Equity & Basket Total Return Futures

Equity Total Return Futures (ETRF) are part of the Total Return Futures (TRF) portfolio and build on the product structure of the Index TRFs, with a basket trades wrapper on top. ETRFs are designed to replicate the payoff of an equity swap based on the underlying shares of a company included in an eligible index. ETRFs are meant to be the basic building blocks for a customized Basket Trades of Equity Total Return Futures (BTRF). This package trade can consist of one or multiple ETRFs.

Benefit from standardization

The standardization of ETRFs and BTRFs leads to better risk management, improved capital efficiency and security when trading total return exposures on an equity benchmark like EURO STOXX 50®, DAX®, CAC-40® , FTSE 100® as well as Swiss Leaders Index (SLI)®.

You'll need a bigger basket

We will expand our Equity TRF segment in Swiss names listed in CHF

- Key Benefits

- Equity Total Return Futures

- Basket Total Return Futures

- ETRFs are fully fungible and build on the product structure of the EURO STOXX 50® / FTSE 100® Index TRF.

- Mitigates counterparty risk and bilateral margining for non-cleared OTC equity & basket TRS.

- Cross margining offsets with other equity and equity index derivatives within PRISMA, including EURO STOXX 50®, EURO STOXX® Banks, EURO STOXX® Select Dividend 30 and FTSE 100® Index TRF.

- Balance sheet benefits under a transparent and secure CCP environment.

The building block for baskets

ETRFs are fully fungible contracts aiming to replicate the performance of an OTC equity total return swap (TRS). ETRFs represent the theoretical borrowing of cash to purchase the underlying equity at trade date, assuming it’s held till expiry, i.e., there is immediate exposure to the cash leg of the underlying equity. The holder of a long position will therefore receive the returns associated with holding the cash equity – against which they will pay the financing associated with this purchase. The cost of financing is comprised of the overnight funding rate and the determined traded "spread". This traded spread represents the additional rate, over the overnight benchmark funding rate, required by the seller to provide the returns of the cash equity until expiry.

The customized package

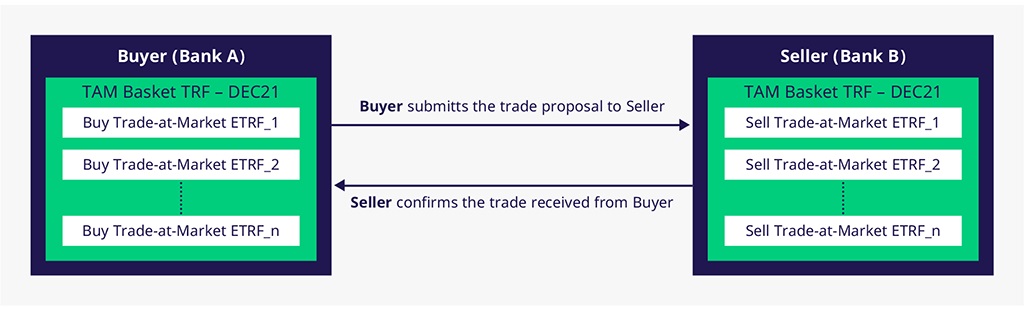

BTRFs are a package of multiple Equity TRFs constructed by traders within certain parameters concerning eligible equity shares. This negotiated and customized package of one or more ETRFs is traded with the same maturity and at the same TRF spread. Basket Trades at Eurex Exchange are incorporated within T7 Release 7.1.

How BTRFs work

- Trading via the T7 trading system

BTRFs can only be traded via the T7 trading system as block trades. - New dedicated screen in the T7 GUI

The ETRFs components of a basket are entered as a package via a new dedicated screen in the T7 GUI or new dedicated requests via the ETI interface. - Same maturity and traded TRF spread

All ETRFs must have the same maturity (expiry), same market side (buy or sell), same trade type (TAC or TAM) and same traded TRF spread in basis points upon initial execution.

Watch the recordings: Focus Day on Futurization

Listed alternatives to the OTC instruments, trading Dividend Derivatives & Total Return Futures.

Videos

What is an Equity Total Return Future and Basket Total Return Future?

Equity Total Return Futures and their Basket functionality provide a futurized solution for equity financing. Find out what an Equity and Basket Total Return Future is, what its key features are and how to use them in a smart way.

How do Basket Equity Total Return Futures work?

Basket Trades of ETRFs are a customized package, negotiated by the exchange participants, of one or more ETRFs all traded with the same maturity and at the same TRF spread in basis points. Find out the main functionalities of Basket Equity Total Return Futures.

Contacts