21 Jun 2021

Eurex

Dipping into the DIPS. The growing importance of dividend derivatives

Dividend derivatives have been one of the Eurex success stories ever since the launch of the EURO STOXX 50® dividend future in 2008. The dividend segment has since grown into a vast offering of more than 80 different products. In a recent webinar, panelists from Eurex, IHS Markit and BNP Paribas discussed the growing importance of the products and shed some light on the outlook for dividends for 2021 and beyond in a post-pandemic world.

Dividend expectations

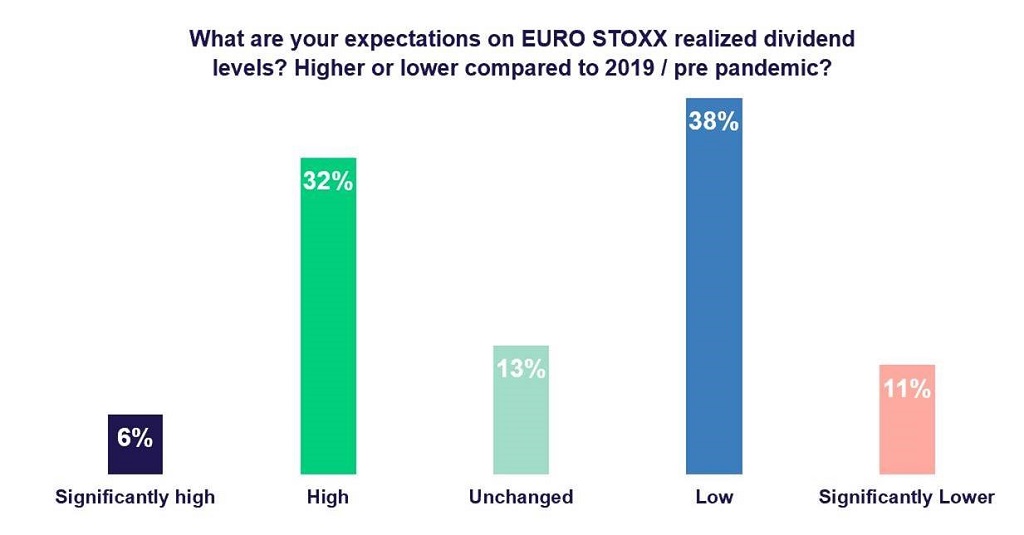

Moderator Cornelius Müller, Head of Marketing at Eurex, kicked off the session with the results from a participant poll, asking their expectations on realized dividends in the EURO STOXX compared to 2019. The audience's view was surprisingly mixed, evenly ranging between higher (32%) and lower expectations (38%).

Panelist Kevin Soyer, Head of EMEA Dividend Forecasting at IHS Markit, could understand the mixed views of the audience.

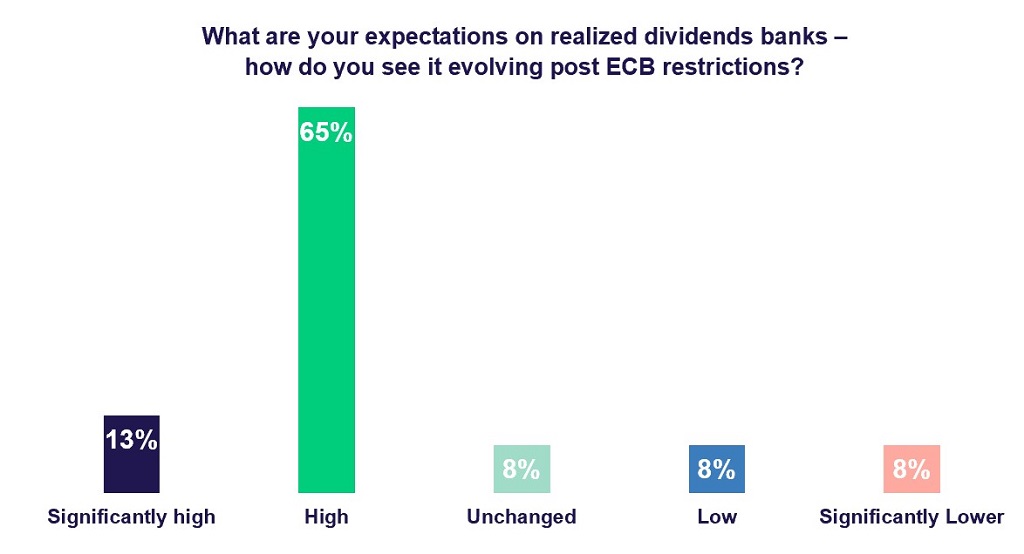

"For 2021, we expect the DIPS (Dividend Index Points) to be lower than pre-pandemic levels but higher than the previous year. And, there is definitely room for growth and the possibility to return to pre-pandemic levels." However, the full recovery is not expected before 2024 and, according to Kevin Soyer, there is still a lot of uncertainty out there. That uncertainty is not just economic. The banking industry is also awaiting further guidelines from the ECB on dividend recommendations. Even though some companies could pay higher dividends based on their profit/dividend distribution history, some elect to be more conservative for now. Antoine Deix, Head of Dividend & Repo Solutions at BNP Paribas, agreed with Kevin's observation. He too sees a recovery of dividend distribution down the road. "You have to bear in mind, roughly 80 percent of the dividends distributed in a calendar year is generated from the previous fiscal year, so there is a delayed effect."

Growth of the segment

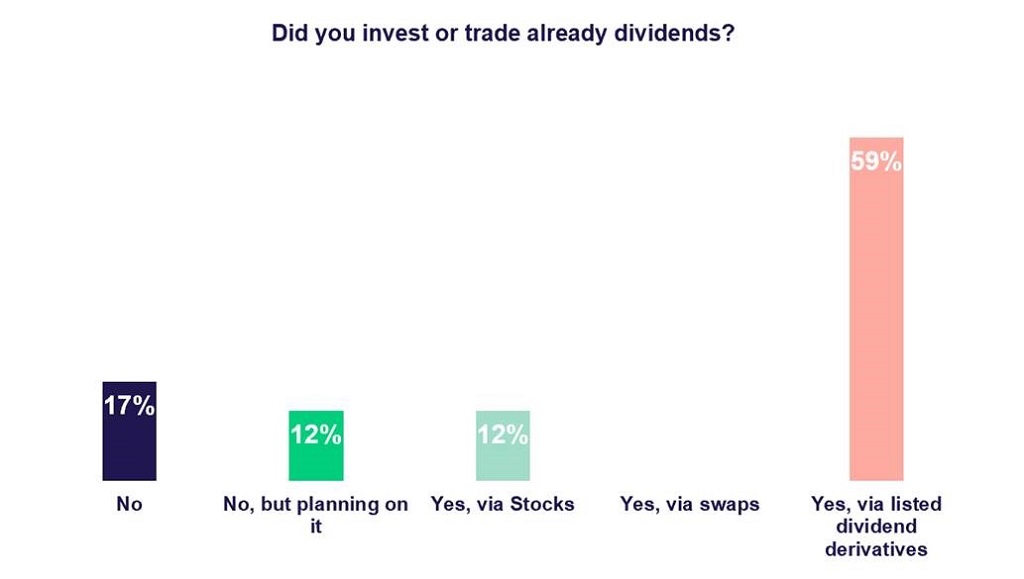

The second poll of the webcast dove into the adoption of trading dividend. The results clearly favored the exchange-listed dividend products over swaps and interest in the segment seems high (59%).

Lorena Dishnica from Eurex's Equity & Index Product Design department explained how the segment launched with the EURO STOXX 50® dividend future: "There was a market demand to hedge the dividend risk from structured products. Since then, the segment not only increased in the number of products that we offer but also in functionality." Over the last twelve years, the segment has expanded towards multiple indices, such as MSCI and recently FTSE100, including single stock futures and options. These expansions created further possibilities, from hedging for structured products towards dispersion trading and outright dividend views. The move away from OTC trading towards centrally cleared markets also helped to drive the segment forward. Lorena also remarks that she sees increased buy-side activity with strengthened fundamental and trading knowledge on dividends. Another interesting trend is that the growth is most significant in the recently introduced quarterly expiries of the single stock names. According to Dishnica, this signals that market demand has shifted towards more short-term hedging.

Seizing opportunities

With such a diverse toolkit to trade dividend, Cornelius Müller asks Antoine Deix what investors could currently do with these products to take a view on the market. According to Antoine Deix, investment strategies differ with the positioning on the dividend curve. In very short-term maturities, tactical positioning on the banking sector could be interesting, especially focusing on Q4 2021 distributions and how the guidance from the ECB may influence the sector dividend pay-out. There are risks on the ability of banks to resume distributions and on their form, dividend or buybacks, but the risk/return might be interesting. On the longer term, one could look at the carry on the index dividend curve and see what maturity will have the highest expected annualized return with the lowest volatility or market beta. Antoine sees many of these strategies aiming towards the 2023 maturity to go long dividend futures that could benefit from the carry to analysts' expectations.

Furthermore, Antoine sees dispersion in the index constituent's dividend risk premium and investors looking at building custom baskets to fine-tune their exposure. According to Antoine Deix, the investment strategy currently of most interest to investors is getting long dividend yield via long-term listed dividend futures vs. index futures. The implied dividend yield has not fully recovered from the March 2020 lows and investors expect dividend yields to display positive exposure in a reflation phase.

Kevin Soyer sees opportunities with dividend strategies to play into the dividend recovery after the pandemic. A strategy closely linked to Europe and the global economic rebound. The forecasts of IHS Markit show there is a large universe of stocks that will keep increasing their dividends, but there may be discrepancies between countries and sectors. For the Banks sector, both experts eagerly await the ECB's guidance and expect that some dividend payments will be resumed by September. The dividend catch-up could also be in the form of buybacks though.

For next year, Kevin expects that the pay-out ratio of banks will return to normal. Antoine Deix sees scope for further additional dividends and buybacks from banks displaying excess capital above MDA requirements and potential for further lower provisioning/provision release.

Lessons learned looking forward

One of the important lessons learned from the dividend season during the pandemic is that we need to pay increased attention to the regulatory environment, according to Kevin Soyer. He also urges investors to pay closer attention to M&As and their impact on dividend payments due to the higher leverage and the change of size of the company. Antoine Deix tells investors to look at dividend risk premium and build models to quantify that risk based on fundamental analysis and liquidity risk premium and act on this information with dividend derivatives. Stuart Heath, Director, Equity & Index Product Design at Eurex, outlined what qualifies as a dividend under the dividend index rules. Special dividends, for example, are not included and so are the buybacks that Kevin mentioned. Script dividends, however, are included at the cash equivalent, as are regular dividends.

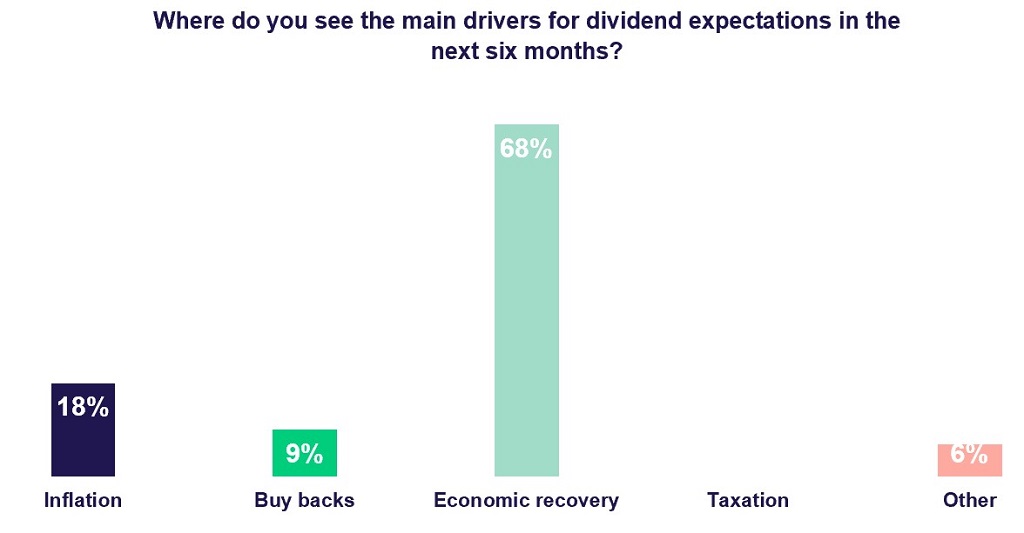

Overall, the audience and panelists expect the speed (or lack) of economic recovery (68%) as well as inflation (18%) to be the main drivers behind the outlook for dividends. Antoine notes that dividend yield strategies are topical in this regard, and he expects more diversification along the different sectors, making plays in the single stock names more interesting. Kevin Soyer adds that he feels that the dividend sector will remain an exciting segment for the coming years to invest and hedge in.

Finally, Antoine highlights the ongoing structural change in structured products flows that have been a key driver of the dividend risk premium. The increasing use of decremental indices, removing the dividend exposure from structured products, and the diversification towards single names or sector indices should ease the excess risk premium in the EURO STOXX 50® dividends and drive further dispersion across its components.

Please click here for a full version of the webcast.