Eurex ETF Options allow investors to actively manage ETF positions and thereby yield a higher return. Among the considerable benefits are the physical delivery of the underlying instrument when exercising the options and the increasing Eurex order book liquidity.

In the US, ETF Options have been a fixture among exchange-traded options for many years. They are among the most popular investment instruments for US private investors as well as for institutional investors. Their application is manifold, ranging from mere participation in rising and falling prices of the underlying to the active management of ETF positions, for example via covered-call writing and protective put strategies.

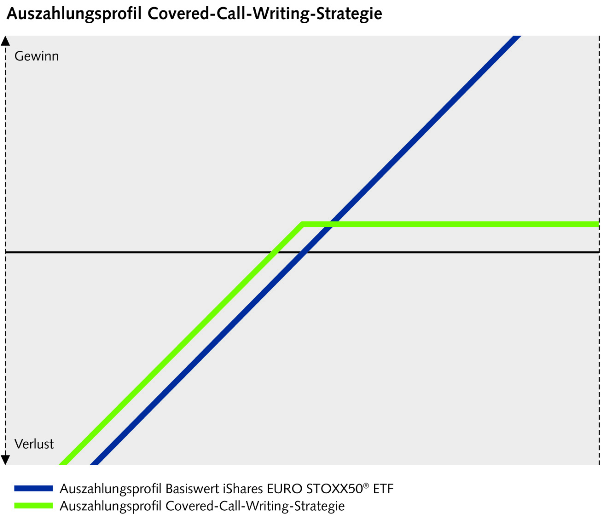

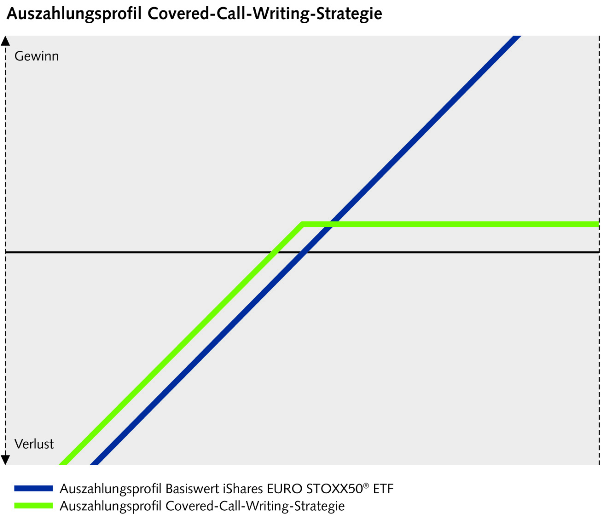

Payoff profile covered-call writing strategy

The main difference between equity index options and ETF Options is the investor’s right to physical delivery of the underlying instrument when an option position is exercised. Equity index options are settled in cash upon expiry; ETF Options are delivered physically. In a long put position, the underlying instrument is sold upon exercise to the owner of the short put position by the owner of the long put position at the strike price. This is of particular benefit to investors seeking to hedge an existing ETF position, allowing them to achieve their defined payoff profile as the option expires.

Example of a covered-call writing strategy

• Initial position: 100,000 iShares EURO STOXX50® ETF (EUN2)

• Price of underlying instrument: €30.00

• Option style: call

• Expiry: September 2016 (remaining term 3 months)

• Exercise price: €31.00

• Subscription ratio: 1:100

• Option price: €0.90

An investor decides to subscribe for a position of 100,000 shares in the iShares EURO STOXX50® ETF through a call option. Accordingly, he sells 1,000 call options (ratio 1:100) with expiry in September 2016 and an exercise price of €31,00 for €0.90 per option. By selling the call options, he yields a premium of €90,000. What is his risk situation?

If the closing price of the underlying instrument is above €31,00 at the end of the option’s term, the option is exercised by the buyer of the call option, resulting in the delivery of 100,000 shares in the iShares EURO STOXX50® ETF to the buyer of the call option for €31,00. The breakeven against an exposure in the underlying instrument only is €31.90 (exercise price plus received option premium).

If the closing price of the underlying instrument is below €31 at the end of the option’s term, the option expires worthless and is not exercised by the owner of the long position. The investor retains his original ETF position and yields a higher return in the amount of the received option premium.

The above represents a suitable strategy for investors expecting prices to be steady or decline slightly, or those seeking to reduce their ETF positions in case of a price increase.

Example for a short put strategy

• Initial position: 100,000 iShares EURO STOXX50® ETF (EUN2)

• Price of underlying instrument: €30.00

• Option style: put

• Expiry: September 2016 (remaining term 3 months)

• Exercise price: €30.00

• Subscription ratio: 1:100

• Option price: €1.68

An investor wants to increase an existing position of 100,000 shares in the iShares EURO STOXX50® ETF by a further 100,000 shares. He can buy them directly on the secondary market. Or he can purchase the shares through a short put strategy. He sells 1,000 put options with expiry in September 2016 and an exercise price of €30.00 for €1.68 per option. Through the sale, he yields a premium of €168,000. What is his risk situation?

If the closing price of the underlying instrument is below €30.00 at the end of the option’s term, the option is exercised, which means that the investor receives 100,000 shares in the iShares EURO STOXX50® ETF for €30.00. Taking into account the premium received the effective purchase price amounts to €28.32. This strategy allows the investor to profit from the premium through a reduction of the purchase price. However, he cannot be certain of the purchase, since the option is not exercised at a price above €30.00 and, therefore, would not allow for further shares to be acquired. In this case, the premium received can be booked as an additional return and the strategy can be implemented again at a different price level.

Low trading cost without execution risk

Equity index options are known to be extremely liquid with narrow bid/ask spreads, and it may be argued that such a strategy can be reproduced with regular equity index options instead of ETF options. However, investment strategies must always take into consideration the overall transaction costs and risks, with ETF options offering clear benefits in this regard.

The liquidity provided by market makers and the bid/ask spread allow for liquid trading and extremely attractive conditions.

In addition, the physical delivery of the underlying eliminates the execution risk in the strategy’s holistic implementation. This risk exists when replicating the strategy with equity index options settled in cash.

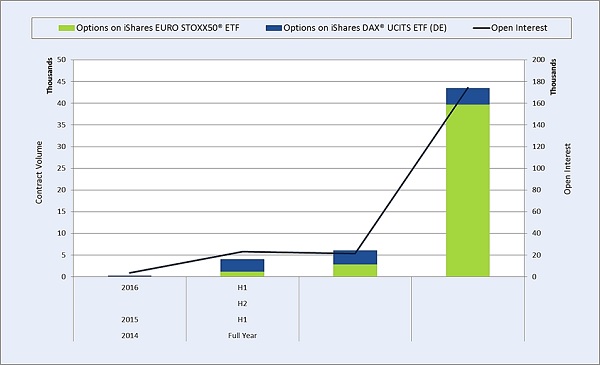

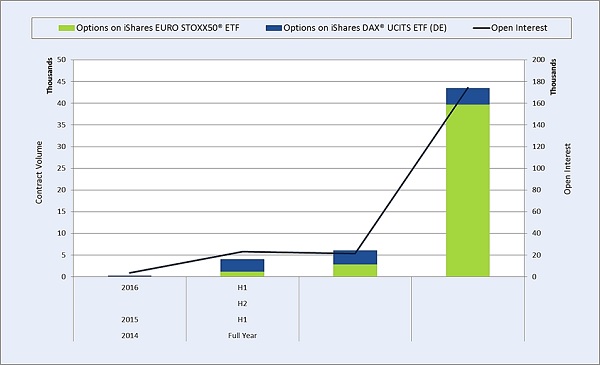

Recent developments

The ETF options volume traded at Eurex has steadily increased during the past months. Market makers Optiver and Susquehana ensure narrow bid/ask spreads and high liquidity. The traded volume is mainly concentrated on the two underlying instruments iShares EURO STOXX50® ETF (EUN2) and iShares DAX® UCITS ETF (EXS1). The growing attention from other European investors and the many advantages of ETF options inspire confidence that this positive trend will continue.

By Philipp Schultze, Sales Europe Equity & Index Derivatives

| Philipp Schultze, Eurex Exchange, is responsible for the distribution of Equity & Index Derivatives in Europe as well as for the distribution of ETF Derivatives traded at Eurex Exchange. He looks back on more than 15 years of experience in the financial industry on both the trading and the distribution side of stocks and derivatives. He holds a degree in business economy from the FH Zürcher Hochschule Winterthur as well as a diploma as a Certified International Investment Analyst (CIIA). |