13 Feb 2025

Eurex

Eurex Repo Monthly News January 2025

Market briefing: ''GC Pooling strength continues, driving term-adjusted volumes higher''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

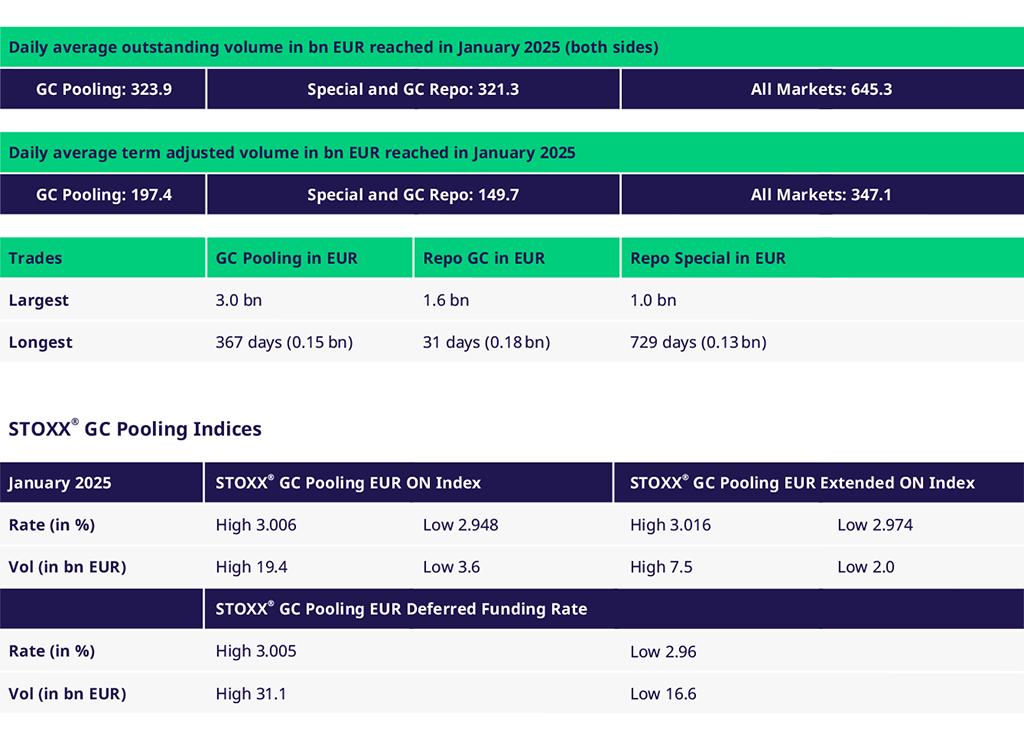

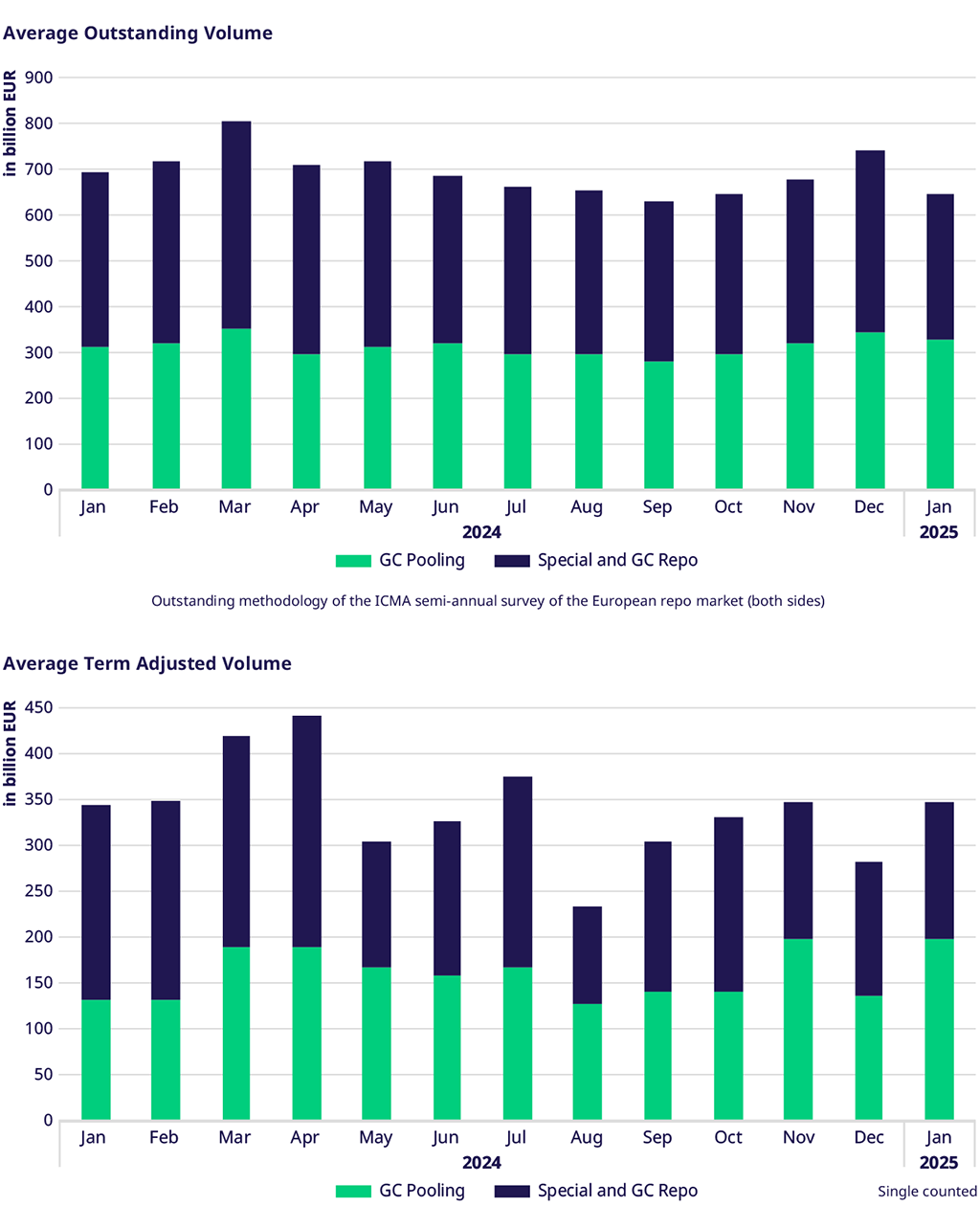

In January, term-adjusted volumes saw a significant increase of 23% compared to December, driven primarily by a 48% rise in GC Pooling term business, while GC & Special volumes remained flat. Compared to January 2024, term-adjusted volumes showed resilience with a slight increase of 1%. This was marked by a strong 53% increase in GC Pooling, offset by a 30% decrease in GC & Special.

Outstanding and Traded Volumes

Average daily traded volumes in January (compared to last year) increased slightly by about 2%, with GC Pooling up by 12% and GC & Special down by 13%. Overall outstanding volumes dropped by 7%, influenced by a 16% decrease in GC & Special, while GC Pooling continued to grow modestly by 3.4%.

Spreads and Collateral

Against the ECB deposit rate, the €STR climbed to -7.7 basis, marking its highest level in 2½ years. The upward trend is slow but steady, seemingly driven by the continuous decline in excess liquidity.

The spread of €STR against Bund single ISIN repos averaged -2.4 basis points in November, widened to -4.5 basis points by mid-December, and now stands at -5 basis points on average. While collateral scarcity still lies in the past Bund repo premiums are having a mini comeback for recently issued ‘active’ bonds and seasoned ‘low free float’ Bunds.

In GC Pooling, the spread between the main ECB and ECB EXT baskets further narrowed to 1.2 basis points. Additionally, the average spread of both baskets versus €STR has tightened, with €STR fixings reaching new highs. Meanwhile, both GC Pooling baskets have widened against the ECB deposit rate.

GC & Specials

Average daily traded volumes in GC & Special decreased slightly by 3.4% compared to December, with Specials down by 2%. This was mainly due to a 20% drop in Bund special volumes. However, there were strong increases in French government bonds (+88%), Italian government bonds (+9%), and SSA trading activity (+71%), with notable rises in EU bonds (+64%), KfW (+90%), and EIB (+32%), which nearly offset the decline in Bunds.

Eurex Term Repo

Term trades saw significant activity, particularly in the GC Pooling ECB basket across various maturities (1, 2, 3, 6, 9, and 12 months). There was also notable business in flex terms (3 and 4 months) and 1-year trades with monthly break dates for balance sheet netting opportunities. In the EXT basket, 9-month trades were observed, while the INT MXQ was mainly traded up to 3 months. In Special repo, substantial trades were seen in 3-month and 24-month in French government bonds, along with some 6-month transaction in covered bonds.

GC Pooling Green Bond Basket

Trading activity in the GC Pooling Green Bond basket was subdued until mid-January, before volumes began to pick up slightly. The overall average cleared volume was relatively low at EUR 180 million compared to the previous month, but is expected to increase again in February.

Events - save the date

Derivatives Forum Frankfurt Summit

📍 Congress Center Messe Frankfurt | 26-27 February 2025

Volumes

| |||

|

Participants: 167