27 Mar 2024

Eurex | Eurex Clearing

Future-proofing your FX portfolio

Tobias Rank, Head of FX Product Sales at Eurex, looks at the increasing cost of trading in the dealer-to-client (D2C) FX market and how future-proofing your business can alleviate the effects of regulatory requirements.

Under Basel III, the cost of doing business in the dealer-to-client FX market is increasing for many participants. The Standardized Approach for Counterparty Credit Risk (SA-CCR), which is used to determine the regulatory credit exposure for derivatives trades, results in conservative capital requirements for FX forwards and FX swaps books. Meanwhile, Uncleared Margin Rules (UMR), which were created to reduce the risk of derivatives exposure, has added a funding requirement for buy-side firms for cash-settled FX derivatives. More importantly, buy-side firms are increasingly being requested to voluntarily post margin for physically-settled FX transactions to reduce the capital burdens for banks under the SA-CCR regime, despite these products being exempt from margin requirements under UMR.

An increasing number of OTC FX participants on the buy- and sell-sides are gravitating towards exchange-traded FX instruments to address these capital-intensive requirements.

Don't want to miss updates on Eurex FX?

Subscribe to our newsletter on FX highlights, product launches and extensions, as well as news on events and recommended reads.

The two predominate cost drivers under the Basel III rules and UMR – the increased capital required to be held against derivatives exposures and the increased funding costs driven by collateral provision – are both sensitive to risk. The capital requirements are influenced by a number of factors, including: i) the size and directionality of an FX portfolio; ii) whether trades are collateralized with variation margin (VM) and/or initial margin (IM), and whether positions are held with a central counterparty (CCP). Lowering the risk of a portfolio typically results in lower regulatory capital costs. Hence, the netting efficiencies from maintaining balanced portfolios between counterparties is becoming ever more important.

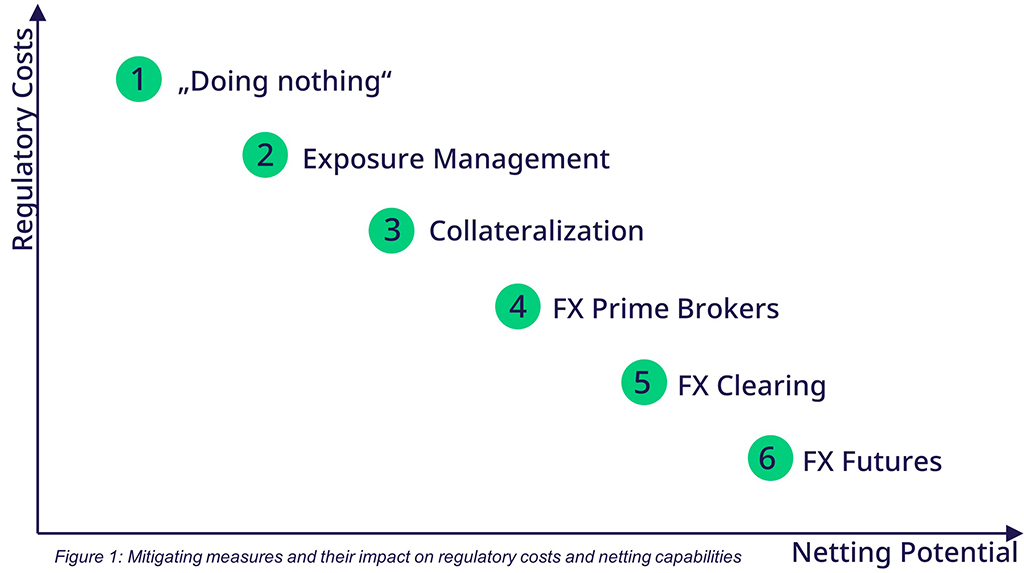

In the dealer-to-client FX space, participants commonly refer to six mitigating measures. These measures can be classified for their respective impact on regulatory costs and netting capabilities as shown in Figure 1.

“Doing nothing”: The feedback from the dealer community has consistently shown that profit margins in the FX forwards and FX swaps markets have little capacity to absorb increasing capital charges. Hence, banks have started to factor capital into the pricing offered to clients, and more banks are expected to follow suit.

Clients subject to UMR also need to factor in additional funding charges in relation to their FX positions. While physically-settled FX forwards and FX swaps are exempt from bilateral margin obligations, they do count towards the annual Average Aggregate Notional Amount (AANA). As a result, various buy-side firms must now post collateral for their equity or fixed income portfolios because their FX portfolios are taking them over relevant UMR thresholds.

For clients with sizeable and/or directional FX portfolios, simply “doing nothing” might lead to higher funding costs and/or adverse market pricing over the long run.

Exposure Management: In determining if UMR applies to a buy-side firm, various thresholds and limits come into play. This includes the annual AANA threshold (€8 billion) to specify whether a firm is in scope, and the initial margin threshold (€50 million) to determine whether counterparties must exchange collateral.

In the early days of UMR Phase 6, which took effect in September 2022, buy-side firms introduced exposure monitoring frameworks to actively manage UMR thresholds. Firms and funds close to the threshold would then choose cleared instruments to reduce their uncleared AANA exposure or strategically allocate exposure to certain counterparties to stay below the initial margin threshold. By doing so, they could avoid being in scope of UMR and circumvent any requirements to setup collateral accounts with counterparties.

Once in scope for UMR, participants are then required to establish the infrastructure to exchange collateral in a short period of time once they are above the thresholds. Therefore, exposure management is often seen as a temporary rather than a permanent solution. Exposure management also has consequences for market pricing, given that trades remain uncollateralized, which has implications for bank market-maker’s capital requirements.

Collateralization: Exchanging bilateral initial margin has become mandatory for firms exceeding relevant UMR thresholds, where products are in scope of the rules. Banks have also started to collateralize trades with clients that are out of scope of UMR to mitigate adverse capital requirements under the SA-CCR regime.

If banks and their clients decide to collateralize their FX business, this can substantially increase funding requirements for clients. This also means buy-side firms must negotiate CSAs and set up collateral accounts with each of their bank counterparties separately.

Collateralization can have mitigating effects on bank capital requirements – but has often been inefficient from a client funding perspective due to collateral being posted on a bilateral gross basis for each bank-client relationship.

FX Prime Brokers (FXPBs): Under an FXPB relationship, buy-side firms can combine and net their trading activity across counterparties. The relationship between client and FXPB is collateralized, which helps to reduce capital impact. FXPB relationship can therefore be an effective tool to address current regulatory changes.

However, some clients may find that they utilize their credit lines too quickly, especially when trading derivatives such as FX forwards or FX swaps. And some market participants might not be able or willing to face an FXPB at all.

FX Clearing: CCPs have started to offer central clearing for OTC traded FX forwards and FX swaps. The CCP guarantees any cleared trades until expiration, effectively removing bilateral counterparty credit risk from the transaction. By facing a CCP, participants can effortlessly net their positions across counterparties to minimize funding requirements.

Since the introduction of UMR Phase 6, D2C clearing of non-deliverable forwards (NDFs) and other cash-settled FX transactions has gained traction. However, clearing deliverable FX instruments in the D2C space remains challenging. CCPs and clearing banks have yet to identify ways to effectively provide settlement for cleared deliverable D2C FX trades via CLS, and therefore may not be able to offer clearing for FX forwards and FX swaps to clients yet.

FX Futures: FX futures are increasingly being considered the tool of choice to optimize FX portfolios. These instruments are widely available to both dealers and clients, and are often integrated into existing systems already. Participants that currently use futures in other asset classes (e.g., fixed income futures or equity index futures), can often enable FX futures in their existing systems without significant operational lift. This makes futures the natural instrument of choice to clear FX transactions for various FX users.

By leveraging the capital efficiencies that FX futures provide, dealers are expanding their FX futures offerings as a result. Banks can shield their businesses from adverse capital costs, while maintaining their client offering on a high volume/low margin basis.

Buy-side firms, on the other hand, preserve access to OTC-style liquidity sources by interacting with their dealers directly, and new counterparties can be added without ISDAs or CSAs. Additionally, since the FX futures trades are cleared, they do not count towards UMR thresholds. FX futures trades are fully collateralized – and users can often choose from an extensive universe of both cash and non-cash collateral. Furthermore, the standardization of FX futures provides netting across all counterparties and results in the lowest margin period of risk of 2 days in initial margin calculations (compared to 5 days for cleared FX forwards and FX swaps or 10 days for uncleared derivatives under ISDA SIMM). Lastly, clients can tap into all-to-all FX liquidity streamed into the futures exchange’s central limit orderbook (CLOB) as an additional source.

The FX market is in a state of change, but FX futures provide the chance to leave a key element of market’s characteristic largely intact: FX futures can complement existing FX portfolios and protect the relationship between buy-side participants and their dealers, making these relationships more efficient and therefore ‘future proof’ from the raft of regulatory changes.

A hybrid approach to FX efficiency

Eurex has partnered with FX trading platform 360T to design the ideal FX futures market for new and existing users and provide a liquidity hub for cleared FX instruments. By offering trading in FX futures from USD 3 per million notional, Eurex aims to offer cost-efficient access to cleared FX liquidity.

Eurex encourages bilateral trading between counterparties. We aim to protect the D2C relationship often established in FX markets over years and decades. We therefore offer trading outside the exchange orderbook starting at any size – no matter how small. FX futures are fully integrated into 360T for this purpose, where buy-side firms can send RFQs straight from their order management system and receive prices from their preferred dealers in competition.

We are actively working with banks to facilitate hybrid trading models, which allows the buy-side to tap into OTC FX liquidity when establishing an FX futures position. Going forward, we will also provide flexible expiration dates to enable the market to effectively clear a larger portion of OTC FX portfolios with the help of FX futures.

Ultimately, Eurex aims to help the market harness the full benefits of cleared FX futures instruments while minimizing market impact.

This is the first in a series of articles outlining the current view on FX futures. The next article will cover how banks and buy-side firms are integrating FX futures into their businesses.

Don't want to miss updates on Eurex FX? Subscribe to our newsletter on FX highlights, product launches and extensions, as well as news on events and recommended reads. Sign up for FX News!

Don't want to miss updates on Eurex FX?

Subscribe to our newsletter on FX highlights, product launches and extensions, as well as news on events and recommended reads.