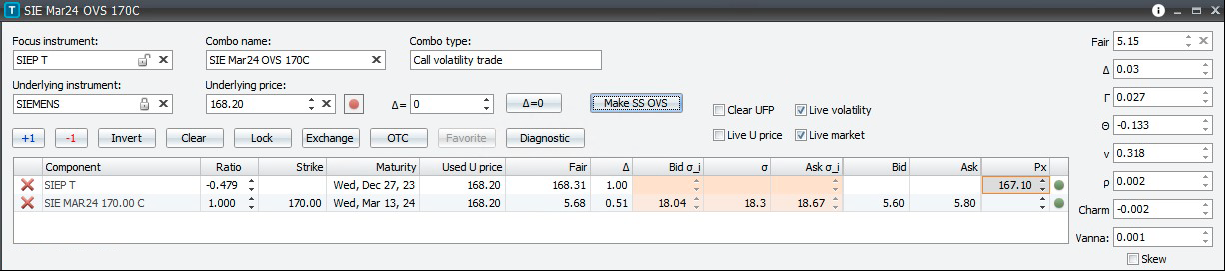

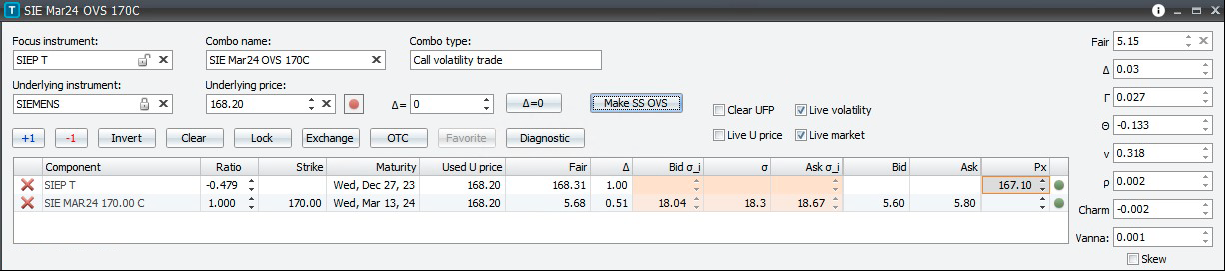

Broadridge Trading and Connectivity Solutions (BTCS), a leading global infrastructure provider for the financial industry, has announced the integration of Eurex delta-neutral trading in its trading and risk management solution Tbricks. The update allows participants to trade delta-neutral, including trading the underlying cash leg, via physically settled single stock futures with t+0 expiry. The solution offers an increase in efficiency as the entire transaction is traded and cleared through Eurex’s risk framework without any manual booking of the underlying cash leg, while no bilateral risk limits or KYC processes are required for the participants. Volatility strategy trades can be traded either on-screen, via the selective RfQ functionality Eurex EnLight or off-book as a block trade.

“BTCS is excited to contribute to Eurex’s effort to improve option markets by supporting delta-neutral strategies combined with daily expiring physically settled futures,” said Christian Voigt, Head of Markets at Broadridge Trading and Connectivity Solutions. “Continuously improving the way risk is transferred in markets is key to ensuring vibrant and sustainable markets.”

“It’s encouraging to see that market participants are starting to adopt the solution offered by Eurex. Tbricks is one of the most popular trading and risk systems used by various market makers and banks.” says Philipp Schultze, Head Equity & Index Sales EMEA at Eurex.

Eurex fee waiver for OVS trades in single stock options

To encourage members from a cost-benefit perspective, Eurex is waving the full trading and clearing fee for the underlying physically settled single stock futures in combination with an option (OVS) transaction for the entire calendar year.