS | T+2 in RTS |

USD GC Pooling SpotNext (SN) | T | T+2 in RTS | T+3 in RTS |

USD GC Pooling Spot Term | T | T+2 in RTS | T+X in RTS |

USD GC Pooling Flex Term | T | T+X in RTS | T+Y in RTS |

CHF GC Pooling Tomorrow Next (TN) | T | T+1 in RTS | T+2 in RTS |

CHF GC Pooling SpotNext (SN) | T | T+2 in RTS | T+3 in RTS |

CHF GC Pooling Spot Term | T | T+2 in RTS | T+X in RTS |

CHF GC Pooling Flex Term | T | T+X in RTS | T+Y in RTS |

RTS = Real Time Settlement; SDS1 = Same Day Setttlement

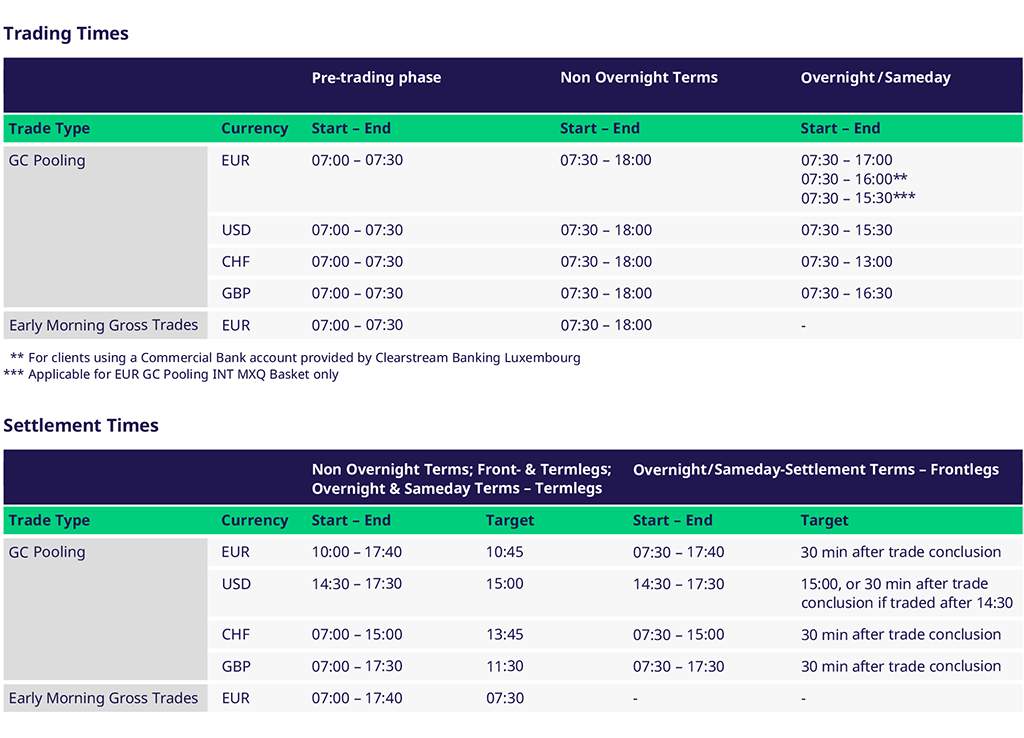

* All times: Frankfurt am Main time

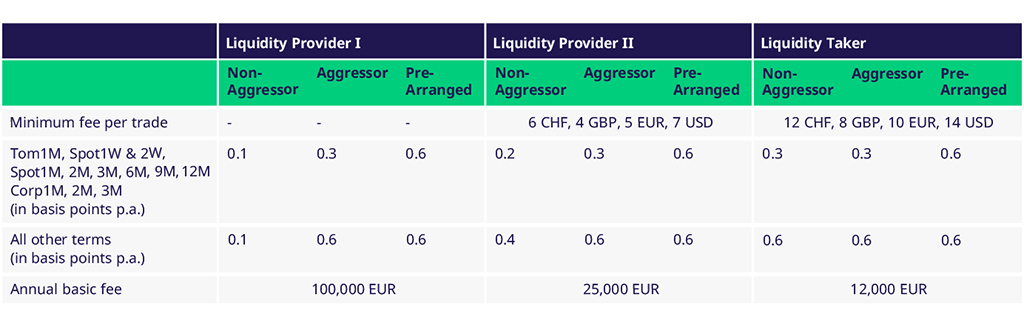

- Registration fee of EUR 10,000

- Minimum transaction fees of EUR 800/month

- Annual and transaction fees according to the below listed fee group

"Aggressor": Participant who lifts or hits quotes. "Non-Aggressor": Participant who actively quotes.

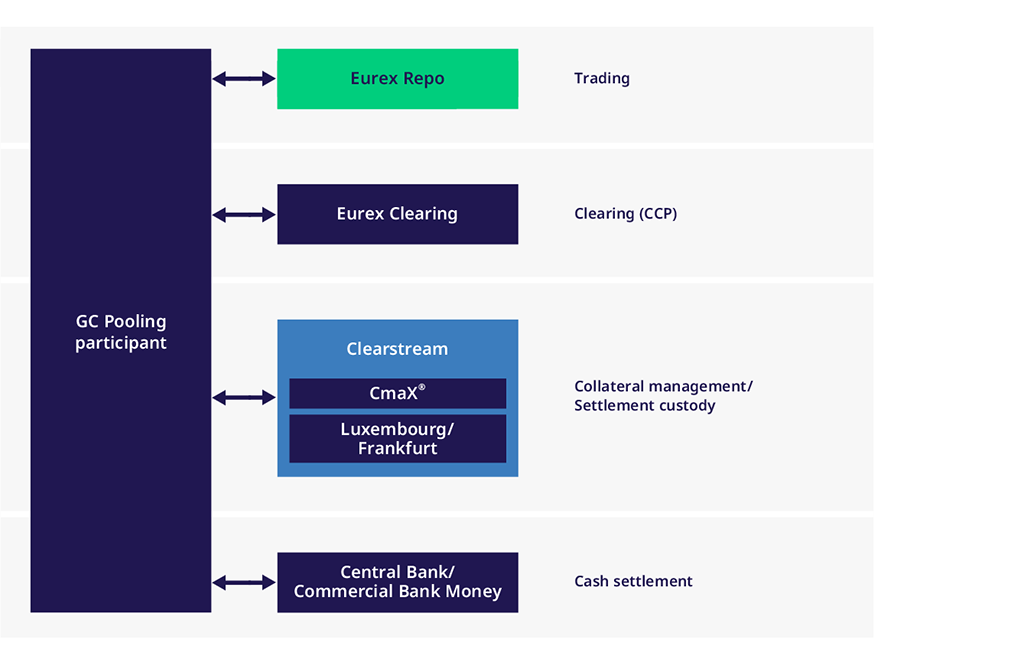

GC Pooling ensures straight-through processing with automated connectivity to Eurex Clearing AG as central counterparty and the settlement organization Clearstream Banking. As soon as a GC Pooling transaction is concluded on the electronic Eurex Repo trading system, Eurex Clearing steps in as legal counterparty (CCP).

Eurex Clearing performs e.g. the delivery management and the intra-day risk evaluation of all positions held by a clearing member. A comprehensive reporting informs the clearing member about the status of delivery activities and the margin requirements. On the settlement day Eurex Clearing sends the netted settlement instructions on behalf of the customers to Clearstream Banking for settlement. Within the delivery versus payment process, the collateral management system of Clearstream Banking automatically allocates collateral of the traded basket to secure the cash trade. A real-time substitution of single bonds or equities is possible during the term of the trade.

- The applicant must be under the regulation of a domestic regulatory Authority

- The applicant must be a credit institution or an investment firm according to the definition set forth in Art. 1Paragraph 1 and 2 and Art 4 Paragraph 1 of the Council Directive on markets for financial instruments 2004/39/EG ("MiFID")

- The applicant is responsible for the technical connection to the Eurex Repo trading system

- The applicant is required to follow the Eurex Clearing clearing process

- Directly: As a Clearing Member of Eurex Clearing

- Indirectly: By signing an agreement with an existing Clearing Member

The applicant may apply for a General-Clearing or Direct-Clearing-Membership. The General Clearing Member (GCM) has the right to clear its own trades as well as the trades of its customers and DC Market Participants. The Direct Clearing Member (DCM) has the right to clear its own trades as well as the trades of its customers and NCMs provided they are affiliated.

Institutions and/or its branches which are permitted in its country of domicile to provide credit to customers in relation to the matching of orders or quotes and receive collateral from customers in the form of securities and cash may apply for admission.

In addition the Clearing Member must fulfill the following requirements:

- Minimum amount of liable equity capital

- Default fund contribution

- Cash Clearing: RTGS eligible account

- Pledge Securities Account

Once a company becomes a participant, Eurex Repo does not limit the number of registered persons on its behalf.

The STOXX® GC Pooling index family is based on the Eurex Repo GC Pooling segment and offers a transparent, rules-based, independent alternative to unsecured interbank benchmarks such as LIBOR and EURIBOR/EONIA. The indices represent secured euro lending transactions and binding Quotations that take place on the Eurex Repo GC Pooling Market.

Within the index family, STOXX introduces the funding rates, which aim to be a new benchmark for interbank funding and cover one business day liquidity for the broader Eurozone. The funding rates have all the advantages of standardized secured funding.

STOXX GC Pooling EUR Deferred Funding Rate

STOXX GC Pooling EUR Deferred Funding Rate as Euro RFR Benchmark, ECB Working Group

GC Pooling video tutorials

What the buy-side should know about cleared repo in a changing interest rate environment.

GC Pooling Baskets

Standardized baskets of fixed income securities and equities tradable in EUR, CHF, USD and GBP.

ISA Direct: safe access

The buy side benefits! ISA Direct combines elements of direct and traditional client clearing. It provides the buy side with a variety of mandatory and optional service functions.

With ISA Direct, the buy side has direct membership facilitated by the Clearing Agent. The Clearing Agent covers the default fund contribution while the member maintains the legal and beneficial collateral ownership.

Contact us

Eurex Repo

Eurex Repo Sales & Relationship Management

Frankfurt/London/Paris/Zug