12 Feb 2025

Eurex

Volatility Outlook: Why should all eyes be on Europe in 2025?

We're only one month into 2025, and the financial markets have already dealt with what seems like a year's worth of news. Donald Trump began his second term in office by making market-impacting decisions from day one. European markets felt the impact of some of those actions as well. Also, Europe will have many events of its own impacting financial markets and volatility expectations throughout 2025, including national elections and central bank interest rate policy decisions. There will be a lot to keep up with in 2025, and Eurex has created a calendar highlighting these events. European traders should be prepared for extra volatility on the day of these events, and markets will exhibit some anticipatory behavior as we approach each event.

Expected stock market volatility is often the result of changes in equity index levels, specifically moving higher when stock prices move lower. VSTOXX®, as a consistent measure of expected 30-day volatility, displays this by displaying an inverse correlation with changes in the EURO STOXX 50®. However, there are also times when volatility expectations move higher in anticipation of a potential market-moving event. In 2024, the French elections during the summer and the US elections in the fall both impacted VSTOXX® levels leading up to and after each event. This coming year may bring more instances of VSTOXX® anticipating volatility.

Volatility traders will not have to wait long for an event that should drive volatility expectations in 2025. Germany is set to hold elections in late February, which comes during a critical time for Germany, the world's third-largest economy. It comes while Germany is dealing with slow economic growth and inflationary pressures due to higher energy prices combined with geopolitical uncertainty associated with the recent US elections. The German election has been impacting the VSTOXX® term structure since it was announced in late 2024.

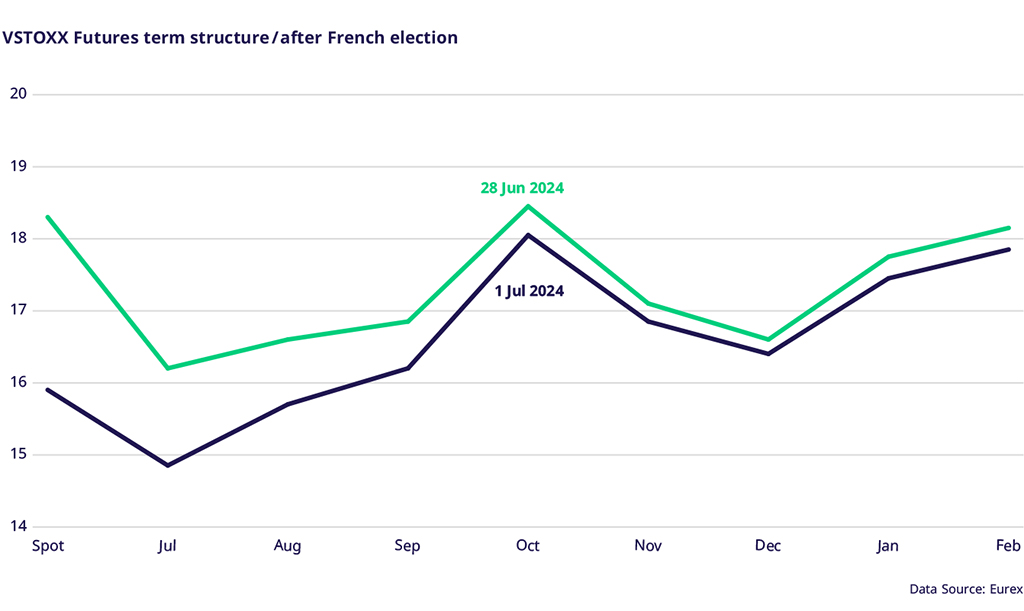

Typically, the term structure of VSTOXX® futures pricing is in contango, where prices move higher in conjunction with the time to futures expiration. However, backwardation occurs when an event provides an anticipatory boost to the future that is first to expire after the event. In the case of the German election, this is the March 2025 contract. For the French election in 2024, it was the July 2024 contract.

The figure below shows the VSTOXX® term structure on the Friday before and Monday after the first round of the French election. Note how the spot index and front month July future prices moved lower at a substantially greater rate than the farther-dated futures. This is typical of VSTOXX® behavior when pending events with the market’s attention pass and markets start to look forward.

The Polish presidential election in May will be another event to influence VSTOXX® and VSTOXX® futures pricing. Although Poland is not as influential in the Eurozone as Germany, there is a feeling that the outcome may indicate the extent of far-right movements in Europe. Finally, there is always the possibility of another French election. Recall that VSTOXX® and associated futures quickly adjusted when the 2024 elections were called.

A more consistent series of events that will influence VSTOXX® are the remaining seven European Central Bank (ECB) target rate announcements for 2025. The market anticipates three to four rate cuts in 2025. In the US, the Federal Reserve Open Market Committee (FOMC) also has seven more meetings scheduled, but the expectation is for only two 25 basis point cuts in 2025. The markets will focus on both institutions and adjust before and after each announcement.

With upcoming elections and economic uncertainty, there are several key dates for the financial markets in 2025. To assist traders and investors in staying organized, Eurex created a calendar highlighting major potential volatility events for 2025, available for download here: