Mar 29, 2022

Eurex

Record volumes for FTSE 100 Derivatives at Eurex marking one year anniversary

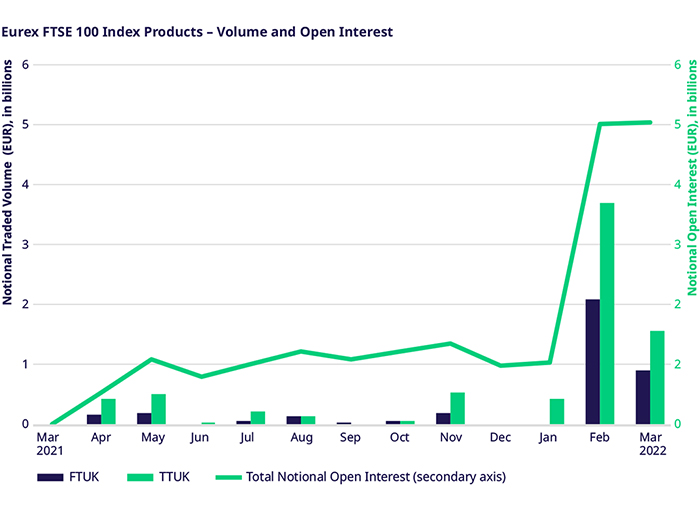

2022 witnessed a sharp increase in trading activity for the FTSE 100 Derivatives at Eurex compared to last year (+254% vs. 2021).

Since the launch in March 2021, the traded value was EUR 7.4 billion for FTSE 100 Index Total Return Futures (TTUK) and EUR 3.6 billion for the regular FTSE 100 Index Futures (FTUK). The combined open interest is at present approx. EUR 5 billion notional.

The recent developments such as the outperformance of the UK benchmark versus its peers as well as market volatility have also triggered additional interest into the FTSE 100 Index offering at Eurex resulting in new players joining the offering.

Typical trading strategies with FTSE 100 Index TRF include repo curve trades and directional play, often executed in conjunction with FTSE 100 Index Futures.

Benefits:

In light of the challenges posed by the Uncleared Margin Rules framework, the FTSE 100 Index TRF has helped market participants exposed to FTSE 100 Index initiate their transition to a listed solution replacing traditional OTC transactions.

Another key benefit is the ability to achieve margin reductions at portfolio level between FTSE 100 exposure and other index and equity derivatives traded at Eurex.