15 Jul 2024

Eurex

Eurex Repo Monthly News June 2024

Market briefing: ''June 2024 shows steady growth amid market volatility''

by Frank Gast - Managing Director, Member of the Management Board, Eurex Repo

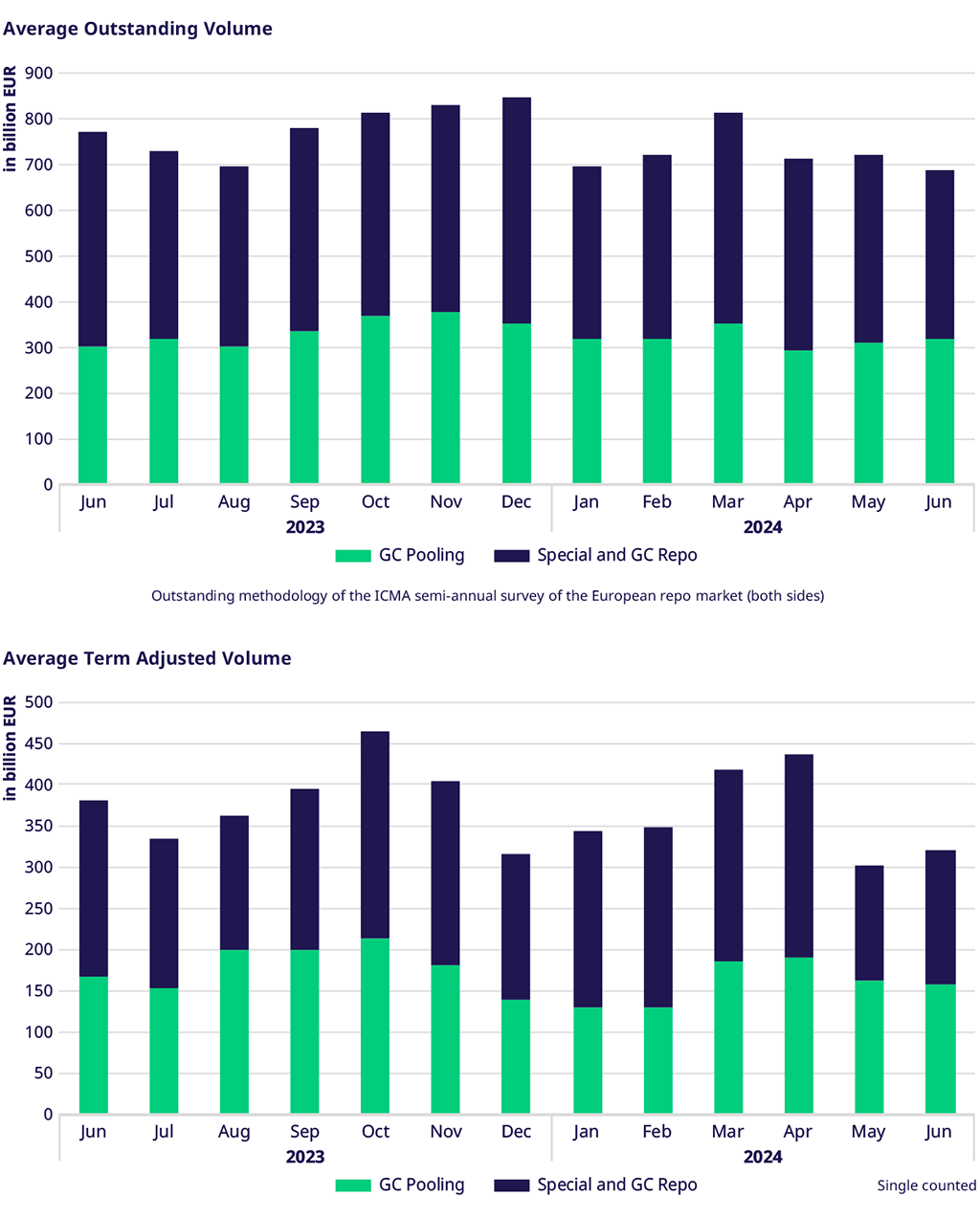

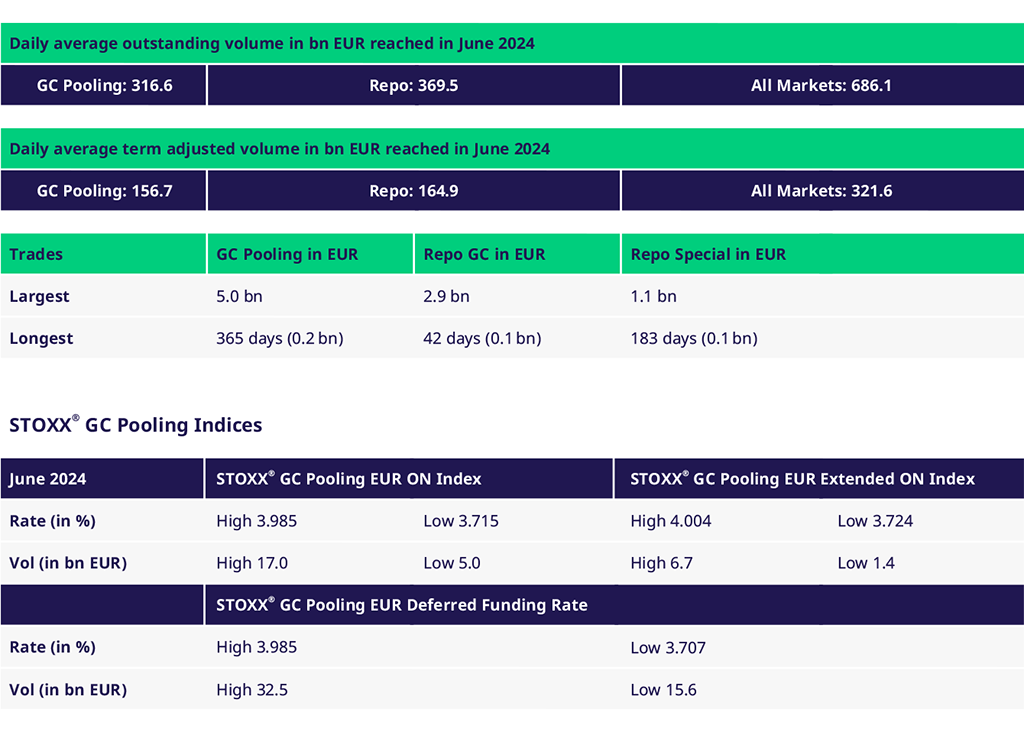

Repo term-adjusted volume in June was about 6% higher compared to May 2024. The period from January to June 2024 showed continued growth of about 7% compared to the same period in 2023, with the GC Pooling market growing by 17% while Repo markets remained flat.

Outstanding and Volumes

When comparing June 2024 to June 2023, the average outstanding volume across all market segments saw a decrease of 10.5%. This was primarily driven by the Repo Market, which fell by 20.2%. In contrast, the GC Pooling Market showed resilience, increasing by 4.3%. For the first six months of this year, the average outstanding volume across all markets increased by 9% compared to the same period last year. This increase was mainly driven by higher outstanding volumes in GC Pooling (+31%). Eurex Repo’s average traded volume for June 2024 compared to June 2023 slightly decreased by 3.0%. The GC Pooling Market saw positive growth of 6.5%, while the Repo Market declined by 14.5%.

Spreads and Collateral

June witnessed continued stability in short-term rates within the GC Pooling Market. The average spread between the ECB and EXT ECB baskets further tightened to 0.95 basis points. Additionally, the average spread between the ECB basket and the deposit rate narrowed to -2.3 basis points, while the spread between the EXT basket and the DFR widened to -1.35 basis points.

Eurex Term Repo

The activity in the standard terms ranging from one week to twelve months remained robust, maintaining tight spreads and ensuring adequate liquidity across all maturities.

Green Bonds

The GC Pooling Green Bonds basket, though relatively new, has shown promising activity. The cleared volume has increased to €26 billion since the launch on 29 April, indicating a growing interest and demand for green bond investments within the market.

EU Bonds

Traded volumes in June were down by 10% with two trading days less than in May, whereas average daily traded volumes were almost unchanged. This was mainly due to a drop in GC volumes as GC paper was moved into GC Pooling. Overall, SSAs were down 15%, with average daily volumes decreasing by 7%.

Government Bonds

Bunds saw average daily traded volumes decrease by 2.5% compared to May. Bund Specials remained quite "cheap", with an average rate in short terms (up to one week) around ESTR -5 to -6 basis points. A decrease in Spanish government bonds was compensated by higher volumes in Italian, Dutch, and Belgian government bonds.

News

Eurex is the European #Repo team of the Year!

We are thrilled to announce that Eurex Repo has been awarded last night, 11 July, the European Repo Team of the Year! 🚀

Our substantial growth in the Eurex repo markets, driven by our innovative product and sales initiatives, along with rising interest rates and reductions in excess liquidity, has helped us build the broadest global customer network for secured funding and financing. We are proud to have over 160 participants from 20 countries as part of our network.

A heartfelt thank you to our incredible team and valued clients and partners for making this achievement possible. Together, we are setting new standards in the repo market! 🙌

Save the date

Eurex Repo update roundtables:

📍 Frankfurt, 26 September

📍 New York, 3 October

📍 Vienna, 24 October

Volumes

Participants: 165

View the current participant list

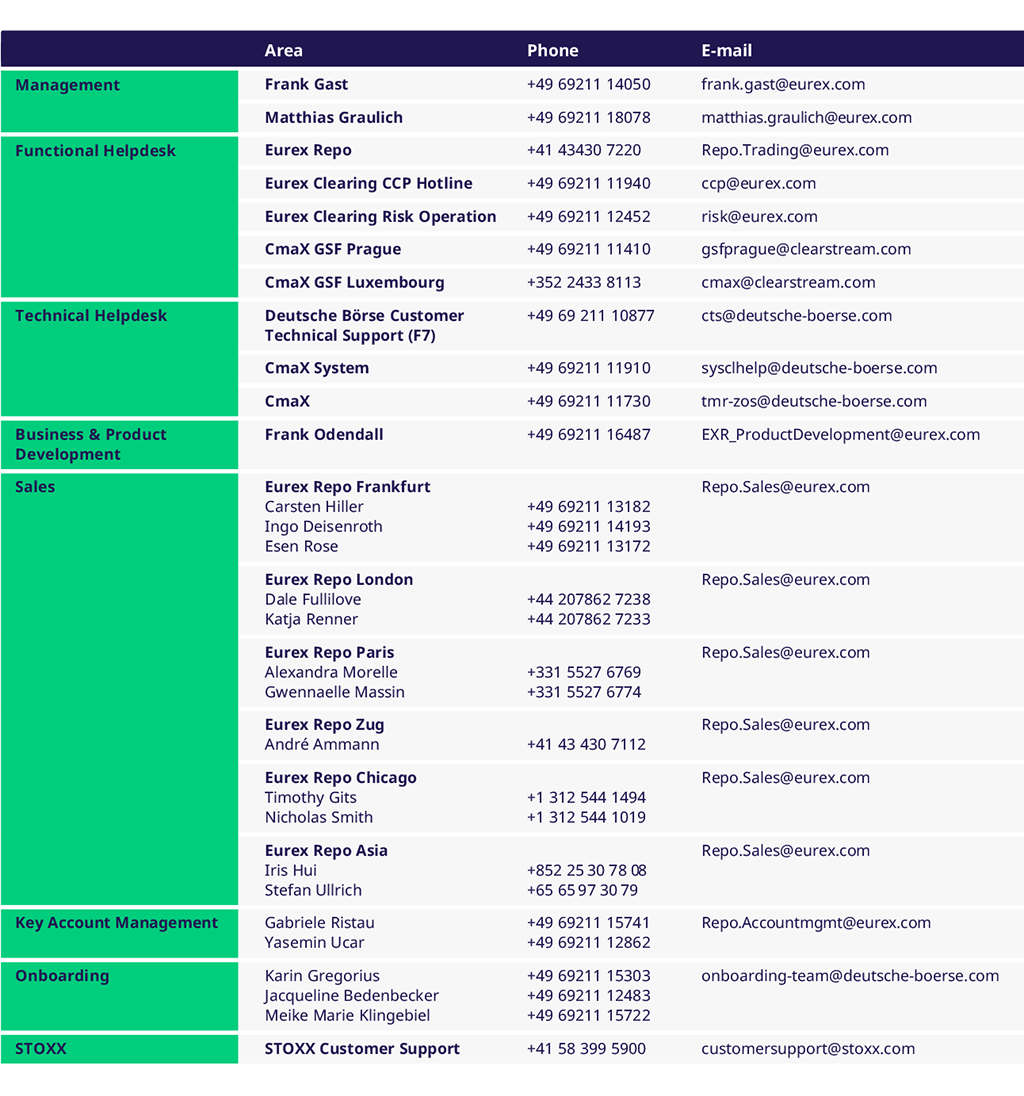

Services & Contacts