17 Nov 2023

Eurex

FIC Credit Market Snapshot October 2023

Rising Stress in High Yield markets adds to US curve steepening

US Curve bear steepening and rising distressed share in HY drove credit markets. EUR IG (+0.50%) outperforms vs. flat EUR HY, US IG (-2.42%)

Like equity markets, credit markets were suffering globally in October. In Europe, the benchmark German government bond yield curve shifted down, breaking with the recent trend of bear-steepening. EUR investment grade corporate bonds outperformed against high yield. USD-denominated credit suffered in comparison, driven by the US Treasury curve bear-steepening further. This specifically weighed on longer-dated investment grade bonds. The USD investment grade ETF performed the worst out of all underlyings of listed credit ETF options (-2.42%). Shorted-dated USD high yield corporate bonds were less impacted, with the USD HY ETF falling 1.07%. USD emerging market sovereign credit was hit similarly to investment grade, as the duration of these non-US government bonds denominated in USD is generally higher. Still, higher carry and compressing spreads supported the EM SOV ETF (-1.18%).

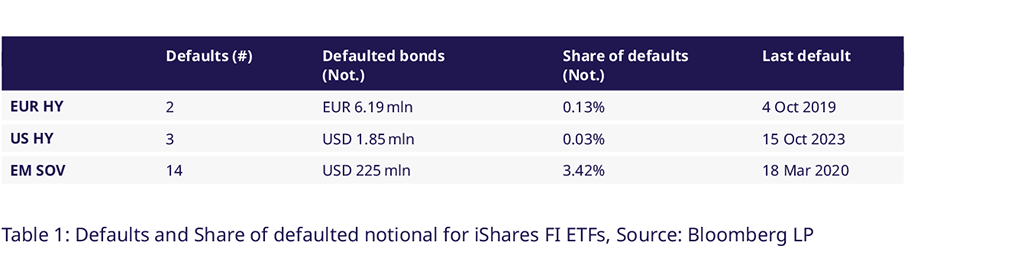

Third default in US HY UCITS ETF points to solvency challenges ahead

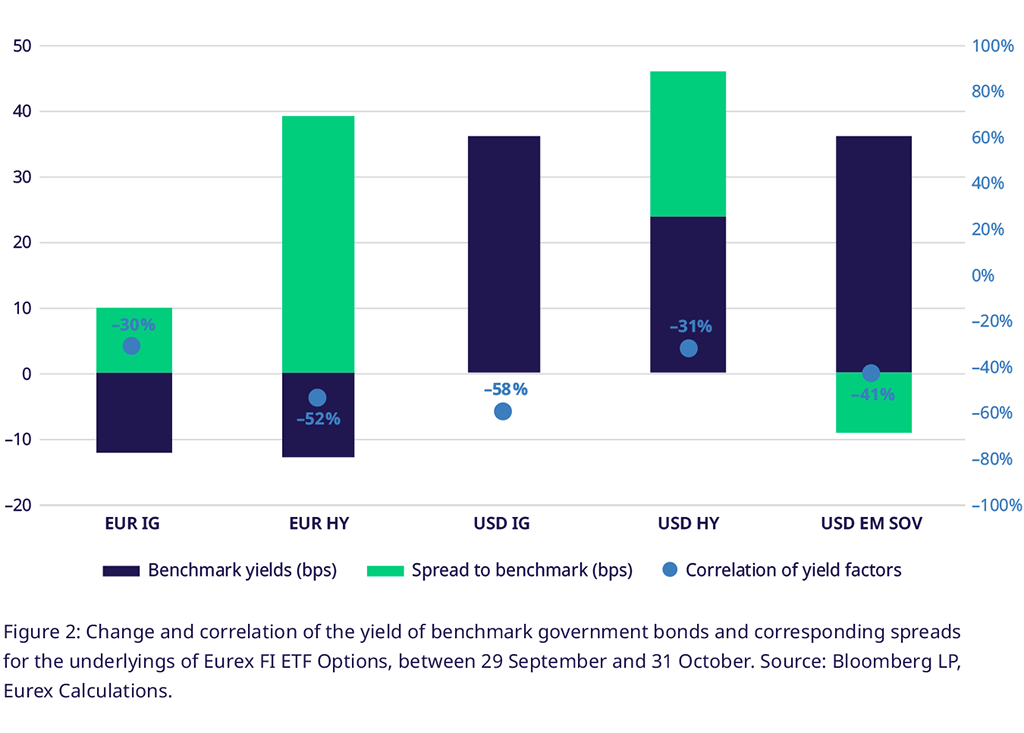

Spreads in high yield corporate credit widened globally on rising defaults in USD and EUR markets. EUR HY was hit the most dramatically, as the implied spread against the benchmark German curve rose almost 40bps. However, the impact was dampened by the benchmark yield falling 12bps. USD HY saw its first default since March 2023, as Rite Aid Corporation defaulted on a USD 850mln. callable bond. However, the news had little impact as the ETFs holding comprised 330k of notional. USD HY unfortunately did not see any support from the benchmark Treasury curve, which added 24bps to spreads widening 22bps. Long duration credit markets were more protected from outsized spread movements. EUR IG saw spreads widen 10bps, which was completely offset by the benchmark curve moving down 11bps. USD IG saw spreads flat, while EM SOV saw spreads fall 9bps. However, USD long duration names suffered from the bear-steepening as the benchmark for both ETFs rose 46bps.

Share of bonds in (dis-)stressed conditions held by USD HY and EUR HY reach 13%, 11.5%, spreads turn cheap vs. 5yr history

Solvency risks are increasingly priced in for short-dated corporate credit. The share of bonds in stressed or distressed condition, i.e., priced below 80% of notional, climbed to 13% for USD HY and 11.5% for EUR HY. For USD-denominated names, spreads are slightly cheap to rich. USD IG ended the month with spreads around half a standard deviation below the 5yr average, while USD HY spreads were flat at the 5yr average and IEMB was slightly cheap at 0.18 standard deviations. In Europe, investment grade spreads are almost one standard deviation above the historical average, while HY is slightly less cheap. For EUR IG, the high spreads are partially a function of the ECB rolling of the credit holdings it acquired during the pandemic. However, the central bank still holds 32% of the eligible supply, so further tightening could weigh on this market.

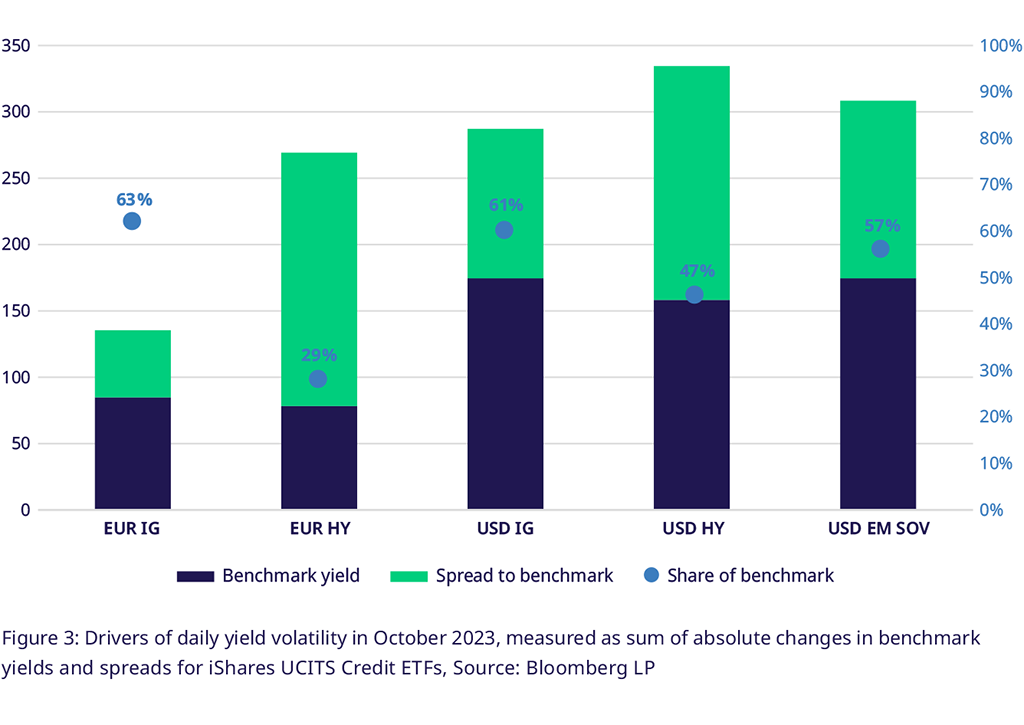

Negative correlation between spreads and curve makes credit attractive amid elevated yield volatility

Fixed Income investors taking on credit risk consider the volatility that this factor contributes to the overall returns of the instrument. For EUR HY, spreads made up 71% of overall yield movements, while 65% of the yield to maturity lies in the spread. This may sound sobering; however, spreads and curve movements were consistently negatively correlated during 2023, culminating in a -52% negative correlation in October. Extrapolating this relationship forward, taking on high yield credit risk makes a corporate bond yield more than the sum of its parts from a yield per unit of volatility perspective. Overall, this effect is stronger for European names, as the US benchmark curve levels are higher than in Europe; hence, spreads are comparatively low on a relative basis. All iShares Credit ETFs underlying Options at Eurex exhibited negative correlations over October.

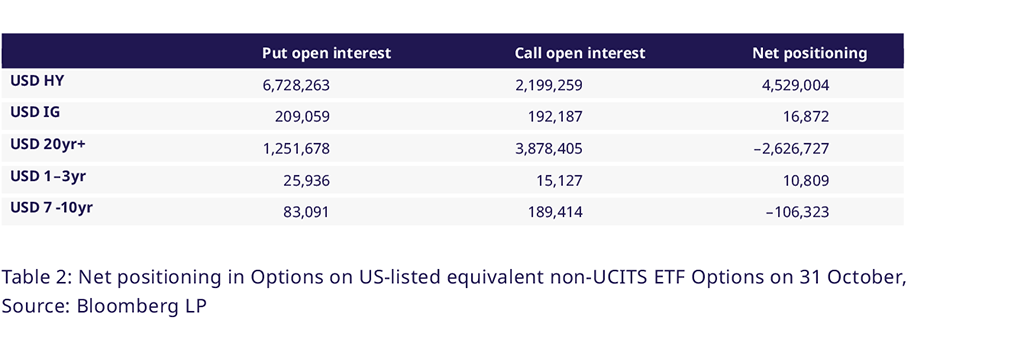

US-listed USD high yield ETF Open Interest skew points to increased interest in protection

The difference between put and call open interest for US-listed USD high yield ETF options has declined throughout October as call positions grew, while open puts were closed. However, in the last week of the month, we saw increased interest in puts again, pushing up the put-call position skew to $450bln in notional. For USD Investment grade, US-listed ETF Options saw gross open interest decline by around 50bln in notional, while the skew stayed relatively stable. In rates markets, clients have been reducing their positioning in calls on the 20yr+ US-listed ETF, while call positions on the 1-3yr tenor and 7-10yr tenor have risen relative to Puts.

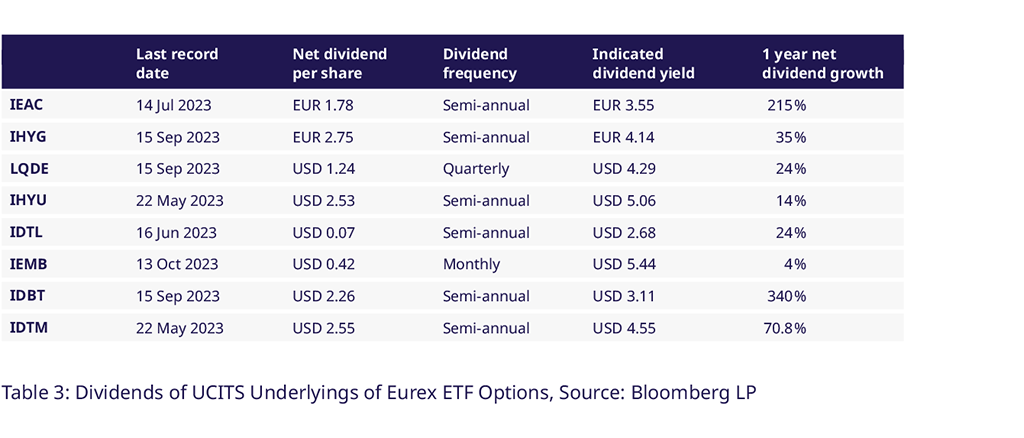

EM SOV pays a $ 0.42$ dividend, USD HY to pay in November

The EM SOV dividend marks a 4% increase in dividends over the past 12 months, bringing up the total 12-month indicated dividend yield to 5.44%. Looking ahead, US HY announced a $ 2.65 per share to be paid in mid-November, giving an indicated dividend yield of 5.52%.

Utilizing Eurex Credit Futures & Options for Market Positioning

Eurex credit futures and options enable you to hedge existing portfolios against duration and credit risk in one go. Eurex Options on Fixed Income ETFs allow for directional positioning whilst limiting options premium paid with options spreads or more tailored option strategies.

Thinking about trading US Interest rates and volatility using UCITS compliant instruments? Gain exposure to US Treasury markets using the new Options on the IDBT (1-3yr Tenor) and IDTM (7-10yr Tenor) UCITS ETFs.

Contacts