14 Nov 2022

Eurex

Money Market Futures: Introduction of Three-Month Euro STR Futures (FST3)

1. Introduction

The Management Board of Eurex Deutschland took the following decision with effect from 23 January 2023:

- Introduction of Three-Month Euro STR Futures

This circular contains all information on the introduction of the new products and the updated sections of the relevant Rules and Regulations of Eurex Deutschland.

Simulation start: 1 July 2021

Production start: 23 January 2023

2. Action required

Eurex invites all Trading Participants to familiarize themselves and their clients with the adjusted obligations for performance for the introduction of Three-Month Euro STR Futures.

3. Details of the initiative

Introduction of Three-Month Euro STR Futures

In September 2018, the ECB's Euro Risk-Free Rate Working Group recommended the Euro Short Term Rate (€STR) as the replacement rate for EONIA. With the discontinuation of EONIA, and the transition to €STR underway, Eurex Deutschland will provide a centrally cleared, cash settled, listed solution to trading the underlying €STR.

A. Contract specifications and product parameters

Eurex plans to further expand its Money Markets futures offering by the introduction of the following futures contracts on the €STR rate:

Product name | Currency | ISIN | Product | Product | |||

code | type | ||||||

Three-Month Euro STR Futures | EUR | DE000A3CNW06 | FST3 | FINT |

For the detailed Contract Specifications, please see the Attachments.

The full version of the updated Contract Specifications will be published on the Eurex website www.eurex.com as of start of trading under:

Rules & Regs > Eurex Rules & Regulations > 03. Contract Specifications

B. Admission to the Eurex T7 Entry Services (TES)

The new products will be admitted to the Eurex T7 Entry Services (TES). You can find the minimum block trade sizes on product level in the attached Contract Specifications in the Attachment 1.

An overview of the Eurex T7 Entry Services available for the products as well as detailed information on single product basis with regard to availability, possibility of utilization and minimum entry size for the various Eurex T7 Entry Services is available on the Eurex website under the link:

Data > Trading files > T7 Entry Service parameters

C. Risk parameters

As of start of trading, risk parameters of the new products will be published on the Eurex website under the link:

Data > Clearing files > Risk parameters and initial margins

and on the Eurex Clearing website under the following path:

you will also find an updated list with details regarding Prisma-eligible Eurex products.

D. Excessive System Usage Fee and Order to Trade Ratio

The Excessive System Usage Fee and the Order to Trade Ratio for the new products are determined in line with the existing money market derivatives. For detailed information, please refer to the Eurex website under the following links:

Rules & Regs > Excessive System Usage Fee

Rules & Regs > Order to Trade Ratio

E. Mistrade parameters and position limits

Mistrade ranges and position limits for the new products will be published as of start of trading on the Eurex website under the link:

Markets > Product Overview > Contract Specs

F. Transaction limits

The same values apply as for existing products with the relevant Eurex group ID. For details, please refer to the Eurex website under the link:

Rules & Regs > Excessive System Usage Fee

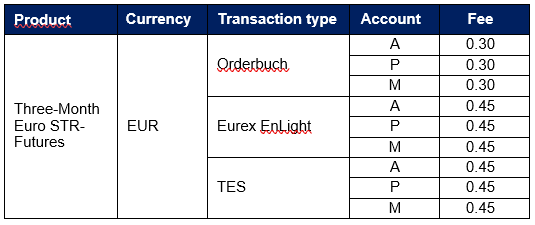

G. Transaction fees

The Three-Month Euro STR Futures will be subject to the following transaction fees:

For details, please refer to the Price List of Eurex Clearing AG available for download on the Eurex Clearing website www.eurex.com/ec-en/ under this link:

Rules & Regs > Eurex Clearing Rules & Regulations > 3. Price List

H. Vendor codes

As of start of trading, vendor codes for the new products will be published on the Eurex website under the link:

Markets > Product Overview > Vendor Codes

I. Availability in Eurex simulation

From 1 July 2021, Three-Month Euro STR futures have been available in the Eurex simulation environment for testing purposes.

For further information, please refer to the simulation calendar on the Eurex website under the following link:

Support > Initiatives & Releases > Simulation calendar

Attachments:

- Updated sections of the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland

- Updated sections of the Annexes to the Contract Specifications for Futures Contracts and Options Contracts at Eurex Deutschland

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

Related circular: | Eurex Clearing Circular 083/22 | |

Contacts: | jenny.ivleva@eurex.com, vassily.pascalis@eurex.com, client.services@eurex.com | |

Web: | www.eurex.com | |

Authorized by: | Michael Peters |