10 Sep 2024

Eurex

Focus on VSTOXX® Derivatives | August 2024 recap

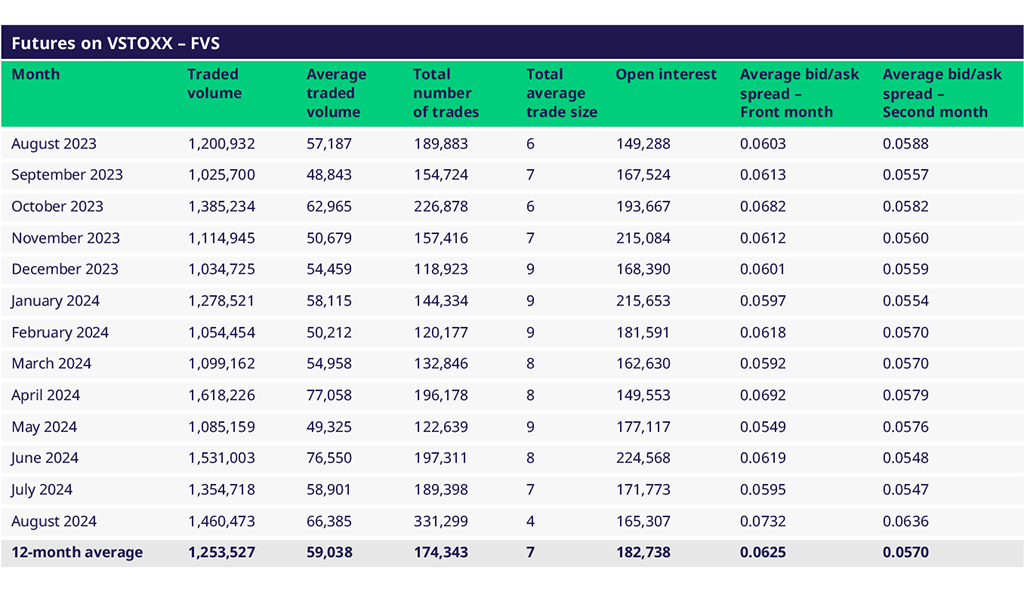

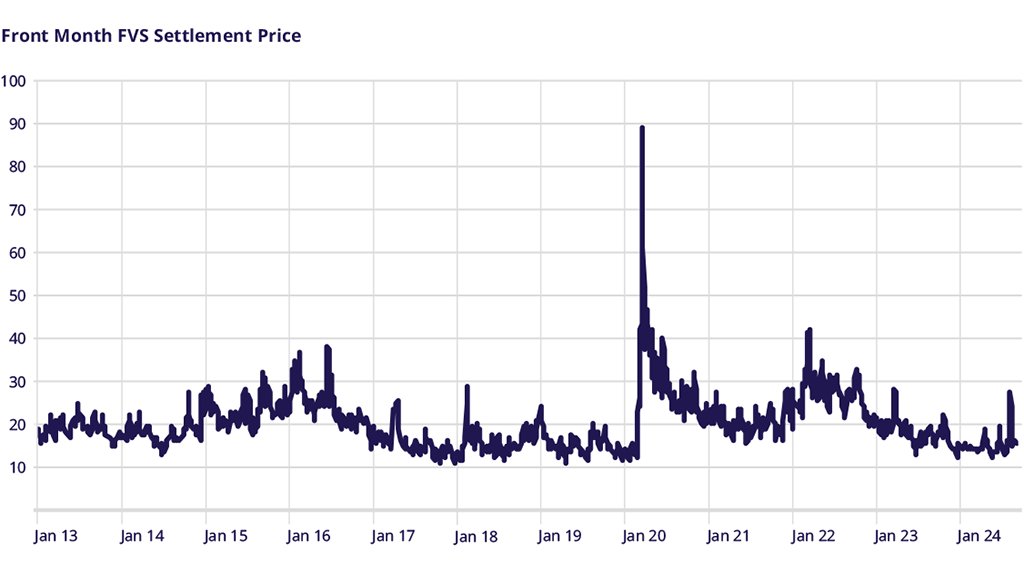

The market meltdown on 5 August resulted in VSTOXX futures recording their fourth most active trading day ever. Now, two of the top ten busiest days for VSTOXX futures ever were recorded in 2024. August was also the fourth most active month for VSTOXX futures ever when measured by the number of trades concluded (104% above the previous 12-month average). 5 August was the most active day of the month, with more than 212k contracts traded.

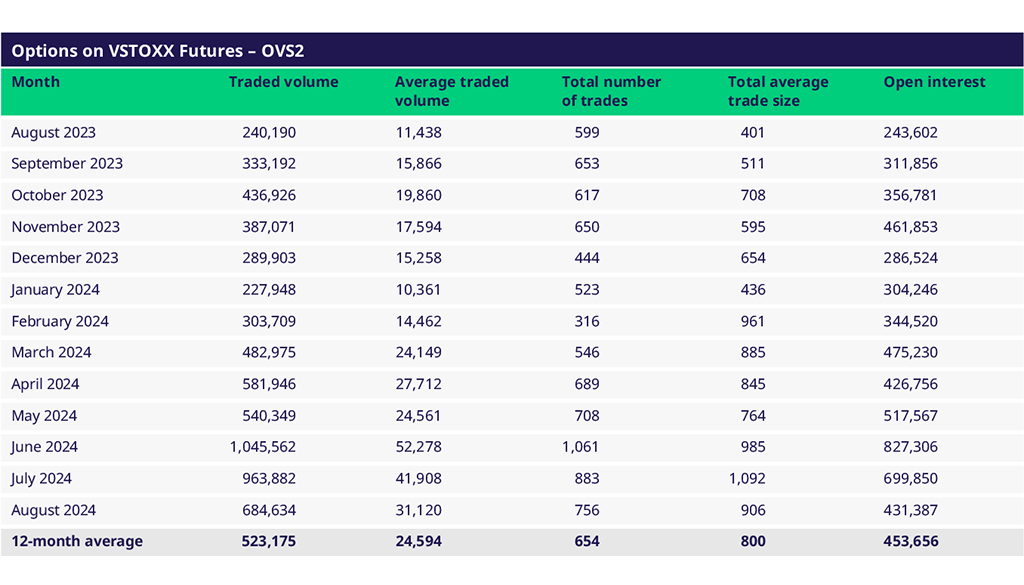

VSTOXX options had a more muted month, though volumes were still 41% above the previous 12-month average. Over 115k contracts traded on 2 August, the busiest day of the month.

As a reminder, new liquidity provider schemes went into effect on 1 September. These schemes materially tightened and deepened screen markets, with the percentage of order book trading already ticking higher even after just a few trading days.

VSTOXX Futures (FVS)

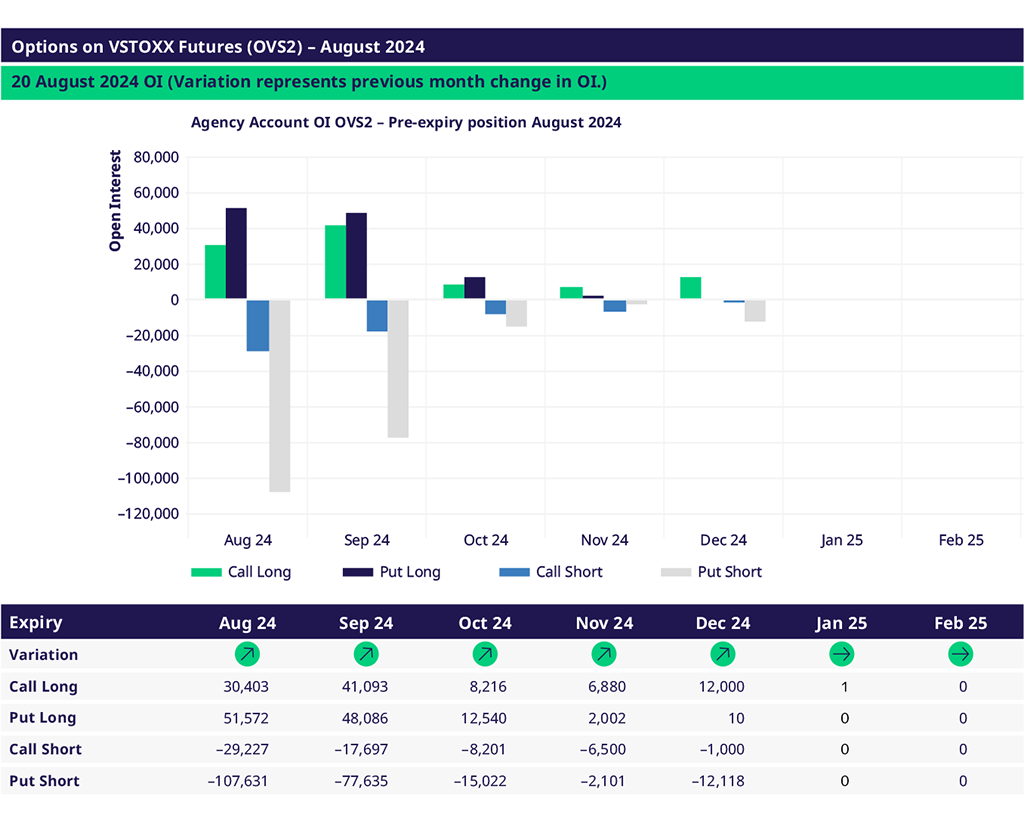

Options on VSTOXX Futures (OVS)

Trade the European volatility benchmark

Explore this year's macro events and find an overview of dates.

Volatility Views Podcast

Listen to the newest edition of the podcast by "The Options Insider" and get more information on this week's volatility markets and the VSTOXX® review and outlook.

For more information, please visit the website or contact: