30 Sep 2024

Eurex

STOXX Europe 600 index underlies new Total Return Futures on Eurex

The TRFs on the leading pan-European benchmark were listed on 30 September. TRFs have seen strong demand from market participants as a way to efficiently gain exposure to price-plus-dividend returns of shares and indices.

Eurex has introduced Total Return Futures (TRFs) on the STOXX Europe 6001, expanding an increasingly popular type of exchange-traded derivatives to a broad pan-European benchmark for the first time.

The new product was listed on 30 September and follows in the footsteps of strong demand for EURO STOXX 50 Index TRFs. They also come amid record demand for existing products tracking the STOXX Europe 600, which include futures and options, ETFs and structured products.

A TRF holder receives the price performance of the underlying index or security plus 100% of its dividends from a seller, in exchange for a fee. A TRF provides a collateral-efficient, fully fungible and liquid alternative to a bespoke equity swap used in equity financing. In contrast to a swap, TRFs are governed by exchange rules, bringing a whole set of cost, risk and operational benefits.

Beyond the EURO STOXX 50, Eurex also offers TRFs on the EURO STOXX Banks and EURO STOXX Select Dividend 30 indices.

Key benefits of listed TRF's

- Reduce balance sheet costs: TRFs aim to cost-effectively replicate the payoff profile of OTC Total Return Swaps, creating a positive effect on capital requirements.

- Equity financing: Use TRFs to hedge the implied equity repo rate.

- Portfolio margining: Trade TRFs with other equity derivatives for high netting effects up to 80%.

- Increased transparency: Based on a standardized set of contract specifications (standardized maturities), on screen liquidity providers, and having daily published settlement prices.

- Risk mitigation: Provides the widest toolkit to support structured products, allowing the hedging of delta, dividend, and repo exposure on Europe’s key equity benchmarks.

TRF make-up

An equity index TRF is made up of three underlyings:

- The main index’s price

- An index of distribution points paid by constituents of the main underlying benchmark

- A short-term interest rate

The STOXX Europe 600 TRFs track:

- STOXX Europe 600 Index (SXXP)

- STOXX Europe 600 Distribution Points Index (SXXPDD)

- Euro Short Term Rate (€STR)

Having a TRF that’s traded on a regulated exchange and centrally cleared is also an advantageous alternative to over-the-counter derivatives at a time when the latter have been subject to increasingly demanding regulation, according to Eurex.

Read more here: Q&A with Eurex: Switching OTC swaps to a capital-efficient alternative under Uncleared Margin Rules

Cost-efficient access to total returns

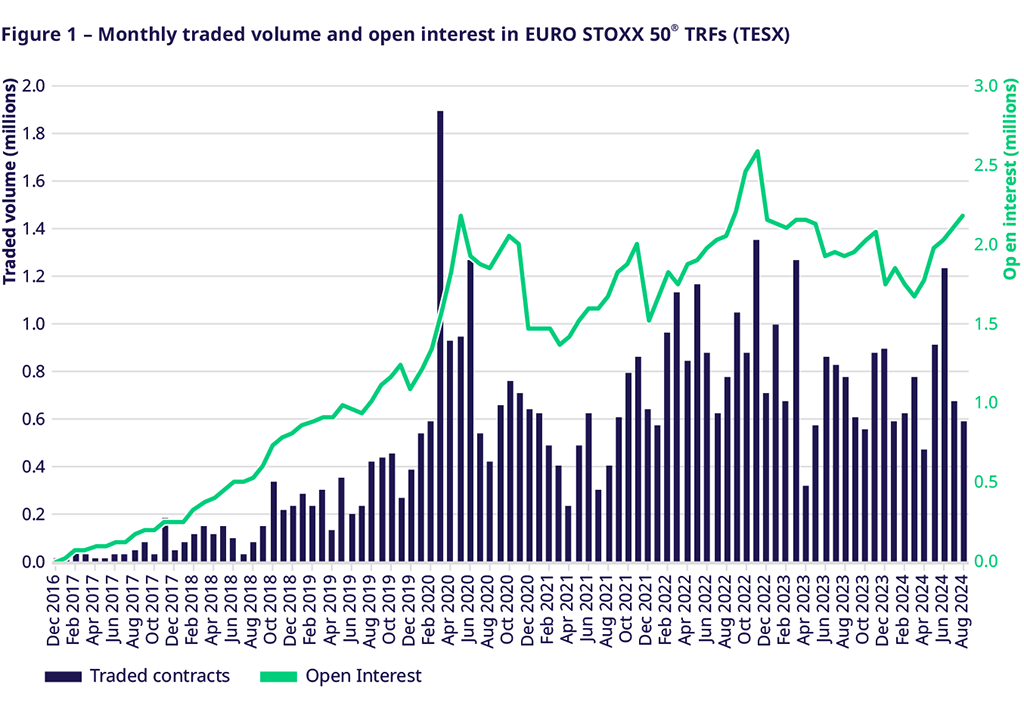

Total return products have less pricing sensitivity to dividends than do price-return futures, and therefore have attracted traders in times of rising volatility and uncertainty over dividend payments (Figure 1)

Source: Eurex. Data through August 2024.

The STOXX Europe 600 is a broad benchmark that covers 17 national markets across developed Europe. It consists of a fixed number of constituents, and it stands out for its popular sub-indices including sector and size strategies. Almost 27 million options and futures on the STOXX Europe 600 index traded in 2023 on Eurex, with options trading reaching a record volume in August 2024 and recording an all-time-high open interest of more than 1 million contracts (Figure 2).2 More than USD 35 billion is invested in ETFs tracking the benchmark and sub-indices.3

Source: Eurex. Data through August 2024.

In 2019, Eurex launched futures on the STOXX Europe 600 ESG-X, a version of the pan-European benchmark with negative ESG exclusions, which have become some of the world’s preeminent sustainable derivatives. Futures on the STOXX Europe 600 SRI, which employs negative exclusions and integrates a best-in-class ESG approach, followed in January this year. In June, the exchange listed weekly options on the STOXX Europe 600.

Leading partnership in derivatives

TRFs are growing in volumes as they allow traders and fund managers to hedge risk, improve capital margins obligations and overall manage portfolios and balance sheets more efficiency. The latest launch cements STOXX’s and Eurex’s collaboration and leadership in this segment.

1 The U.S. offering of STOXX Europe 600 Index Total Return Futures is still pending CFTC certification.

2 Adjusted Open Interest on STOXX Europe 600 options stood at 1,046,586 on September 16, 2024.

3 Data from ETFBook as of September 17, 2024.

This article was initially published by STOXX