17 Apr 2024

Eurex

ESG Index Derivatives Development Update Q1/2024

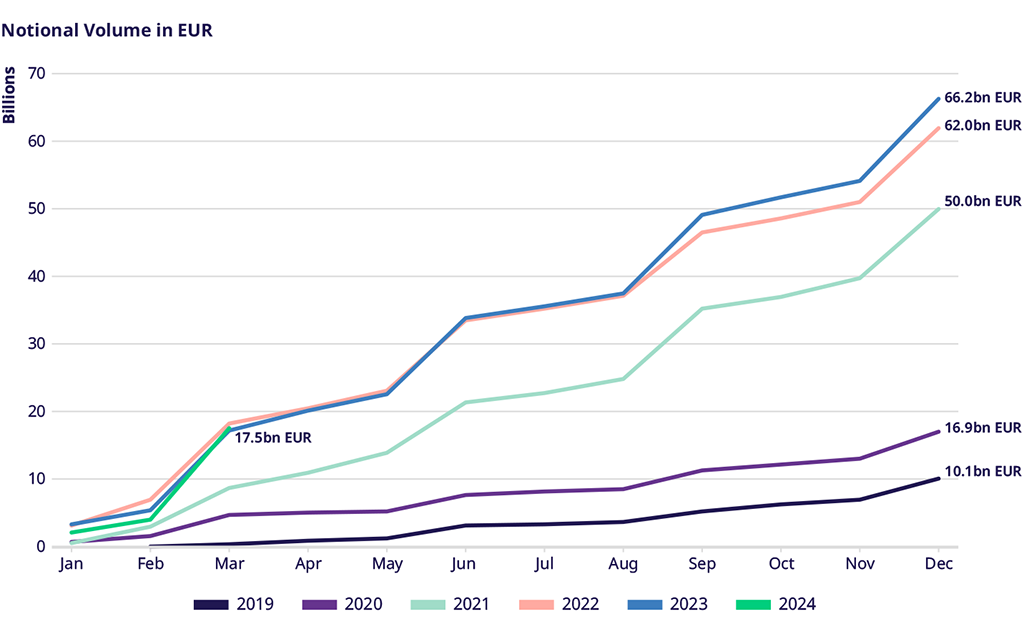

Eurex ESG Index Derivatives segment continued its strong development in Q1 2024. New SRI products recorded their first trades, while selected ESG Index Derivatives reached new highs.

Development highlights Q1 2024

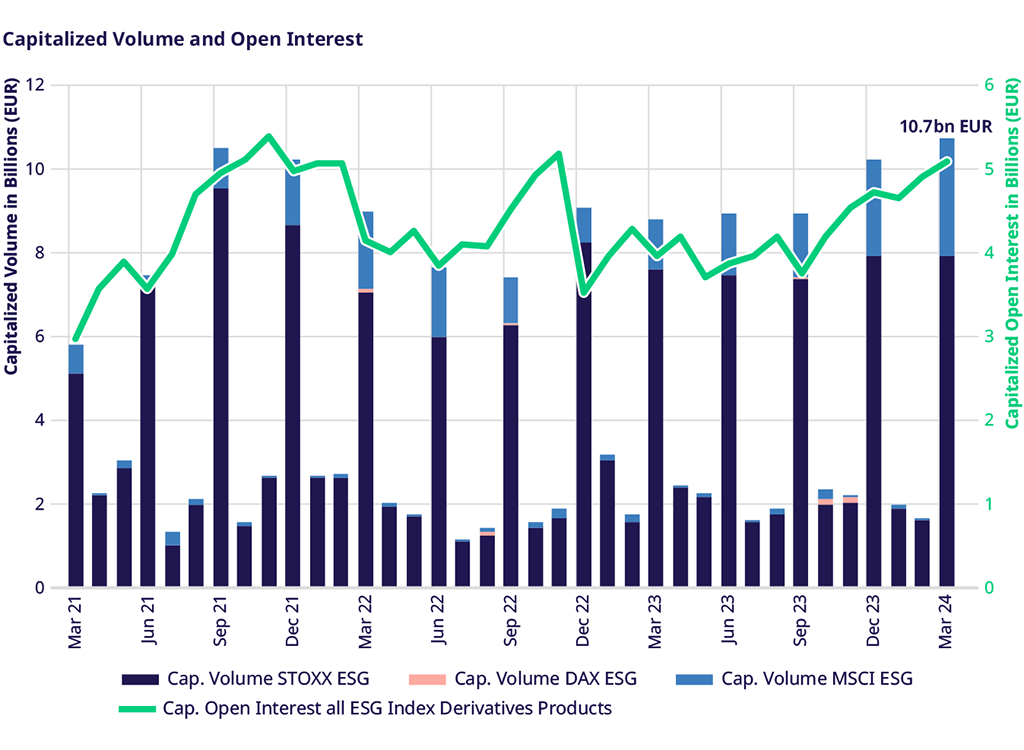

- Capitalized volume of all ESG Equity Index Derivatives products hit a new monthly record in March, for a total of €10.7 billion notional volume.

- MSCI ESG products drove this result. In Q1, the whole segment accounted for €2.9 billion capitalized volume (new record).

- Capitalized open interest in all Equity products steadily increases, recording over €5 billion for the first time since November 2022. Including Fixed Income ESG Index Derivatives, the total capitalized open interest reached €6 billion, up 27% compared to last year.

Main facts & figures Q1 2024 – Equity and Fixed Income ESG Index Derivatives

- Capitalized volume: €17 billion in Q1, up +3% vs. the previous quarter and +2% vs Q1 2023.

Capitalized open interest: €6 billion (+9% QoQ and +27% YoY).

Capitalized average daily volume (ADV): €278 million, up +7% QoQ and +5% YoY.

Derivatives on STOXX & MSCI ESG Indices

- Over €7.8 billion traded in STOXX indices in March 2024, making it the best month since December 2022.

- Proven order book liquidity for our flagship product, the STOXX® Europe 600 ESG-X Futures (FSEG), with major activity on the best bid/ask level.

- New quarterly record for EURO STOXX 50® ESG Futures (FSSX), with 134,000+ traded contracts (+23% QoQ).

- MSCI: quarterly record with over €2.9 billion traded (+12% QoQ). In particular, futures on MSCI Emerging Markets ESG Screened (FMSM) and on the MSCI USA ESG Screened (FMSU) outperformed compared to the previous quarter (respectively +27% and +32% in traded lots).

New Product Launch

In January Eurex broadened its offering of derivatives on ESG indices with futures on Socially Responsible Investing (SRI) indices. These new derivatives contracts use the STOXX Europe 600 SRI Index as well as MSCI’s SRI index suite, covering Europe, USA, World, and Emerging Markets and serve the growing demand for an advanced ESG methodology.

SRI indices provide broad exclusions combined with a best-in-class selection approach. The new SRI products recorded their first trades, and liquidity providers continuously provide on-screen prices. The Eurex press release and member circular provide further information on the new derivatives on Socially Responsible Investing indices.