06 Feb 2023

Eurex

Next Generation ETD Contracts: Details on integration of Weekly Options and launch dates for daily expiring futures

1. Introduction

Launch date for Next Generation ETD Contracts is 27 March 2023.

This circular outlines further details on the integration plans for Weekly Options contracts and the launch dates for daily expiring Futures contracts.

Since February 2022, Eurex has offered its full simulation environment for the Next Generation ETD Contracts. In the course of the NextGen ETD initiative, the following three major business initiatives will be introduced by Eurex:

- Starting on 27 March 2023: Weekly Options contracts will be integrated under the main Option Product-ID.

- Starting on 17 April 2023: Daily expiring Single Stock Futures contracts will be activated, which will be physically settled and can be used as underlying leg in options volatility strategies in Single Stock Options without any need to trade the cash underlying.

- Starting on 24 April 2023: Daily expiring MSCI Futures contracts (T+0, T+1 and T+2) will be activated, which, traded as a specific futures calendar spread denoted as MSCI basis spread where the standard quarterly future is traded against the daily expiring MSCI Futures contract, will allow fully straight-through processed basis trading in MSCI Futures contracts.

The full documentation regarding Next Generation ETD Contacts including system documentation, circulars, newsflashes, time schedule and further information is available for you on the Eurex website www.eurex.com under the following link:

Support > Initiatives & Releases > Readiness for projects > Next Generation ETD Contracts

2. Required action/requirements for participation

Market participants, who have not yet achieved readiness for the launch of the NextGen ETD initiative, are requested to continue with their preparations. Market participants are strongly reminded to ensure that the impact on their end clients – if any – has been analysed and considered by their end clients and that all reasonable efforts have been taken to ensure readiness of the end clients for the introduction of NextGen ETD Contracts.

Depending on the chosen implementation approach of vendors, Trading Participants and Clearing Members, the impact of required NextGen ETD changes may differ and even reach beyond the three business initiatives. Therefore, it is of high importance for all market participants including end clients to verify and understand their individual impact.

3. Details of the initiative

A. Integration of Weekly and end-of-month (“EoM”) options contracts

The integration of Weekly and end-of-month (“EoM”) options contracts into the main Product-ID starts on 27 March 2023 and will be completed by 17 April 2023 with the exception of OESX, where the integration period lasts until 8 May 2023.

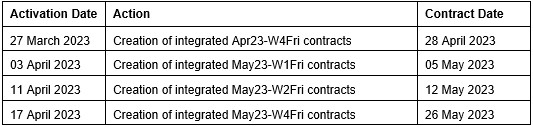

For all options products absorbing integrated Weekly Options contracts except OGBL, OESX and OSSX, the following integration plan will apply (the contract notation shown in the tables below are identical with the T7 Trader GUI display notation, see Eurex Circular 029/22):

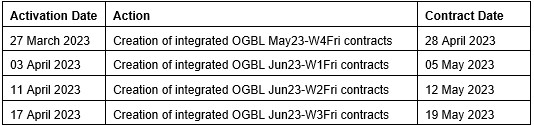

For OGBL, the following integration plan will apply:

Please note that, as in the past and in line with a longstanding market convention, for Fixed Income Options including OGBL, “DisplayMonth” (e.g. May-23) and the month shown in the Contract Date (e.g. 28 April 2023) will differ. This applies to monthly and weekly expiring Fixed Income Options contracts.

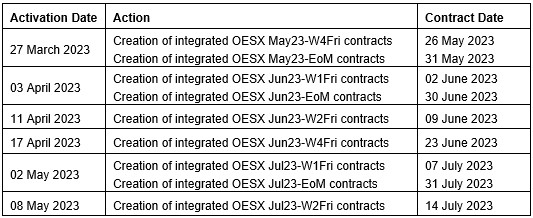

For OESX, the following integration plan will apply:

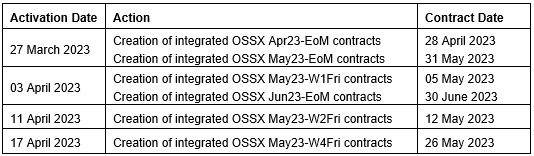

For OSSX, the following integration plan will apply:

B. Daily expiring Single Stock Futures (T+0)

The creation of Daily expiring Single Stock Futures (T+0) will be activated on 17 April 2023 for the first time.

C. Daily expiring MSCI Futures (T+0, T+1 and T+2)

The creation of Daily expiring MSCI Futures (T+0, T+1 and T+2) will be activated on 24 April 2023 for the first time.

D. Contract eligibility flag for participants to be set to level 2

The contract eligibility flag for participants will be set to level 2 with effective date 20 March 2023 for all Eurex participants. Participants can check the status in the C7 Clearing Relationship Overview window. This parameter change is a technical pre-requirement for the launch of Next Generation ETD Contracts on 27 March 2023.

E. Contract eligibility flag for all contracts in all Eurex derivative products to be set to level 2

With effective date 27 March 2023, the contract eligibility flag for all contracts in all Eurex derivative products will be increased from level 1 to level 2.

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Middle + Backoffice, IT/System Administration | |

Contact: | client.services@eurex.com | |

Related circular: | Eurex Circular 029/22 | |

Web: | Support > Initiatives & Releases > Readiness for projects > Next Generation ETD Contracts | |

Authorized by: | Jonas Ullmann |