30 Sep 2016

Eurex

Transtrend: Trend-following in non-symmetric markets

Transtrend’s latest research addresses the non-linear and non-symmetric behavior of markets in the context of a diversified investment strategy. The paper highlights how disregarding the non-linearity and non-symmetry of market behavior can result in an underestimation of portfolio risks. Furthermore, how these characteristics may actually create opportunities for a diversified trading strategy. Transtrend’s Diversified Trend Program (“DTP”) is such a diversified trading strategy, running many different positions at the same time.

Each of these positions is effectively running many different risks. Any pair of positions can share (or add to) one risk, while partly offsetting (or hedging) another risk. The real challenge of investing is to balance all these risks, without hedging them all away or to be exposed to one dominant single risk factor.

The price sensitivity of markets towards common risk factors can be different throughout time. Also, correlations can be higher above a certain threshold, or, in other words, in extreme circumstances. This phenomenon is relevant for risk management purposes and should be taken into account when constructing portfolios.

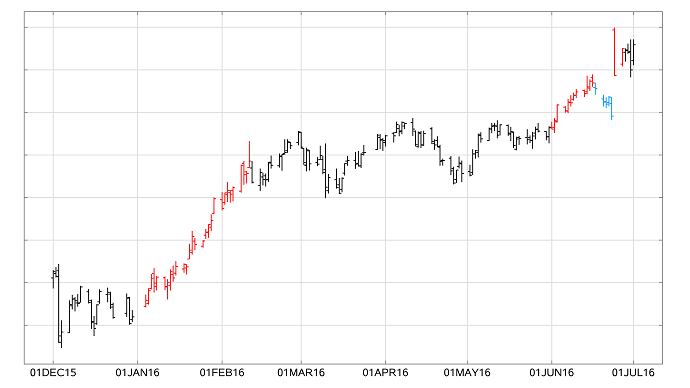

The paper discusses a number of examples of non-symmetric and non-linear behavior, including cases of the Eurex listed 10-year German bund futures, 10-year Italian Government bond futures and Eurostoxx Banks futures. With this paper, Transtrend gives a unique insight in how Eurex Futures products are used within their strategy.

Graph 1: 10 Year German Bund futures

Graph 2: 10-Year Italian bond futures

Graph 3: STOXX ® 600 Banks Index futures

About Transtrend

Rotterdam-based Transtrend is a pioneer in systematic trading with over 25 years of track record, specializing in trend following. Transtrend’s team is highly experienced and consists of more than 60 qualified professionals, approximately half of whom are dedicated to Research & Development, illustrating the firm’s commitment to ongoing R&D. Transtrend cultivates a culture of innovation, independent thinking and risk control, and aims to contribute to well-functioning, organized and stable markets. Transtrend’s Diversified Trend Program’s trading style is “systematic medium term trend following”, a recognized active strategy with a non-linear correlation with traditional asset classes as well as with other hedge fund styles. The program has a proven track record since June 1992 and has delivered attractive risk return characteristics, with strong returns during periods of stress in equity markets. Transtrend currently manages approximately 6 billion USD (including notional funds).