Eurex Market Models

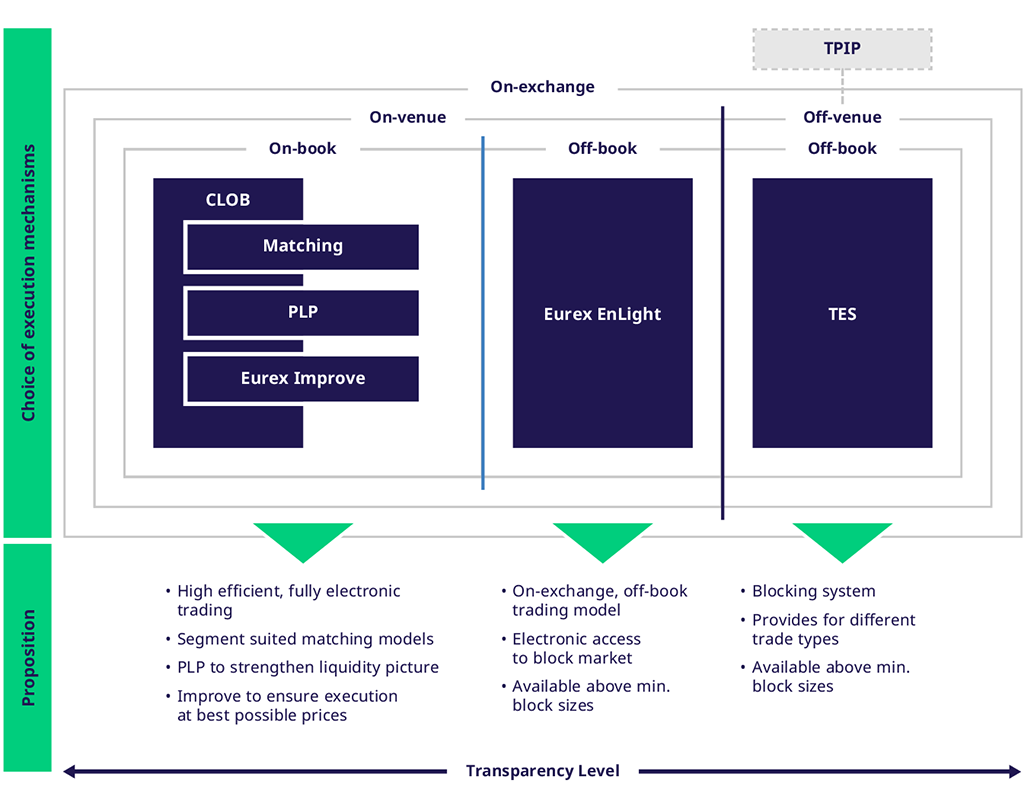

The European derivatives landscape is characterized by a two-tiered on- and off-book market structure.

To enhance fair, accessible and efficient markets on-book, Eurex introduced several initiatives to bolster liquidity in its Central Limit Orderbook (CLOB). Programs such as Eurex PLP and Eurex Improve have been pivotal in this effort. Eurex PLP protects liquidity providers against adverse low-latency trading strategies, allowing them to offer tighter spreads and manage larger transaction sizes for the investment community. Conversely, Eurex Improve guarantees that end customers can execute their trades in full size at predefined prices or better, through competition in the CLOB, ensuring greater transaction reliability and best execution.

Over the years, the shift toward algorithmic execution strategies in the CLOB significantly enhanced liquidity, efficiency and speed of market transactions. These advancements also lowered entry barriers, expanding the market's user base.

Despite the significant strides made in the CLOB, a considerable segment of off-book trading in Europe still relies on traditional communication methods such as voice or chat. In response, Eurex introduced Eurex EnLight, a selective RFQ platform that seamlessly merges electronic and manual trading aspects to increase operational efficiencies in and provide for an electronic access possibility to off-book trading. This platform facilitates negotiations and executions within a centrally cleared counterparty (CCP) environment, enhancing the security and efficiency of off-book trades.

The trend of greater automation in the listed environment is set to continue. As the architects of trusted markets, Eurex will continue to ensure that the needs of a diverse array of participants are met.