Feb 10, 2017

Eurex Exchange | Eurex Group

EQDerivatives: "RV Funds Eyeing VIX Futures Butterflies As VSTOXX® Disparity Grows"

This article first appeared in EQDerivatives' subscription Commentary & News service.

Relative value traders are looking at CBOE Volatility futures butterflies, selling the March future, buying two April futures and selling one May future, in a bid to play expected volatility around the French presidential election.

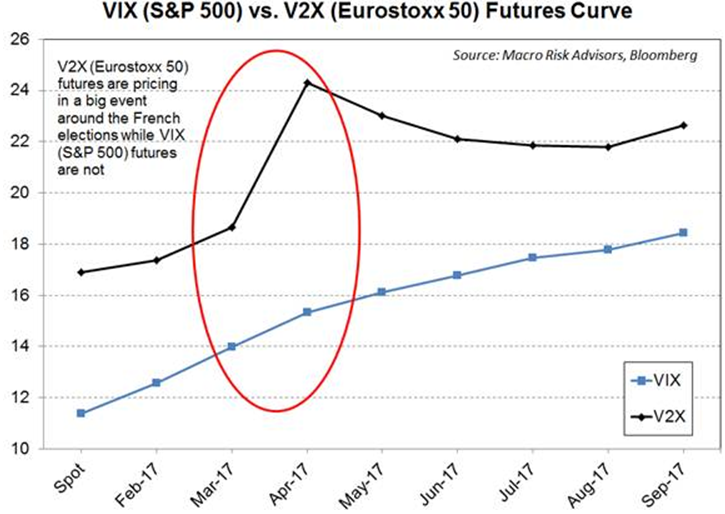

The election in April does not seem to be affecting the VIX term structure, unlike the Euro Stoxx 50 Volatility Index, which has seen elevated levels around the April expiry. The elevated levels in the VSTOXX futures is largely due to the surging popularity of the National Front Party’s candidate, Marine Le Pen, who is campaigning on a far-right Eurosceptic platform.

Pravit Chintawongvanich, head of risk strategy at Macro Risk Advisors in New York, said the VIX will likely react to the election as the date gets closer, similar to what was seen last year in the lead up to the Brexit referendum and the U.S. election. “I think it will be an important macro event, so I think the U.S. April VIX futures can keep a bid,” he said. “But, we’re probably not going to see such a gigantic kink in [the VIX] futures curve.”

He noted executing flys isolated the April futures. “And you’re not really exposed to the level of volatility,” he said. “A much simpler trade might be to just sell puts on the VIX April futures; so selling VIX April 13 puts at 65c, makes sense.”

Chintawongvanich explained, once it gets to April expiry, S&P one-month options are not going to be as cheap that the VIX sells below 13. “Those one-month options are going to be keeping the bid,” he said. “Because of the voting; there’s two rounds to it, so not a binary. It could just mean high vol around both rounds of voting.”

The first round of the election will be held on April 23, 2017. Should no candidate win a majority, a run-off election between the top two candidates will be held on May 7.

One relative value fund manager told EQDerivatives the French election had the potential to lead to greater volatility later in the year, should Le Pen win and start the process of a referendum on the country’s E.U. membership. “It’s a few steps removed from the big event, but France leaving the E.U. would be a bigger event than U.K.,” he said. “How do you have open borders in Europe if the biggest country in the middle leaves?”

He said the disparity between the VSTOXX and the VIX was interesting. “If France is moving towards an E.U. exit and maybe even a euro exit, that isn’t just a European issue, it’s a global issue,” he said. “Remember how the SPX reacted when Greece almost exited? Obviously France in many ways sits much more centrally within Europe than Greece ever did.”

The VIX was trading at 10.93 down 4.54%, while the VSTOXX was also down 2.51% to 27.15 during U.S. afternoon trading hours.

About Daniel O'Leary

Daniel is Managing Editor at EQDerivatives, Inc. Prior to that, he was Derivatives Editor at GlobalCapital where he led the publication's global cross-asset derivatives coverage. At GlobalCapital, he chaired the publication's Global Derivatives Awards and roundtable events, and also expanded the supplement offering, particularly surrounding OIS discounting and swap execution facilities.

Before joining GlobalCapital, he was Bureau Chief of Institutional Investor in Hong Kong where he focused on cross-asset derivatives and regulatory developments in the Asia Pacific region. He has also held roles at Total Securitization and the Australian Associated Press.

A graduate of the University of Canberra, he is based in New York.