Eurex - the only after-hours trading venue for USD/KRW Futures

Manage your Korean exposure after KRX closing hours

Following strong demand from our market participants, KRX and Eurex continued their product cooperation ("Eurex/ KRX Link") by listing the Eurex Daily USD/KRW Futures on US Dollar Futures of the Korea Exchange ("Daily USD/KRW Futures") at Eurex starting 26 July 2021.

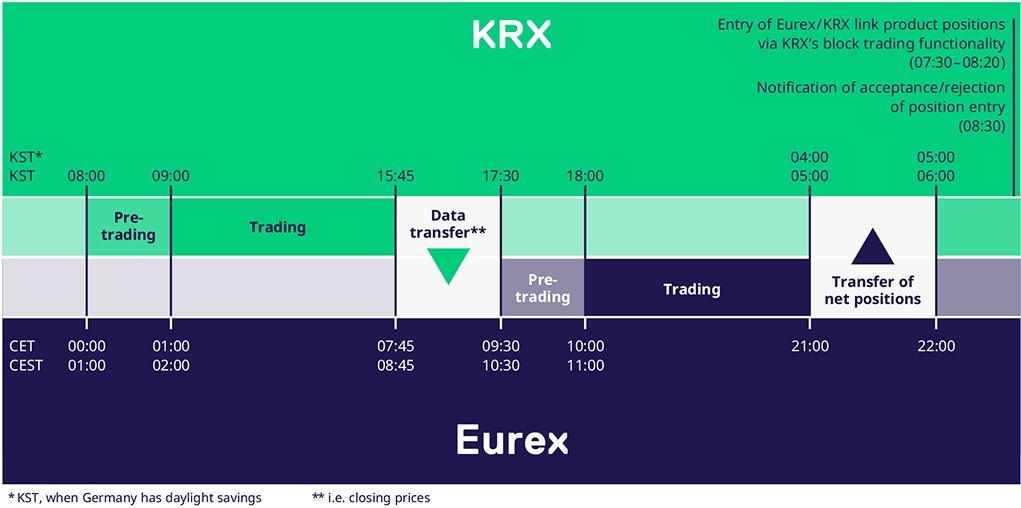

This product is a fully fungible contract with the corresponding KRX US Dollar Futures contract. Market participants can continue to trade the Daily USD/KRW Futures at Eurex during the European and core U.S. hours from 18:00 KST or 10:00 CET.

More trading opportunities for the U.S. market participants

The Daily USD/KRW Futures is a CFTC approved product, allowing U.S. market participants trading access during the U.S. time zones.

- Contract Specs

- Key Benefits

- Trading phases

- Access Eurex/KRX Link

- Prices/Quotes

Daily USD/KRW Futures on US Dollar Futures

Min. Price Change | Product Code | Trading Hours | Contract multiplier | |

Points | Value | |||

0.1 | KRW 1,000 | 10:00 - 21:00 CET | One USD/KRW Futures | |

* during the daylight savings time in Europe

- Access to USD/KRW Futures after-hours market

The KRX US Dollar Futures (denominated in KRW) are one of the most liquid forex derivatives in the world. The Eurex/KRX Link creates a platform for market participants to trade or hedge this product during the core European and U.S. time zones

- Fully fungible product

Eurex Daily USD/KRW Futures is fully fungible with the corresponding contract at KRX

- Exchange-traded benefits

Important exchange-based trading, clearing and risk management functionalities help to

reduce counterparty risks and increase margin efficiencies

- Listing of the Eurex/KRX Link product

- Eurex members: must have a business relationship with at least one KRX member to facilitate the delivery of the Eurex/KRX Link product. KRX members: open an account with at least one Eurex member to facilitate outbound orders from Korea to trade the Eurex/KRX Link product

- Eurex members trade the product at Eurex by indicating the KRX member and the ID account number of the final beneficiary into the respective dedicated field along with the order. KRX members trade the Eurex/KRX Link product through Eurex members

- Margining: Intra-day margin in one of the Eurex clearing currencies (EUR/CHF/USD/GBP)

- Clearing: Payment/Receipt of variation margin in KRW at a Korean settlement bank by KST 15:00 (CET 07:00 or 08:00*)

- Settlement information transfer on a final beneficiary basis from Eurex Clearing to KRX

- Settlement information transfer from KRX to the respective KRX members

- Margin check & entry of the settlement information into the KRX system through KRX‘s OTC Block Trading Functionality

- Confirmation of settlement information entry which results in Eurex/KRX Link product positions in the KRX market

| Product | Diff. to prev. day last | Last price | Contracts | Time |

|---|---|---|---|---|

| FCUW | -0.29% | 1,464.00 | 5,626 | 20:56:53 |

Contact

FX Sales

Frankfurt

T +49-69-211-1 26 19

London

T +44-20-78 62-76 64

Chicago

T +1-312-544-1056

E-Mail

fx@eurex.com

For immediate operational issues, please refer to the respective hotlines.