15 Oct 2024

Eurex

ESG Index Derivatives Development Update Q3/2024

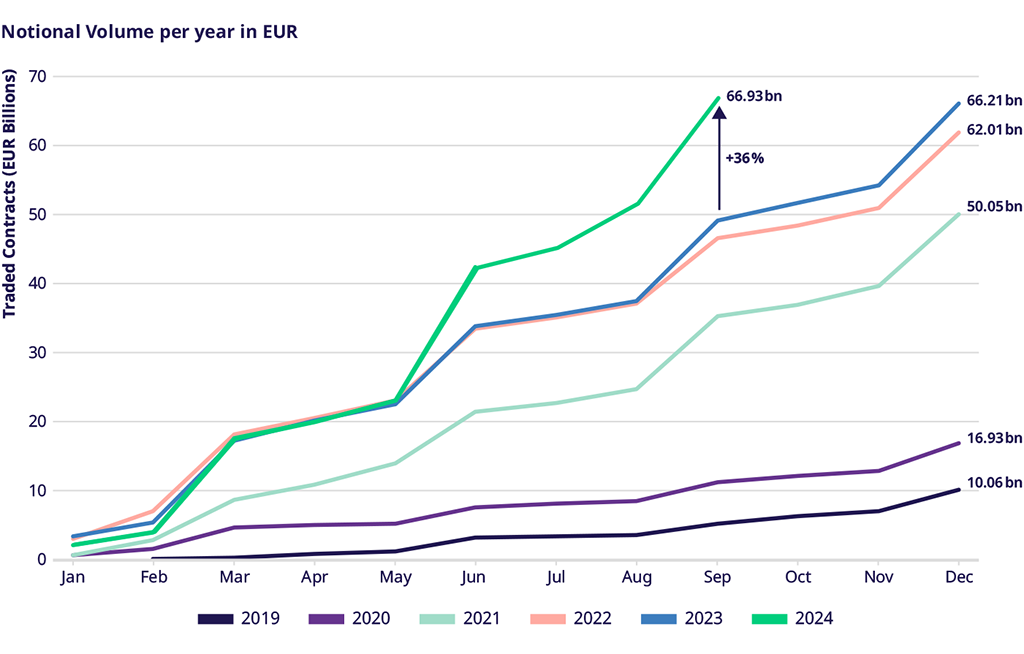

The Eurex ESG Index Derivatives segment continued its strong development in Q3 2024, already reaching the Notional Volume figures of the FY 2023 in September 2024.

Development highlights Q3 2024

- Notional Volume of all ESG Index Derivatives reached the FY 2023 figures already on September 26, 2024.

- The cumulated Notional Volume reached more than 66 billion EUR this year, leaving 2022 and 2023 behind by more than 17.7 billion EUR.

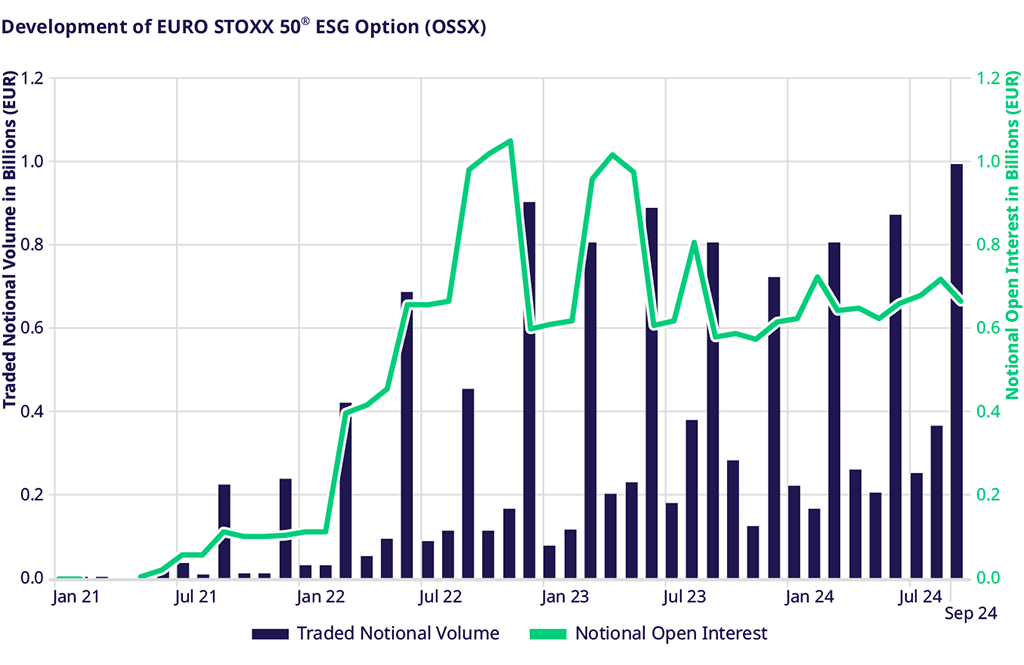

- Options on EURO STOXX 50® ESG (OSSX) reached an all-time high in Notional Volume with 994,087,100 EUR in September 2024. (see development chart below)

- Traded Notional Volume of Bloomberg MSCI Euro Corporate SRI Index Futures (FECX) shows a significant growth in Q2 and Q3 of 2024 with a peak of 7.1 billion EUR.

Main facts & figures Q3 2024 - Equity and Fixed Income ESG Index Derivatives

- Total Traded Volume: 764,771 contracts (+4.8% vs. Q3 2023).

- Total Notional Volume: 24.6 billion EUR (+59.8% vs. Q3 2023).

- Total Notional Open Interest (OI) in September: 5.2 billion EUR (+11% vs. September 2023).

- Average Daily Volume (ADV): 11,587 contracts (+3.2% vs. Q3 2023).

Market consultation by index providers

Index providers have explored the implications of ESMA’s new rules on the use of terms like “ESG” and “sustainable” in fund names. Some indices are already aligned with the ESMA guidelines. One example is the STOXX® Europe 600 SRI index, which underlies futures listed on Eurex in January this year. In a recent Blog post it has been discussed what the ESMA guidelines mean for the market and for listed products: “New ESMA fund names rules: Q&A with Eurex and STOXX on changes to ESG index derivatives”.

Below you find conclusions announced by index providers MSCI and STOXX for selected indices underlying Eurex derivatives:

✅ MSCI ESG Screened indices: The MSCI ESG Screened Indexes will be renamed as MSCI Screened Indexes, effective February 3, 2025.

✅ STOXX Europe 600 ESG-X: Period has been extended. Market participants are invited to indicate their preference (e.g. for keeping the original index / amend it and/or provide any objections, etc.) until October 31, 2024.

✅ EURO STOXX 50 ESG: The following changes are to be applied to the methodology at the ordinary index review in March 2025:

- Adding additional screens for Coal (>1%), Oil fuels (>10%), Gaseous fuels (>50% / Power Generation), to "Exclude investments in companies referred to in Article 12(1)(a) to (g) of CDR (EU) 2020/1818 (PAB exclusionary screens)".

- Switch of legacy Sustainalytics indicators to the equivalent ISS ESG indicators.

✅ STOXX Europe 600 SRI: The Legacy Sustainalytics indicators will be replaced by the equivalent ISS ESG indicators at the ordinary index review in December 2024.