22 Jan 2025

Eurex

ESG Index Derivatives Development Update Q4/2024

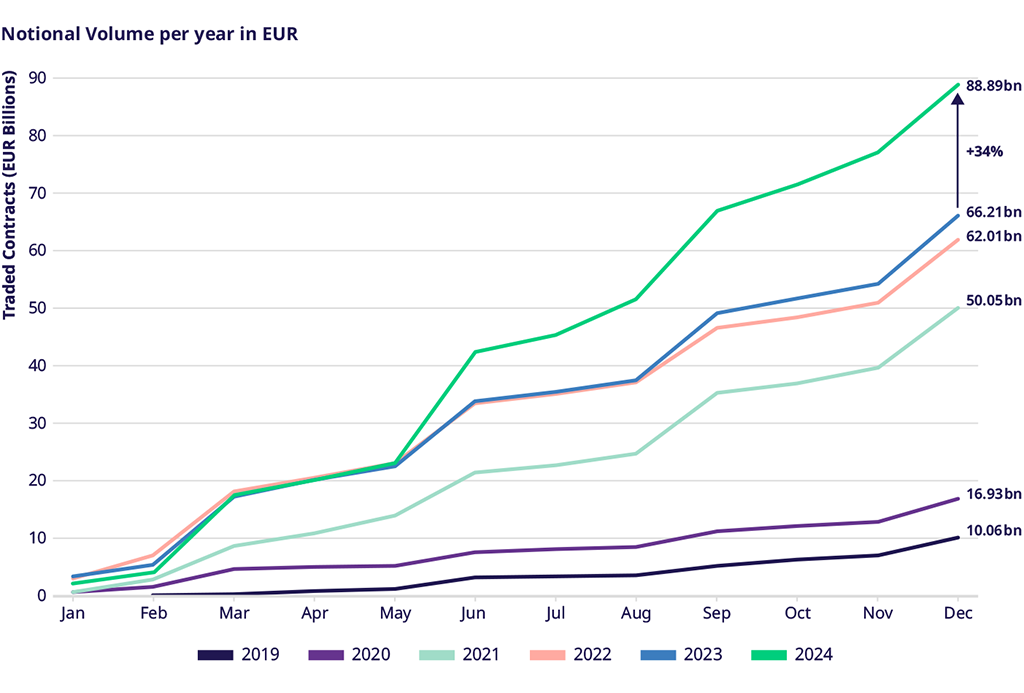

The Eurex ESG Index Derivatives segment continued its strong development in Q4/2024, already equaling the 2023 notional volume figures in September 2024.

Development highlights Q4 2024

- The notional volume of all ESG Index Derivatives equaled the 2023 volume on 26 September 2024. This marks an outstanding year for derivatives on ESG Indices.

- The cumulated notional volume reached over 88 billion EUR this year, leaving 2022 and 2023 behind by more than 22.6 billion EUR.

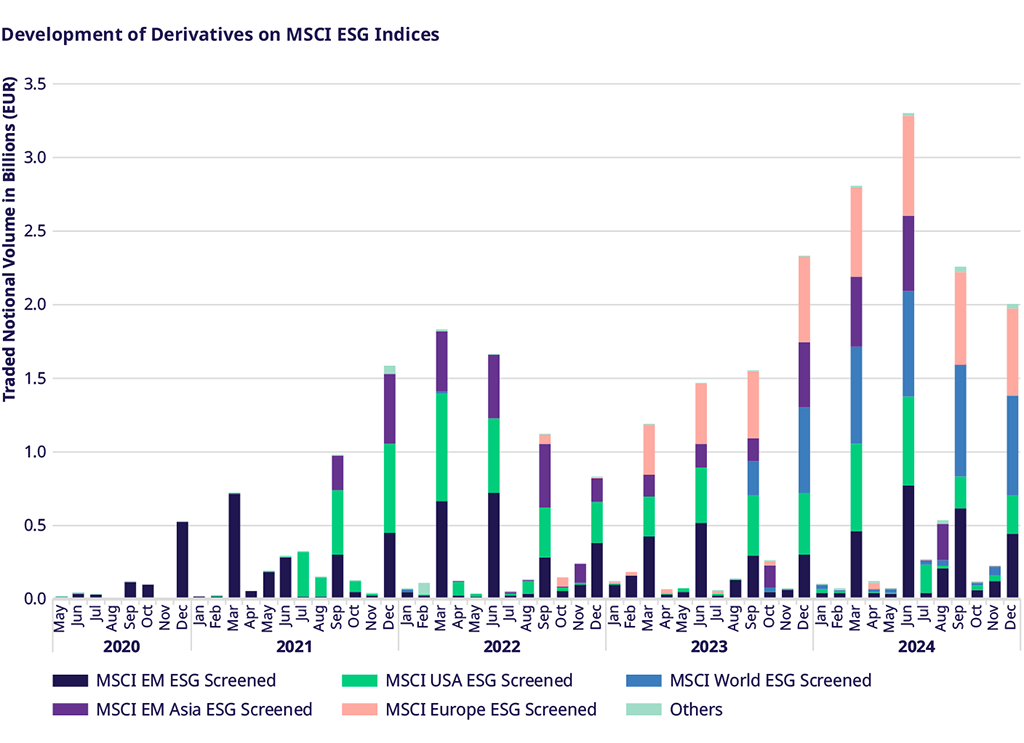

- Notional volume for all ESG Index Derivatives shows a growth of 34.3% compared to 2023. Notional volume for Equity ESG Index Derivatives is recording a rise of 3.2%, mainly driven by futures on MSCI ESG Indices (see development chart below).

- Futures on STOXX® Europe 600 ESG-X (FSEG) show 27.9 billion EUR in notional traded contracts. 52.8% order book and 47.2% off-book trading.

- Options on EURO STOXX 50® ESG (OSSX) mark an excellent year with 5.6 billion EUR traded in notional volume. Compared to last year, it is a 15.6% growth.

- The traded notional volume of Bloomberg MSCI Euro Corporate SRI Index Futures (FECX) shows a significant growth in Q2, Q3 and Q4 of 2024, with 10.1 billion EUR in Q4 2024.

Main facts & figures Q4 2024 - Equity and Fixed Income ESG Index Derivatives

- Total notional volume Q4: 21.9 billion EUR (+28.8% vs. Q4 2023) and for the full year 2024: 88.9 billion EUR (+34.3% vs. FY 2023)

- Total notional open interest (OI) peaked in November: 5.7 billion EUR (+7% vs. November 2023)

- Average Daily Volume in EURO STOXX 50® ESG Index Options: 1,306 contracts (+13.8% vs. Q4 2023)

Announcement from index providers on the ESMA Guidelines on funds’ names using ESG or sustainability-related terms:

Changes becoming effective as announced by MSCI and STOXX for selected indices underlying Eurex derivatives:

3 February 2025

MSCI ESG Screened indices will be renamed as MSCI Screened Indexes

March 2025 (change effective with the regular index review)

- STOXX® Europe 600 ESG-X, EURO STOXX 50 ESG and DAX 50 ESG:

- Adding additional screens for Coal (>1%), Oil fuels (>10%), and Gaseous fuels (>50% / Power Generation) to "Exclude investments in companies referred to in Article 12(1)(a) to (g) of CDR (EU) 2020/1818 (PAB exclusionary screens)"

- Switch of legacy Sustainalytics indicators to the equivalent ISS ESG indicators

- STOXX® Europe 600 ESG-X:

- Compliance with the 80% threshold linked to the proportion of investments used to meet environmental or social characteristics or sustainable investment objectives in accordance with the binding elements of the investment strategy, which are to be disclosed in Annexes II and III of CDR (EU) 2022/1288

- STOXX® Europe ESG Leaders Select 30 EUR:

- Upgrade to the new Sustainalytics Risk Rating Management scores