Eurex/KRX Link

Trade and hedge your Korean exposure after KRX closing hours

The following fully fungible daily expiring futures are available for trading at Eurex during the core European and U.S. time zones:

- KOSPI 200 Options

- Mini-KOSPI 200 Futures

- KOSPI 200 Futures

- USD/KRW Futures

- KOSPI 200 Thursday Weekly Options

- KOSPI 200 Monday Weekly Options

The strategic cooperation between KRX and Eurex has proven extremely beneficial for Eurex and KRX customers alike. It will continue to provide market participants with more trading and hedging opportunities on both exchanges.

Eurex KOSPI Products - Monthly ADV (thousands)

Focus on Korea – Unleashing the potential of after-hours trading

The article delves into the market liquidity of Eurex KOSPI derivatives and the potential it holds for our market participants.

- Key Benefits

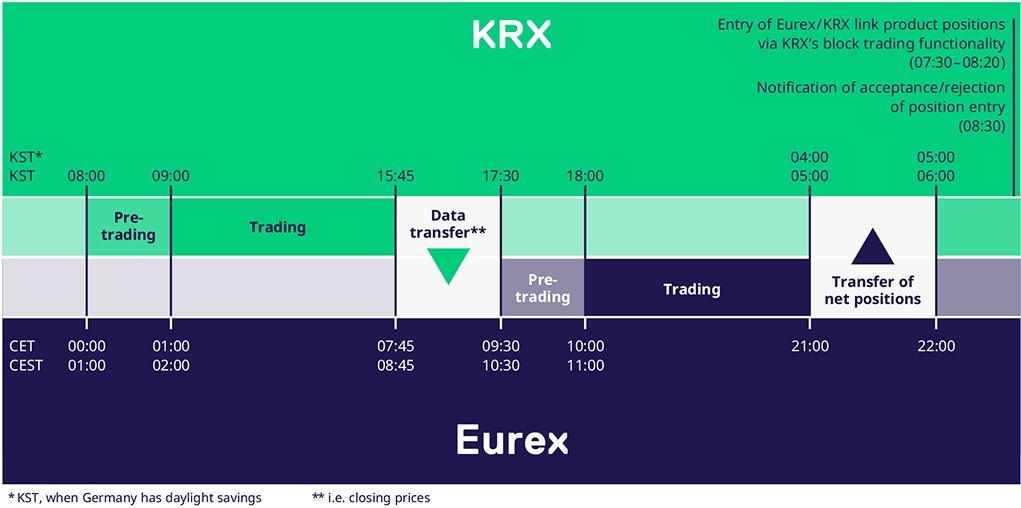

- Trading phases

- Contract Specifications

- How to access the Eurex/KRX link

- Access to KOSPI after-hours market

Eurex KOSPI products provide market participants with more trading and hedging opportunities of the Korean index during the core European and US time zone - Attractive and liquid market

The KRX KOSPI Options are one of the most liquid derivatives in the world. - Fully fungible products

Eurex/KRX Link products are fully fungible with the corresponding contracts at KRX - Exchange-traded benefits

Important exchange-based trading, clearing and risk management functionalities help to

reduce counterparty risks and increase margin efficiencies

Daily Futures on KOSPI 200 Futures

Min. Price Change | Product Code | Trading Hours | Contract multiplier | |

Points | Value | |||

0.05 | KRW 12,500 | 10:00 - 21:00 CET | One KOSPI 200 | |

Daily Futures on Mini-KOSPI Futures

Click on the Eurex product code to view further contract details, such as price charts and trading parameters.

Min. Price Change | Product Code | Trading Hours | Contract multiplier | |

Points | Value | |||

0.02 | KRW 1,000 | 10:00 - 21:00 CET | One Mini-KOSPI 200 | |

Daily Futures on KOSPI 200 Options

Click on the Eurex product code to view further contract details, such as price charts and trading parameters.

Min. Price Change | Product Code | Trading Hours | Contract multiplier | |

Points | Value | |||

0.05 points when the price is quoted at

| KRW 12,500

KRW 2,500 | OKS2 | 10:00 - 21:00 CET

| One KOSPI 200 Option

|

Daily Futures on KOSPI 200 Thursday Weekly Options

Min. Price Change | Product Code | Trading Hours | Contract multiplier | |

Points | Value | |||

0.05 points when the price is quoted at

| KRW 12,500

KRW 2,500 | OKW1/ OKW3/ OKW4/ OKW5 | 10:00 - 21:00 CET

| One KOSPI 200 Thursday Weekly Options

|

Daily Futures on KOSPI 200 Monday Weekly Options

Min. Price Change | Product Code | Trading Hours | Contract multiplier | |

Points | Value | |||

0.05 points when the price is quoted at

| KRW 12,500

KRW 2,500 | 10:00 - 21:00 CET

| One KOSPI 200 Monday Weekly Options

| |

1 during the daylight savings time in Europe

- Listing of the Eurex/KRX Link Products

- Eurex members: must have a business relationship with at least one KRX member to facilitate the delivery of the Eurex/KRX Link Products. KRX members: open an account with at least one Eurex member to facilitate outbound orders from Korea to trade the Eurex/KRX Link Products

- Eurex members trade the product at Eurex by indicating the KRX member and the ID account number of the final beneficiary into the respective dedicated field along with the order. KRX members trade the Eurex/KRX Link Products through Eurex members

- Margining: Intra-day margin in one of the Eurex clearing currencies (EUR/CHF/USD/GBP)

- Clearing: Payment/Receipt of variation margin in KRW at a Korean settlement bank by KST 15:00 (CET 07:00 or 08:00*)

- Settlement information transfer on a final beneficiary basis from Eurex Clearing to KRX

- Settlement information transfer from KRX to the respective KRX members

- Margin check & entry of the settlement information into the KRX system through KRX‘s OTC Block Trading Functionality

- Confirmation of settlement information entry which results in Eurex/KRX Link product positions in the KRX market

Contacts

Eurex Product Design Sascha Semroch T +49 69 211-1 50 78 | Eurex Sales Jane Yeo (여지윤) T +852 2530- 78 07 | KRX Global Alliance |