10 Sep 2024

Eurex

Eurex Repo Monthly News August 2024

Market briefing: ''Repo Markets are in a holding pattern before the ECB’s interest rate decision in September''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

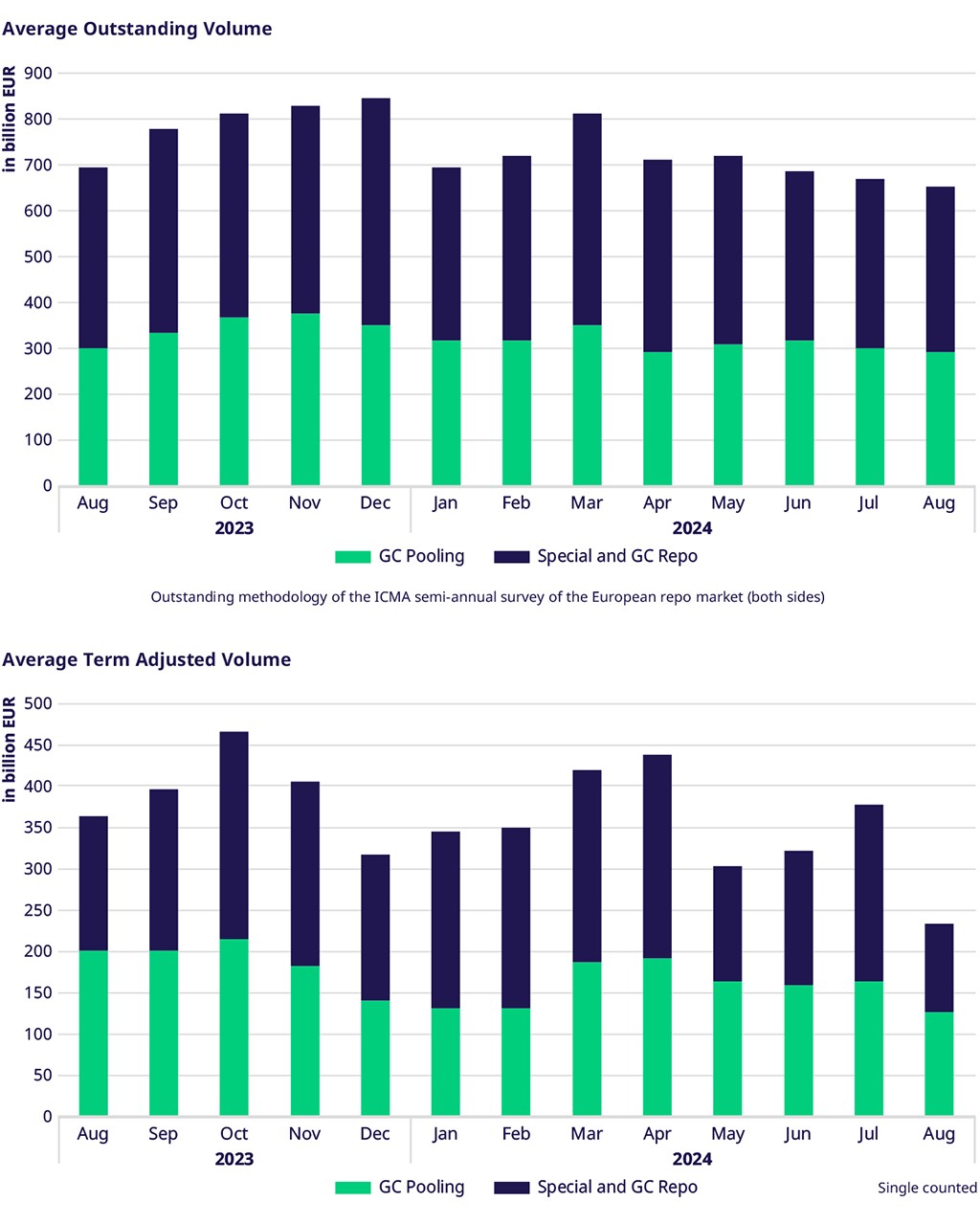

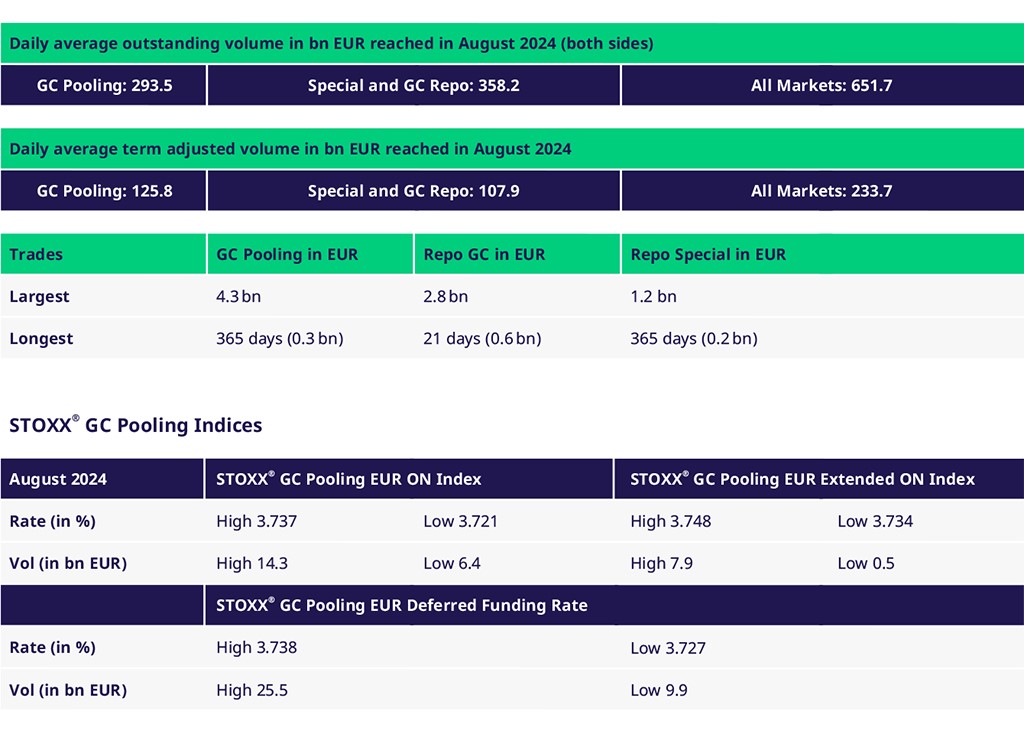

Despite the usual summer slowdown, we observed a slight uptick in repo trading activity during the first eight months of this year. Term-adjusted volume across all segments increased by 1.8% year-over-year (YoY), primarily driven by the GC Pooling segment.

Outstanding and Volumes

While the average outstanding volume across all market segments decreased by 6.1% compared to August 2023, the overall trend for the first eight months of 2024 remains positive, with a 4.7% increase compared to the same period in 2023. GC Pooling outstanding volumes continued to surge, up by 20.3%.

Spreads and Collateral

Short-term rates in the EUR GC Pooling Market remained stable, with a slight move towards the deposit facility rate. The average spread between the ECB and EXT baskets remained minimal, and the overnight rate for both baskets traded close to the deposit facility rate, with an average spread of 1.77 basis points to the Deposit Facility rate for the ECB basket.

Eurex Term Repo

Trading activity in standard terms (1 week to 12 months) within EUR GC Pooling decreased slightly in August compared to July, likely due to market anticipation of the upcoming ECB meeting. Rates for these terms remained stable throughout the month.

Green BondsThe GC Pooling Green Bonds basket continued its strong growth in traded volumes, reaching a new record of just over EUR 11 billion for August. Since its launch on April 29, the total cleared volume has risen to EUR 69 billion, reflecting increasing interest from members in green bond collateral. Repo rates for the GC Pooling Green Bond basket consistently traded around 2 basis points below the GC Pooling ECB basket for terms ranging from overnight to one month.

SSAs and EU Bonds

Traded volumes in SSAs and EU bonds declined in August compared to July, which was the highest volume month of 2024. This decrease can be attributed to the ongoing "cheapening" trend of collateral, as well as potentially higher allocations in GC Pooling.

EUR Government Bonds

Average daily traded volumes in EUR Government bonds experienced a decline in August compared to July, primarily driven by lower demand for Bunds. Short-term rates (up to one week) in Bunds remained relatively low, averaging around 3.64%.

Events - save the date

📍 Bahrain, 25 September

Join Carsten Hiller, Head of Repo Sales Europe at the Absolute Collateral MENA Capital Markets Conference for the repo trading panel. Find out more here:

Absolute Collateral Bahrain Conference

Eurex Repo update roundtables:

📍Frankfurt, 26 September

📍New York, 3 October

📍Vienna, 24 October

Volumes

Participants: 165

View the current participant list

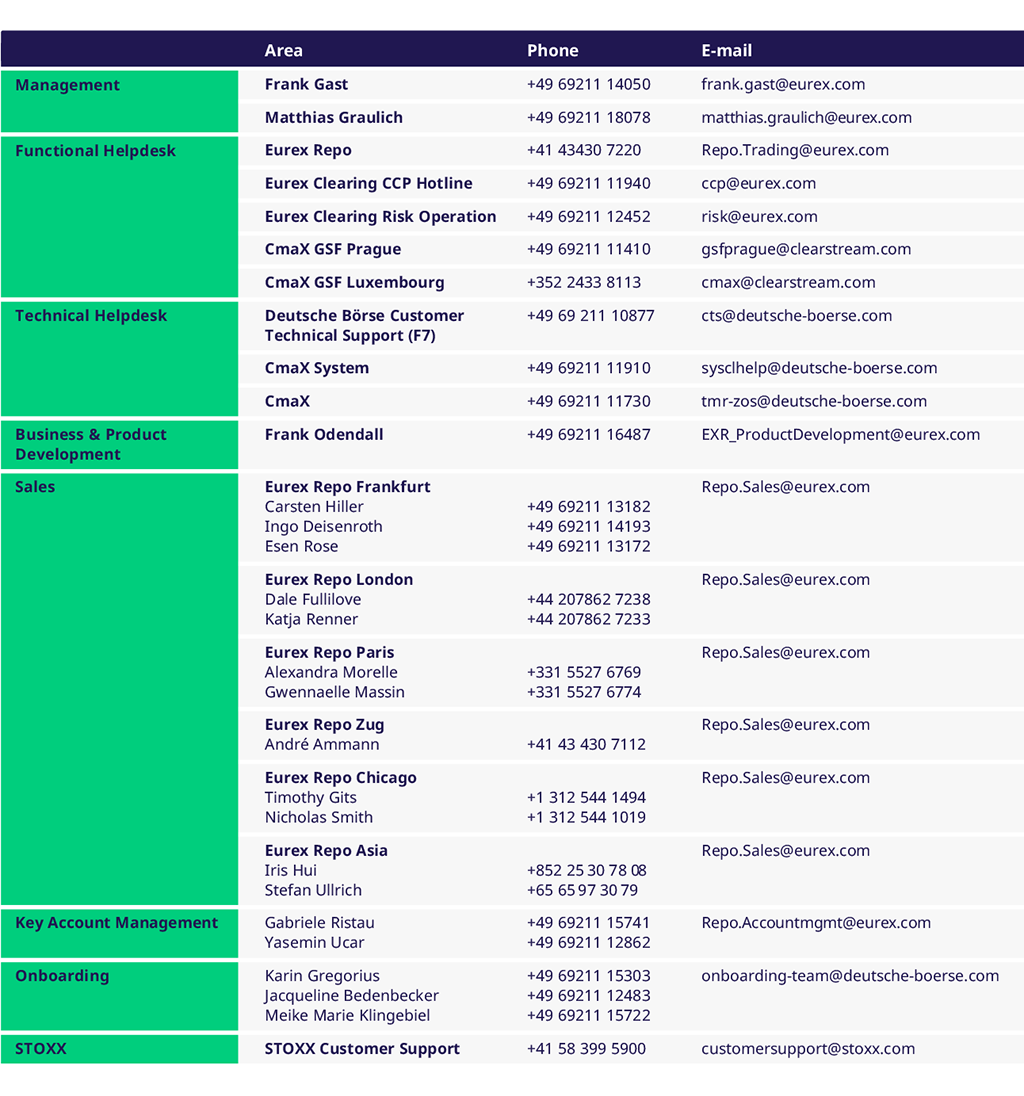

Services & Contacts