06 Jun 2024

Eurex

Now is the time to consider European style equity options

Listed equity options are mostly American style. This factor comes into play with institutions with an option portfolio and no desire to have these positions exercised. For example, having a short call turn into a short position in the underlying or having a short put assigned, resulting in a long position in the underlying equity. Concerns around this potential issue have increased with the increase in structured products incorporating option selling into their investment approach. Eurex has a solution for this with European style equity options, which allow portfolio managers to short options without the risk of early assignment.

American versus European style options

Before diving into European style equity options, we should quickly review American and European style contracts. European style options may not be exercised until expiration. On the other hand, American style options may be exercised at any moment of their life cycle.

Early assignment risk

“European style equity options offer a hedge against a specific expiry without the risk of an early assignment.” says Philipp Schultze, Head of Equity & Index Sales EMEA, Eurex.

A risk associated with short positions in American style options is early assignment. Specifically, short-call positions may have to fulfill their obligation to deliver shares in the underlying stock at any time leading up to expiration. Holding short put positions in American style options may result in being forced to purchase the underlying stock before expiration. Typically, the risk of early assignment on both short call or put positions increases around the time a firm pays dividends, but owners of options have the right to exercise at their discretion.

Remember, there is no early assignment risk on European style options. This works well if a manager intends to hold an option position close to expiration but trade out of it to avoid assignment if it’s in-the-money at expiration. The following examples use market pricing for two stocks with active European style option markets.

Short put example

Roche Holding AG (ROG) is one of the most active equity options markets with both American and European-style options contracts. Late on 2 April 2024, ROG was trading at 227.80. Consider a trader who believes ROG will stay above 225.00 over the next couple of weeks and would like to speculate on this outlook without the risk of buying ROG shares due to early assignment. They may consider selling an April 225 Put, specifically the European style version. There are both American and European style options available for ROG. The European style ROG Apr 225 Put has a bid of 1.71, while the American style version is 1.72 bid.

Covered call example

Many structured products offer exposure to consistent covered call strategies. These funds will roll their positions on standard third-Friday expiration dates. Late in the day on 19 April, Novartis AG (NOVN) was trading at 85.91. A fund that sells At-The-Money (ATM) call options would look to the ROG Apr 86 Call as the appropriate contract. As in the short put example, the pricing of the American and European style options are similar, with the midpoint of the American style bid-ask spread at 1.625 and the midpoint for the European style version at 1.64.

These two examples are the most basic of option trades. However, spread trades where one option is purchased and another sold could be implemented without worrying about a portion of the spread trade turning into a position in the underlying stock. Also, European style equity options are suitable for dispersion trading, where a manager takes a position in index options and individual equity options to benefit from a difference in implied volatility. Assignment on shorted American style options is a risk associated with dispersion trading. European style options negate this risk.

Eurex and European style equity options

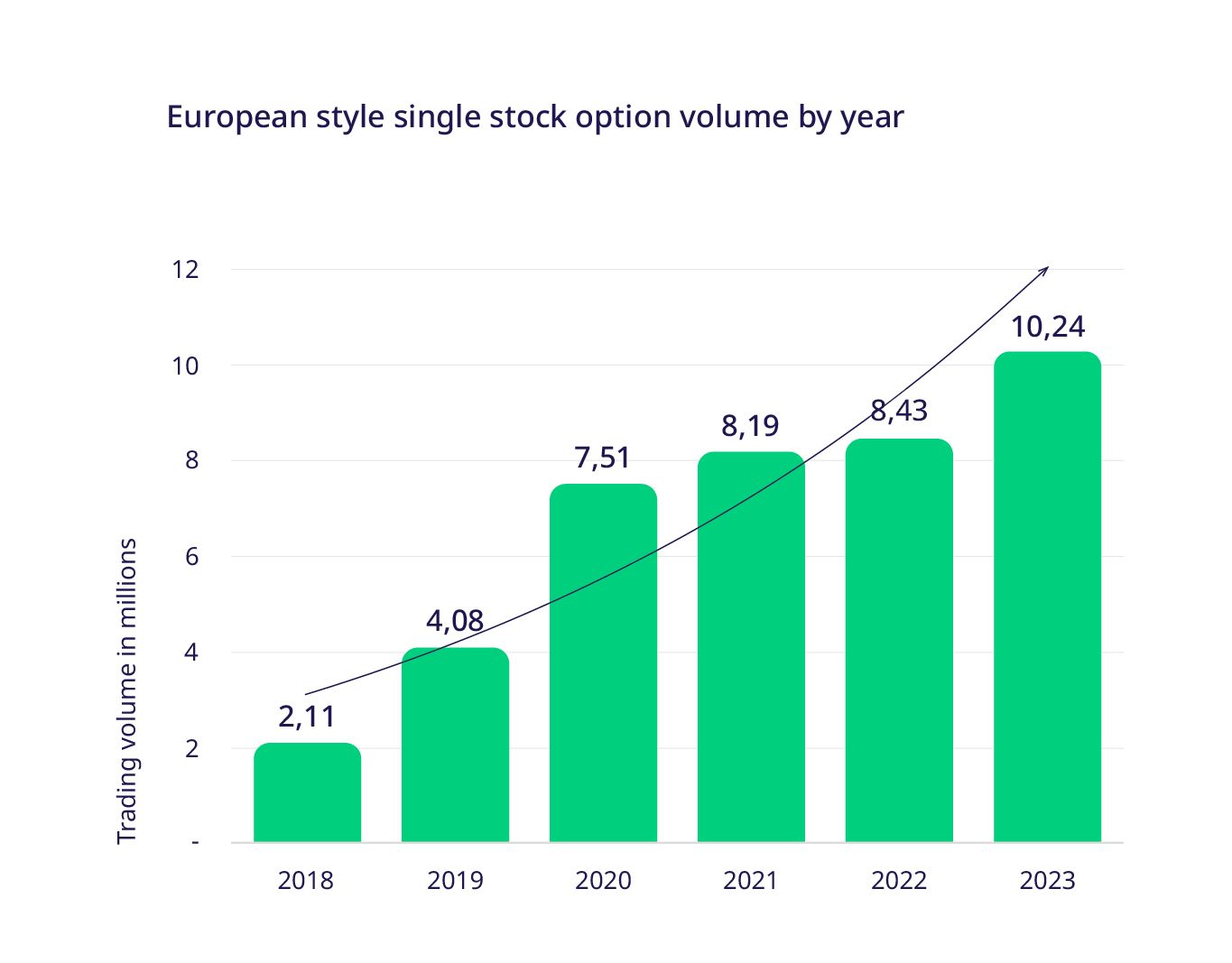

Eurex recently expanded the number of stocks with European style exercise to 119, about 20% of the equities with American-style options. These 119 stocks are the equities with the most active daily option volumes. Since 2018, volume in European style equity options has grown five-fold from 2 million to over 10 million in 2023 (Figure 1).

“At Susquehanna, we see European Exercise Style options as a simple and elegant product that allows short-interest users of the options to avoid an unwanted loss of control over their exposure during the life of their trade,” says Conor McCann, European Head of Derivatives Direct Client Trading, Susquehanna. "These products have been traded by us since their inception. We treat them very similarly to their American exercise complements when pricing and providing liquidity on screen and with our direct trading counterparties."

As of 2023, European style equity options represented about 6% of equity option volume, up from 1.1% in 2018. In addition to steady volume growth, over 100 member firms have traded European style equity options, with 19 individually accounting for over 500,000 traded contracts. The widespread interest in European style equity options should foster further volume growth and solid liquidity.

Conclusion

Selling options alone or versus a position in the underlying stock is a popular use of listed contracts by retail and institutional traders. A risk associated with most short equity options trading is an early assignment. Eurex recognized this issue over five years ago and created an elegant solution with European style equity options. Often, new methods of trading take time to gain acceptance. However, liquidity has not been an issue for these relatively new contracts, with more names being added recently and volume continuing to grow.