Jun 20, 2022

Eurex

Playing Footsie with Eurex

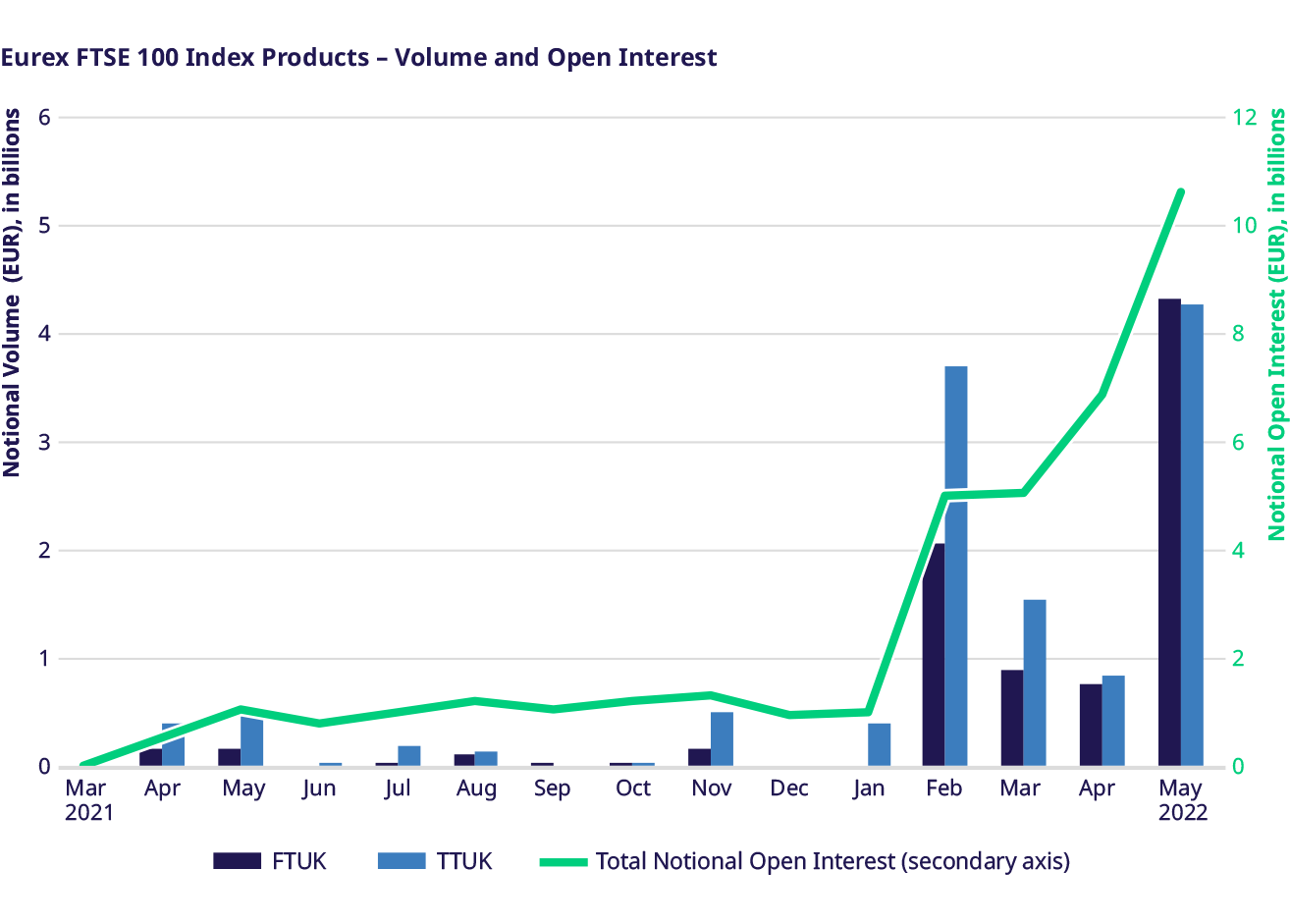

More and more participants choose to hedge their UK benchmark index exposure using Total Return Futures on FTSE 100 Index (TTUK). The first five months of 2022 saw a 120,000 lots trading in TTUK (the equivalent of almost GBP 10 billion notional). This is more than seven times 2021 volumes, the year in which Eurex launched the FTSE product suite.

Open interest has been growing steadily and currently standing at 87,000 lots (equivalent to GBP 6.5 billion).

Similarly, Eurex’s FTSE 100 regular price return index futures have also grown in popularity with over 100,000 lots traded and an open interest of 35,000 lots. The combined open interest on both instruments now standing over 120,000 lots (GBP 9 bn).

Why use FTSE 100 derivatives on Eurex?

Reduced dividend risk - Total Return Futures provide access to long-term maturities with index dividends incorporated, hence dividend risk (such as postponements of dividend payment dates) is reduced, removing forward dividend exposure risk during the quarterly roll periods.

Term structure - FTSE TRF have expiries extending up to 10 years which allows for immediate exposure to longer dated maturities. TRFs can be utilized to express views on the term structure (the variations in spread across maturities). For example, clients could sell longer-dated contracts versus buying a shorter-dated expiry. Eurex TRF is bringing visibility and transparency into the orderbook.

Margin benefits - Through our portfolio-based approach in Prisma, Eurex FTSE 100 derivatives are margined along Eurex’s Equity and Index products, simplifying margin monitoring, reducing postings, and using the same collateral pool. For participants active in the OTC Total Return Swap market, trading the listed TRF at Eurex provides a viable alternative with benefits from price transparency and counterparty risk mitigation.