22 Apr 2024

Eurex

A decade of MSCI derivatives: Growth drivers and further developments (article)

In this article, we provide unique insights into the growth of MSCI derivatives at Eurex over the last decade, highlighting factors like increasing demand for indexing, regulatory changes and recently launched new products as well as further developments.

A decade of MSCI derivatives at Eurex

On March 11th, 2013, Eurex created the foundations of its MSCI regional indices offering with the listing of dollar denominated MSCI World Futures (FMWO).

Before Eurex started to list MSCI derivatives, open interest at the exchange was almost entirely focused on European underlyings. STOXX, DAX and SMI products constituted the bulk of the index derivatives suite.

MSCI derivatives opened up international market access at Eurex. The exchange now hosts single country futures for 20 out of the 23 developed markets and 21 out of 24 emerging markets.

Today, in total, Eurex offers 166 MSCI Futures and 28 MSCI Options. The most prominent index is still MSCI World, which is the leading benchmark for global developed equity markets. Around $15tr of assets in total are benchmarked against MSCI indices, with a high portion of that against MSCI World — a broad index constituting about 1500 stocks.

Growth drivers for MSCI World

In 2013, MSCI World was most commonly used as a benchmark for performance measurement, rather than as a liquid trading instrument. Market participants would execute their hedging and cash equitization needs using swaps or baskets.

Over the last 10 years, those norms have been overturned. The assets in Xetra-listed ETFs that replicate the MSCI World index have grown from €9bn to almost €100bn. During the same period, trading volumes in MSCI World Futures at Eurex went from €0 to €20bn, with another €10bn traded in MSCI World Options.

The causes of this enormous growth are varied. For ETFs, growing demand for indexing and passive investments, combined with downward pressure on management fees, has been a crucial driver.

There is also a growing desire among investors to own global portfolios with less domestic weighting. Market makers have adapted accordingly and increased their capacity for quoting these broader, global benchmarks. Over the last decade, ETF assets linked to MSCI World have grown much more than the rest of the ETF market in Europe.

Growth in futures volume has a strong regulatory impetus. The Uncleared Margin Rules that were designed to push OTC derivatives positions onto exchanges and clearing houses started to impact the major investment banks in 2016. Every year since, they were applied to a broader range of market participants until their final phase-in in 2022.

For banks, UMR began an intense focus on balance sheet optimization, principally through creating margin offsets wherever possible. Eurex has been a key hub for facilitating these offsets as it offers a large variety of equity and equity index products.

The launch of Total Return Futures on MSCI indices in the first quarter of 2024 is a recent example of Eurex’s role in this migration from OTC, providing another listed expression of the Total Return Swaps market.

The launch also adds to the diversity of the MSCI product suite at Eurex, where a combination of the right products, block trading facilities and order book trading capacity has helped the segment grow healthily over time. In total, €150bn of open interest in MSCI derivatives is held at Eurex, with roughly a quarter of that linked to products derived from MSCI World.

Further developments

As the MSCI segment started to grow materially from 2013, it did not take long for additional product requests to start coming in. Only one year after launching the dollar-denominated contracts, euro-denominated MSCI World Futures were added after requests from European buy-side clients.

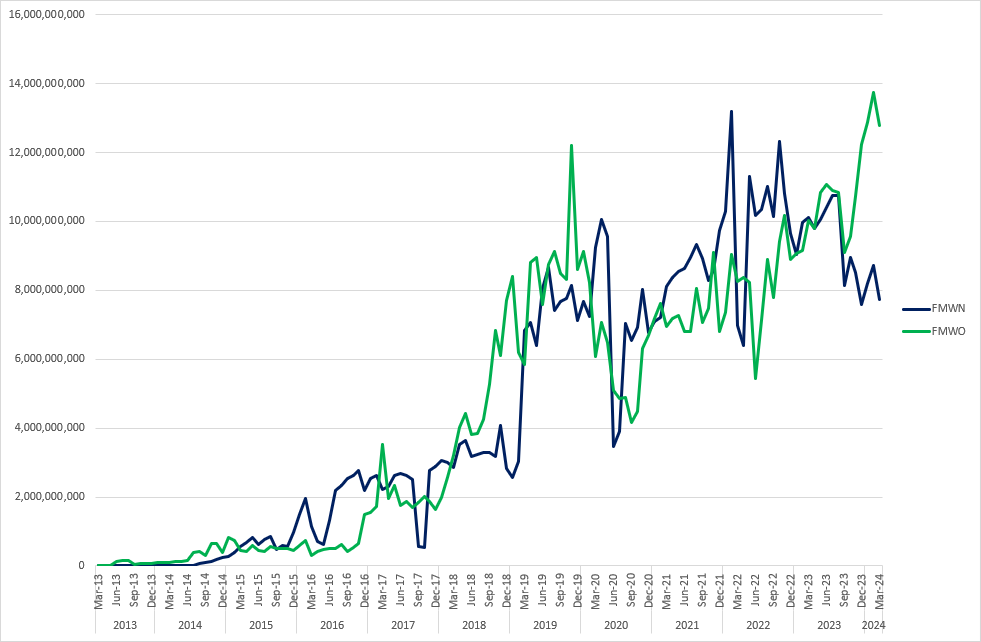

These euro-denominated World Futures at times attracted even higher open interest (in notional terms) than the dollar contracts. More remarkable is how linked the two contracts have been in the development of their open interest. Both futures have maintained open interest of about €10bn in recent years.

Figure 1 – Open interest (in Euro) of MSCI World Futures in USD (FMWO) and in EUR (FMWN)

Both contracts have developed very liquid order books and as a result are often traded in parallel — sometimes as a currency trade or for hedging the risk profile of one product with the other.

While the market for euro contracts has more buy-side participation, the dollar product is used by a broader range of clients. Notable dollar participation comes from the trading-affine community, which includes market makers and high-frequency firms.

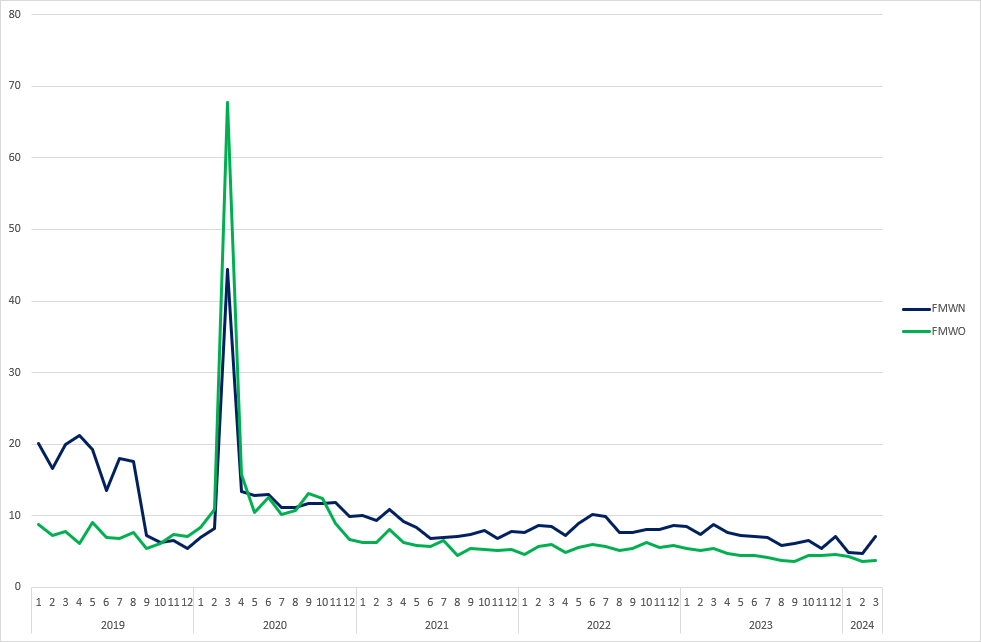

The graph below shows the ELM (Eurex Liquidity Measure) of the two products over a five-year period. This measures, on a continuous basis, the impact of a €1 million order on the order book. The market impact includes the best available bid / ask spread and the market impact of going deeper into the book to execute this order, if needed.

At the beginning of 2019, a trader had to pay 10bp for €1m-equivalent order on the dollar contract, and up to 20bp for the euro future. Today, trading both products only creates a market impact of about 5bp.

Figure 2 – ELM of MSCI World in USD (FMWO) and in EUR (FMWN) for a 1mn EUR order

This means that MSCI World Futures can be easily executed in the order book. A similar trend has been observed over time in other products, like MSCI China and MSCI EM Futures.

Next steps forward

The euro denominated MSCI World Futures have been just one addition to the MSCI product suite since 2013. Sterling futures for UK asset managers have been launched too, alongside plenty of other products:

Currently, futures are available on 11 MSCI World sectors, as well as on “ex-indices” like MSCI World ex-USA, ex-Japan (Kokusai) and ex-Australia. The suite also includes ESG versions of popular indices, such as MSCI World ESG Screened F&O and MSCI ESG Enhanced Focus CTB Futures.

MSCI products have become increasingly refined over time, as index investment grows to cover an increasing variety of sophisticated investment strategies.

MSCI World Factor Futures are one example of this, capturing demand for investment strategies based on factors like momentum, quality and enhanced value.

Eurex launched futures referencing adapted factors, to capture the increasingly global scope of such strategies among the buy and sell-side. The futures have accumulated open interest of about €2bn in the year after their November 2022 launch. The MSCI World Quality index showed strong outperformance against the parent index in 2023.

The MSCI suite continues to expand as it incorporates other investment trends. Eurex launched Socially Responsible Investment Futures in January 2024, which again reference MSCI World and other indices.

These products also mark an evolution in Eurex’s well-developed ESG offering, fulfilling demand for instruments that satisfy stricter ESG mandates. The MSCI SRI indices focus on companies with strong sustainability profiles that comprise the 25% leading stocks per sector.

As aforementioned, Eurex recently launched the first MSCI Total Return Futures. TRFs already constitute a vibrant market, with well-established EURSO STOXX 50, EURO STOXX Banks, STOXX Select Dividend 30 and FTSE100 products. With a very similar structure to Total Return Swaps, these contracts are another wrapper for creating access to long-term exposure to an index without the need to roll every quarter.

Conclusion

Global indices are increasingly popular among investors — not just as benchmarks for performance, but increasingly as tradable instruments such as ETFs, futures and options. The key advantage is to be able to trade or hedge the whole global equity market in one trade, whereas in the past a combination of liquid instruments would be used.

The old way of replicating the MSCI World via other indices (such as the S&P500, STOXX, FTSE, SMI and Nikkei) always meant executing five or more trades instead of one and posting margin to multiple clearing houses, without any offsets. That model created tracking error, especially in volatile periods. The more liquid the benchmark itself gets through instruments like MSCI World Futures, the less clients are willing to accept that tracking error.

It would therefore not be surprising if in another 10 years from now, MSCI World Futures gained further market share from the national and regional benchmarks. This shift, which is partially visible already in the futures market, might extend to options as well.