MSCI Indexes

MSCI indexes are some of the world’s most widely tracked benchmarks and linked to more than USD 16.3 trillion in AUM. The indexes also serve as the basis for over 1,300 Exchange Traded Funds (ETFs). The massive amount of capital benchmarked against MSCI indexes and the improved tradability of index-based products via ETFs has led to an increased need for futures and options. MSCI derivatives help managers facilitate in and outflows of funds, hedge existing equity exposure and enhance portfolio performance.

164 MSCI derivatives

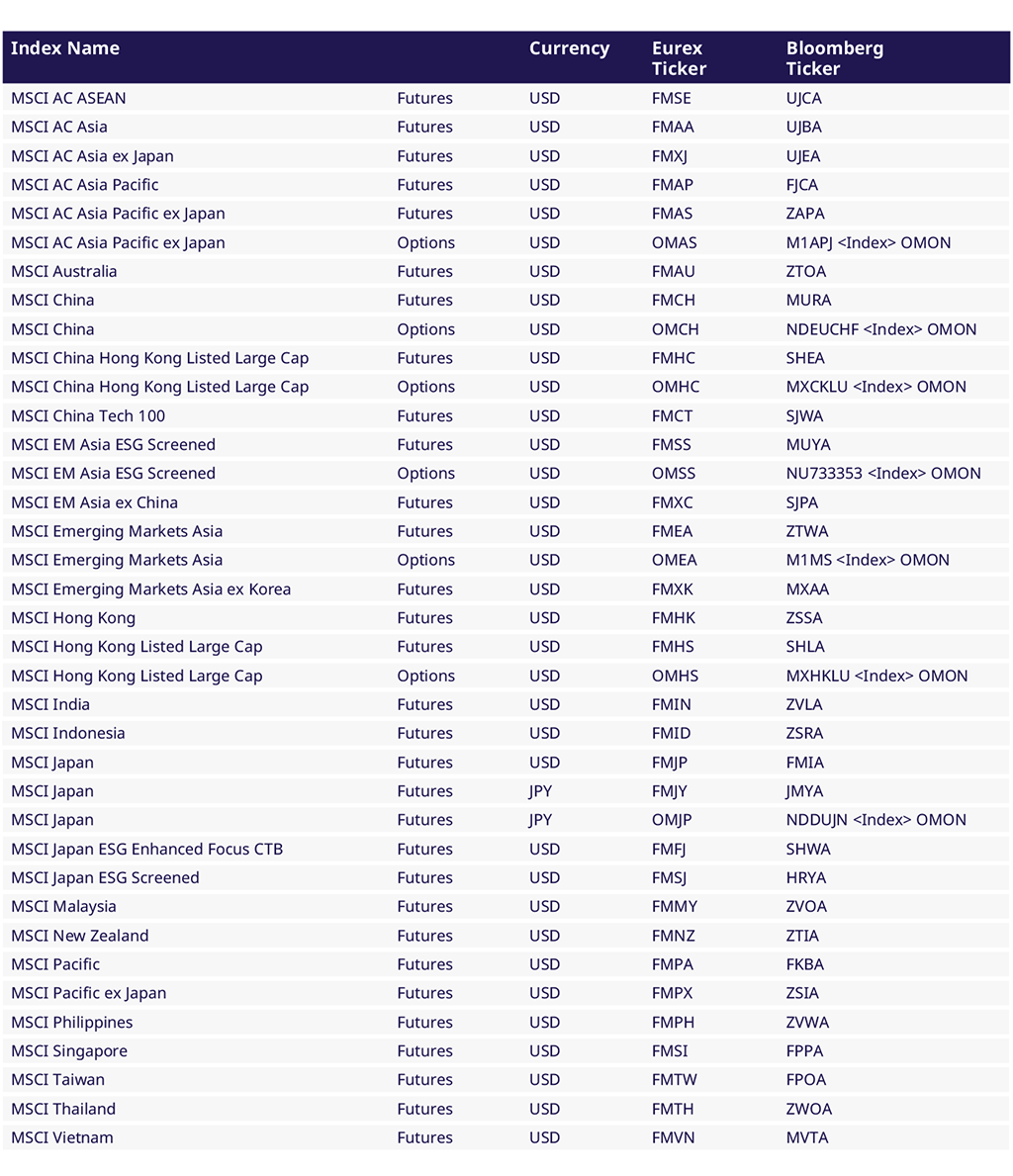

Eurex is the only exchange offering a comprehensive suite of products consisting of futures and options on regional and country indexes: currently, 141 MSCI futures and 23 MSCI options are available covering Emerging Markets (EM) with MSCI Emerging Market Index Futures and Developed Markets (DMs) in different index types (NTR, GTR, and price indexes) and different currencies (EUR, USD, GBP, and JPY), facilitating extensive MSCI trading opportunities.

Developed Markets

With Eurex's MSCI derivatives offering, investors can now bet on entire regions and individual countries. The complete product range covers developed, emerging and frontier markets and includes several attractive contracts on popular benchmark indices such as futures and options:

- MSCI World Index, covering the universe of developed markets as a whole.

- MSCI Europe Index, the leading benchmark for European equity funds.

- All major developed markets in all regions are available via individual futures, e.g. MSCI Japan Index, Australia, USA, Canada, UK, etc.

Emerging Markets

Our regional MSCI Emerging Markets Index derivatives give our participants access not only to leading regional benchmarks (Broad MSCI EMEA, EM, EM Asia and EM LatAm), but also to individual emerging markets in Asia (such as China, India, Taiwan and Thailand), Eastern Europe (such as Poland and the Czech Republic), Africa (such as South Africa and Egypt) or Latin America (such as Mexico and Chile).

MSCI derivatives: Notional Volume and Open Interest in bn EUR

MSCI Futures

MSCI Options

Webcast (replay): Focus Day on MSCI & MSCI TRF

Access to global markets using MSCI derivatives

- Growth drivers and Key benefits

- Products

- Clearing

- Key MSCI Asian underlying products

Growth drivers

- Liquid OB and Block markets

Clients can get competitive prices from dealers on products like MSCI EM & EAFE futures & benefit from increased orderbook volumes in top products such as MSCI World - Cheaper cost of trading

Eurex fees are nearly 50% cheaper than main competitors - Higher capital efficiency

Margins are offset against other Eurex products (SX5E, MSCI, Dividends…)

- Meaningful offset if clients trade other flagship Eurex products

- Important if trade other MSCI single country futures like MSCI Saudi Arabia or MSCI Japan etc.

- Eurex reduced MSCI margins further on large/directional positions by introducing Hedging Auctions - Buy-side flow indicates wider adoption

Buy-side now represents over 28% of Eurex MSCI derivatives flow - Ease of trading

Eurex’s new Market on Close (MoC) functionality will allow for transparent basis trading against index close levels. Efficient lock trade rules also make it easier to get sizes done. - Breath of offering makes it easier to find better fit

- NTR Versions: Eurex offers NTR versions on EM (ZTS) and EAFE (FFA) and most indexes, rather than just price variations

- Options: Eurex offers MSCI Options on the same platform. Margins are offset between options and futures

- ESG indexes: Eurex offers Screened and Enhanced Focus methodologies on the benchmark MSCI indexes

- Sector, Factor and Thematic Indexes: Eurex offers Sectors on EM & World indexes; Factor indexes on regions and country indexes and thematic indexes

Key benefits

- Liquid order books for outrights and rolls

- The broadest offering: 141 MSCI futures and 23 MSCI options

- Extended trading hours covering three time zones with full clearing and risk management capabilities

- No position limits

- No threshold limits on blocks

- Portfolio-margining offsets available against major equity derivatives

Portfolio-based margining methodology (PRISMA) offers the highest levels of cross-margin offsets across equity derivatives

As Eurex is the #1 derivatives exchange in Europe, providing investors access to the broadest spectrum of equity index derivatives, our portfolio-based margining methodology (PRISMA) offers the highest cross-margin levels offsets across equity derivatives. To fully benefit from cross margining efficiencies, take a look at our Eurex Clearing Prisma brochure. For highly accurate what-if scenarios and incremental risk calculations, use our online margin calculators.

Switch to the Global Home of MSCI Derivatives

Eurex has the most comprehensive suite of MSCI derivatives across all time zones, including alternatives directly available.