Common Report and Upload Engine Support

The Common Report Engine (CRE) allows a centralized provision of reports and non-transactional files from multiple exchange markets. The service is provided as a SSH File Transfer Protocol (SFTP) server and allows participants to easily retrieve all their reports and non-transactional files from a single source. The Common Upload Engine (CUE) is a separate part of the CRE which allows admitted participants of the DBAG Group the upload of participant data to dedicated services provided by DBAG Group.

These services are independent from the existing trading and clearing infrastructure, and participants can choose their preferred hardware platform and operating system. The CRE is divided into two instances:

Instance 1 gives access to reports of the following markets and services:

- T7 cash markets including Xetra (XETR + Börse Frankfurt) and partner exchanges

- T7 derivatives markets including Eurex trading and EEX

- Eurex Clearing’s C7

- Eurex Clearing’s PRISMA

- EurexOTC Clear

- CCP

Instance 2 gives access to reports of the following markets and services:

- Eurex Repo

The CUE has at the moment one active instance which gives upload access to files of the following service:

- Regulatory Reporting Eurex and FWB (Non-MIFIR Reporting, short-code and algoID upload)

How to get access to the CRE & CUE

To get access to the CRE and/or CUE, participants may use an SFTP client of their choice and download their reports. The CRE & CUE do not offer any interactive SSH sessions nor any kind of browser access.

The following information is required when accessing the CRE & the CUE:

- UserID which has been generated by successfully setting up a new user in the Member Section

- The IP address (host name) of DBAG CRE, respective CUE

- The private ssh key fitting to the public key uploaded in the Member Section

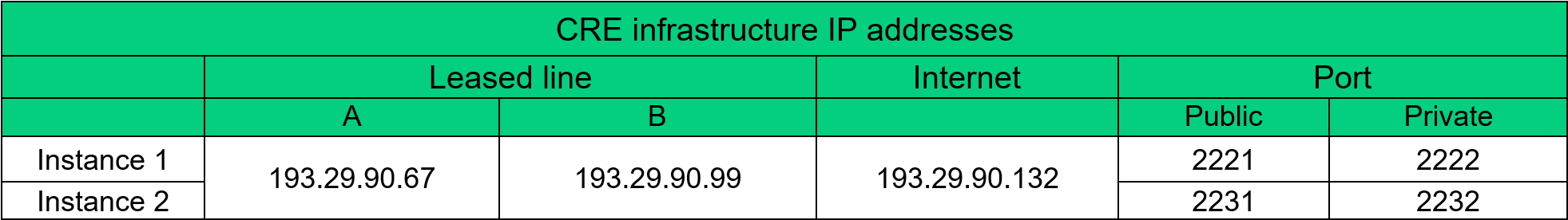

The IP’s used for access to the CRE are shown in the table below all other information is documented in the "Common Report and Upload Engine User Guide" available on this page and for each T7 Release as part of the system documentation.

- Trading Reports

- Clearing Reports

- Transparency Enabler Files

- TA113 GTS – Series Reference Data // Complex and Flexible Instrument Definition

- TD955 Liquidity Provider Measurement

- TD956 Permanent Market Making Measurement

- TD957 Advanced Market Making Measurement

- TE540 Daily Order Maintenance

- TE550 Open Order Detail

- TE810 Daily Trade Confirmation

- TR100 Order to Trade Ratio Report

- TR102 Excessive System Usage Report

- TR902 Daily Order and Quote Transactions

- CB001 Product and Price Report

- CB012 Account Statement

- CB069 Transaction Report

- CB165 Eurex Fee Statement

- CB167 Late Closing Fees

- CB185 OTC CCP Fee Statement

- CB196 Daily Overall Fee Summary

- CB201 Trade Daily Summary

- CB202 Full Inventory Report

- CB702 Cash Settled Contracts Overview

- CB750 Give-Up Trades History

- CB751 Accepted Trade-Up Trades

- CC202 Risk Factor Report

- CC203 Eurex OTC Variation Margin EOD

- CC204 Eurex OTC Overall Margin Report

- CC208 Client Margin

- CC210 Interest Rate Curves Report

- CC750 Daily Margin

- CC760 Daily Margin Summary

- CD220 Cash Forecast Report for OTC FX

- CD010 Daily Cash Account CM

- CD020 Collateral Movement / Coverage

- CD031 Daily Collateral Valuation

- CD042 Daily Settlement Statement

- CD200 Eurex OTC Cash Forecast Report for OTC IRS

- CD710 Daily Cash Account CM

- CE054 End of Day FX Cashflow

- CE056 End of Day CLS

- CE770 Exercise and Assignment Overview

- CE771 OptOn Fut ExerAssign Overview

- CE775 Notification / Allocation Information

- CP005 Sub Portfolio Report

- CP020 Margin Drilldown Report

- CP046 Aggregated Prisma Margins

- TA111 All Active/Inactive Series

- FILFIMMP FI & MM Priority

- FILFOREX Foreign Exchange Rates Configuration

- FILLIQFA Liquidity Factors Configuration

- FILMARCA Market Capacities Configuration

- FILMARIA Market Risk Aggregation Configuration

- FILMATBU Maturity Bucket

- FILMATPA Materiality Parameter

- FILRIMEC Risk Measure Configuration

- FILSTLCF Settlement Prices for Cash Flow

- FILSTLPR Settlement Prices

- FILTHEOI Theoretical Prices and Instrument Configuration

- If you are using a client to connect to the CRE or CUE, the client will ask you once to accept the DBAG CRE and CUE Server Host Key. The Server Host Key will be remembered for future logins by the client.

- If you use a customized script to access the CRE or CUE, the Server Host Key has to be integrated where appropriate.

Supporting Documents

- Common Report & Upload Engine User Guide, Version March 2025

Published 17 March 2025 - The Common Report Engine allows the centralised provisioning of reports and the Common Upload Engine the upload of files. The manual contains everything from access information to the CRE & CUE and report/file naming conventions for CRE.

- FAQ

- Tutorial Videos

Contact

Eurex Frankfurt AG

Customer Technical Support / Technical Helpdesk

Service times from Monday 01:00 – Friday 22:00 CET

(no service on Saturday and Sunday)

T +49-69-211-VIP / +49-69-211-1 08 88 (all)

Eurex Frankfurt AG

Key Account Management

Service times from 09:00 - 18:00 CET