14 Feb 2025

Eurex

Micro futures, broader trading possibilities

Q&A: Navigating market volatility: Trade German benchmark with Micro and Mini-DAX® Futures

The futures on the German index (DAX®) are highly liquid, boasting an average daily volume of EUR 24.58 billion in 2024, making them a popular choice among traders. The introduction of Micro and Mini-DAX® futures broadened the appeal of DAX® futures to a wider range of market participants due to their smaller contract sizes. This development has been particularly beneficial for clients of Madrid-based fintech broker iBroker.

In this article, Enrique Marti, CEO of iBroker, and Vincenzo Zinna, Equity & Index Sales EMEA at Eurex, explain how these products – and others in the pipeline – enable investors to trade on the strength of one of Europe’s economic fulcrums.

What makes the Micro and Mini-DAX® Futures particularly appealing to investors?

Enrique Marti (iBroker): The Micro and Mini-DAX® Futures are highly attractive to investors due to their smaller contract sizes (tick values of EUR 1 and EUR 5 respectively), lowering the entry barriers. They provide access to Germany’s leading stock index, the DAX®, which represents 40 largest and most actively traded German companies, allowing investors to trade on the strength of Europe’s largest economy without needing large capital outlays.

Additionally, the daily price movement range and the ability to trade during extended hours make these products especially suitable for investors across all time zones. The flexibility to implement joint strategies, such as combining futures and options, further enhances their appeal. Lastly, Eurex’s move to subsidize market data has significantly reduced trading costs for clients, contributing to the popularity of these contracts.

Why are traders showing increased interest in Germany and micro derivatives?

Marti: Often considered the economic engine of Europe, Germany is home to many leading global companies and hosts a broad, and diversified stock market representing multiple economic sectors. Many of these companies generate a significant portion of their revenue internationally, providing exposure to global markets.

This and stricter regulations on OTC products such as CFDs, has increasingly driven traders to listed derivatives for greater transparency and reliability.

What observations do you have on recent market trends and their influence on trading behavior?

Vincenzo Zinna (Eurex): In recent years, we have seen a significant shift toward listed derivatives, particularly smaller contracts like the Micro and Mini-DAX®. Liquidity in these products has grown substantially as more investors recognize their potential for portfolio diversification and risk management. We also observed a rise in demand for products that offer greater granularity and flexibility—benefits that the Micro and Mini-DAX® perfectly provide.

What are your thoughts on the upcoming German elections in February and what do you expect?

Marti: I believe investors anticipate potential changes in economic policies following the elections. Germany’s current economic climate – characterized by zero growth, high energy costs due to efforts to reduce reliance on Russian gas, and weak domestic demand – has already impacted investor confidence. After the elections, we may see policy changes related to deregulation, labor market flexibility, and corporate taxes. We should also be prepared to navigate potential episodes of volatility in the lead-up to and around the elections.

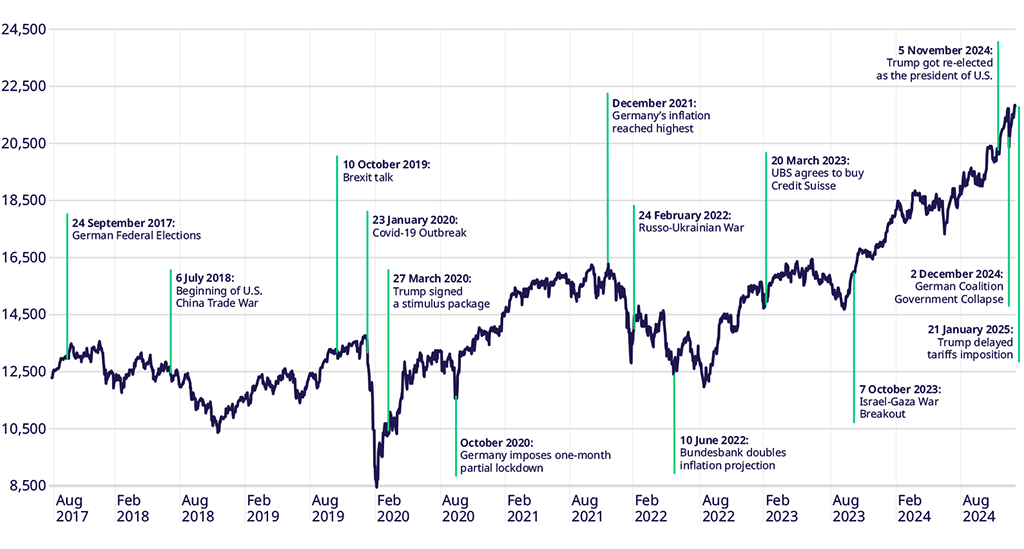

DAX price movement chart

Source: Eurex

How does Eurex plan to enhance its offerings to meet client needs better?

Zinna: At Eurex, we continuously strive to innovate and adapt to our clients needs. The recent launch of Daily Options on DAX® is part of our broader strategy to offer flexible and accessible products.

We also remain committed to maintaining tight spreads and providing cost-effective trading opportunities. By collaborating with partners like iBroker, we ensure that our offerings effectively reach a wider group of investors.

What factors are most decisive for clients when selecting a product to trade?

Marti: The main factors include contract size, liquidity, and the ability to trade during extended hours — because the world never stops. Clients with lower asset allocations focus on efficient execution, narrow spreads, and access to real-time market data, all of which Eurex’s Micro and Mini-DAX® products provide.

Another crucial factor is the ability to implement joint strategies, such as trading options alongside futures on the same underlying asset. Eurex’s reputation and reliability also play a key role in fostering client trust and confidence.

Having someone you can reach out to and count on, along with Eurex’s support – including in promoting the products – is essential to us. Building this relationship is crucial for succeeding in this business.