13 Jan 2025

Eurex

Eurex Repo Monthly News December 2024

Market briefing: ''2024 - The Year of the Central Banks''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

This year central banks played a crucial role in reshaping the securities finance landscape. As the Federal Reserve (FED), European Central Bank (ECB), and other major central banks have been navigating a complex environment of moderating inflation and economic and political uncertainty. ECB’s policy decisions have significantly impacted private funding markets as the eurozone's excess liquidity, although still high, is expected to decline further.

With reduced central bank support ahead, market participants are re-evaluating their funding strategies. In Eurex's cleared repo markets, renewed interest emerged since the ECB’s rate hikes began in 2022 and demand has remained robust since. Total outstanding volumes across all repo segments at Eurex remained on elevated levels just -3.5% down compared to last year’s record numbers.

Year-End 2024 – This Time it’s Different

While in October EUR govies traded in 3-month terms between €STR +(10-15) bps, implying a triple-digit spread versus €STR over the 2-day year-end turn, at the end of 2024 overall conditions were very smooth, with no concerns regarding liquidity in either bonds or cash. The STOXX GC Pooling ECB basket overnight rate was 2.232%, with a spread of -67.3 basis points to the €STR fixing of 2.905%.

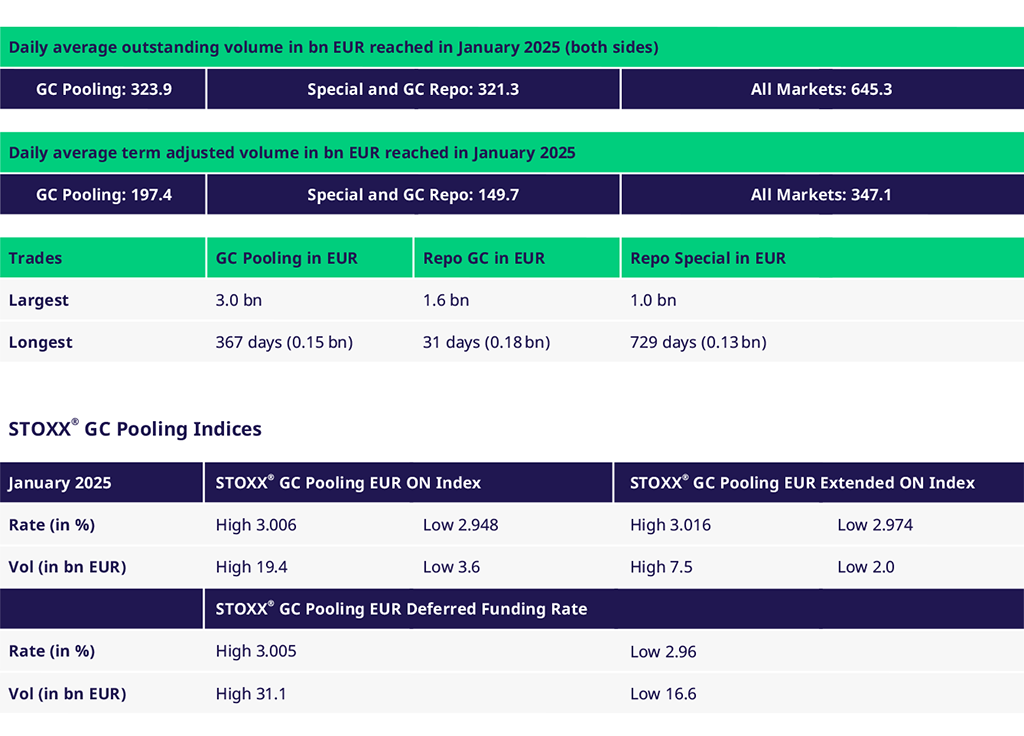

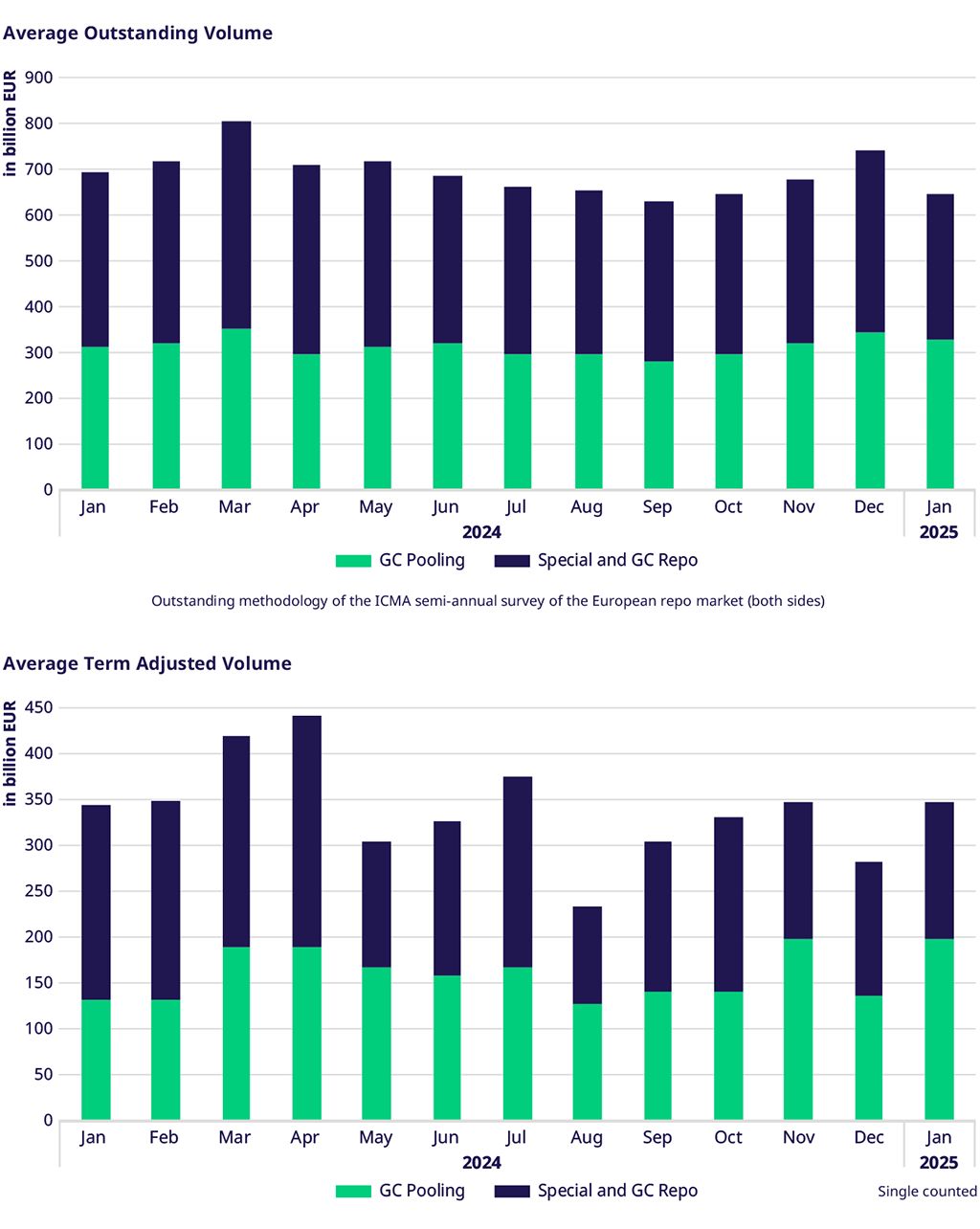

Outstanding and Traded Volumes

In December 2024, daily average outstanding volume increased 9% compared to November. The average daily term-adjusted volume for all segments reached € 282,9 billion, a 18,5% decrease compared to November. GC Pooling demonstrated softness, with volumes decreasing to EUR 133.2 billion daily average, a 31% decrease from November. Furthermore, GC & Special Repo volumes demonstrated resiliency at EUR 149.7 billion daily term adjusted average hence experiencing a 1% decrease in average term-adjusted volumes.

Overall, the average term adjusted volume in 2024 (January-December) in comparison to the same period in 2023 (YoY) decreased 6%, with GC Pooling volumes decreasing by 3.1% and Repo GC & Special volumes decreasing by 8.4%.

In GC Pooling, we recorded a new record in overnight traded volumes for 2024, with EUR 29.3 billion on 13 December.

Spreads and Collateral

The GC Pooling market on the 31st of December saw Overnight trading at significantly lower levels than usual, with the ECB basket trading at an average of 2.23%, and reaching an intraday low of 1.80% - representing a spread to the recent overnight average traded rate of around 120 bps. The EXT ECB basket was less impacted by year end but still saw a much lower daily overnight low point of 2.60% with average traded rate at 2.77%.

Leaving aside the last trading day of the year, December’s last week’s average traded rate for ECB GC Pooling overnight stood at 2.986% with the EXT ECB tipping above the DFR at 3.002%, resulting in an average spread between the baskets of 1.6 bps.

In December, the average monthly spread EXT vs ECB reached 4.02 bps and the average monthly spread between ECB basket vs €STR was at 3.38 bps. The average monthly spread of EXT basket versus €STR stood at 7.4 bps.

German "Bunds" and EU Bonds

Average trading volumes in Bunds increased by 17% compared to November but traded volumes full year 2024 versus 2023 decreased 19%. During the year, hedge funds have shifted toward long positions in European Government Bonds and particularly in German government bonds (bunds) building up the highest net long positions seen in recent years. Amid rate cuts and more Bund supply, Bund prices returned to pre-QE levels.

However, the falling Bund activity in Eurex’s market has been offset by increased activity in French (OATS), Italian (BTPS), and Spanish (Bonos) government bonds at Eurex, where new participants and improved quoting mechanisms added liquidity.

Volumes in SSAs and EU bonds decreased in December by 40% and 46% respectively compared to November. On average 2024 full year compared to 2023 saw growth in SSAs 3% and a slight decrease in EU bonds 6%. In addition to the traded volumes in GC & Special Repo, we had allocated between EUR 6 to 9 billion of EU bonds in GC Pooling.

Eurex Term Repo

Overall term-adjusted volumes decreased by 10% compared to November, as year-end activity differed from previous years and market participants awaited the fourth rate cut by the ECB, including some forward guidance at the ECB’s press conference on 12 December. During December fears over very high repo rates particularly for Italian GC over year end trading subsided with Italian GC returning to regular levels as December went on.

Green Bonds

Although activities in the GC Pooling Green Bond basket dipped slightly in December, the year concluded with a total cleared volume of EUR 143 billion since its launch at the end of April, marking a successful product launch with potential for further growth in 2025.

Events - save the date

GFF Summit | Navigating Uncertainty: Geopolitics and Market Dynamics

📍 European Convention Center Luxembourg | 29-30 January 2025

Interested ? Reach out to our Eurex Repo team for your invitation in case you haven’t received an invite yet. We look forward to seeing you in Luxembourg in January!

Derivatives Forum Frankfurt Summit

📍 Congress Center Messe Frankfurt | 26-27 February 2025

Volumes

| |||

|

Participants: 166