15 Jan 2025

Eurex

Focus on VSTOXX® Derivatives | December 2024 recap

- December was a tale of two halves, with early month Santa rally vibes shattered by the US FOMC that brought rate fears back into traders’ minds

- Risk premia widened across the board more from a collapse of realized volatility while implied volatility normalized

- Skew suggests traders started the month taking hedges off but ended the month putting them right back on, perhaps indicating a market more in balance at year-end

SX5E Index – turning a corner?

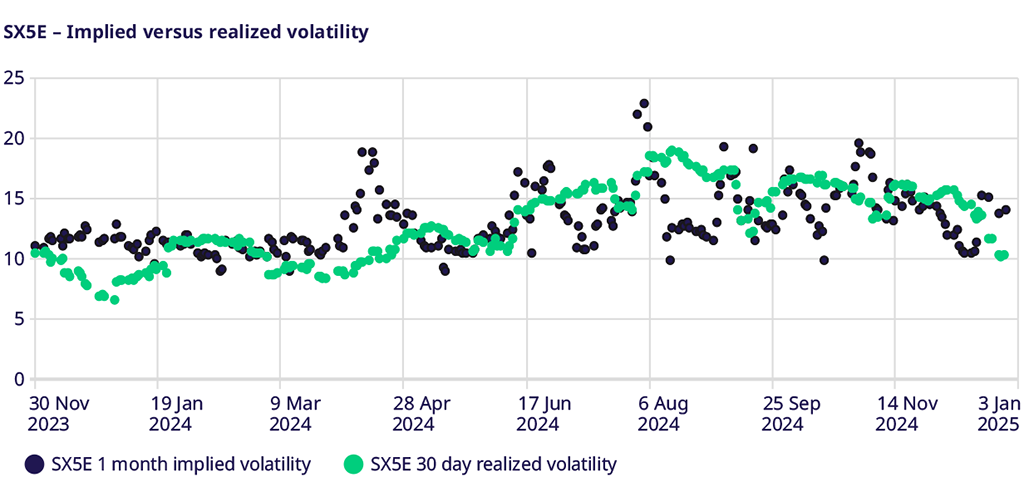

We may look back at December 2024 as a turning point for the headline SX5E Index. The strength of the market in the early part of the month pushed it above technical resistance levels that had given way at the end of November. Perhaps most importantly for global investors, the SX5E, which hit a relative low vs. the SPX on 26 November, rallied above the previous low from March 2022 and above the trendline that was moving lower from April to October 2024. While still below the trendline drawn from March 2023 through April 2024, the movement could mean European markets have turned the corner. You might not know this when looking at the SX5E volatility market, as the realized volatility collapsed throughout the month and ended at the lowest levels we have seen since early summer 2024. However, this may well be due to the holidays, and this point is emphasized by the movement in implied volatility. One-month implied volatility fell early in the month with the combination of a rally in markets and the impending holiday-shortened weeks at the end of the month. Implied volatility bottomed near December expiration on 16 December 1 and marched higher after that, ending the month near the highs at 14.03, well above the realized volatility of 10.31, giving a risk premium not seen since early November.

DAX markets – is outperformance starting to wane?

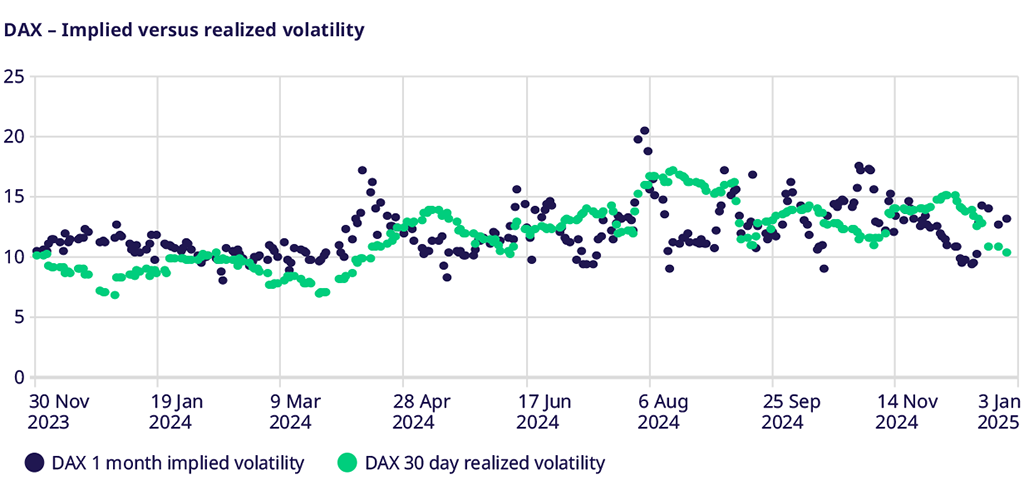

Speaking of relative performance, the DAX Index had shown massive outperformance from February 2024 through its peak on 12 December. After that peak, the DAX lagged for the rest of the month in relative terms and, in absolute terms, gave back the entire rally in the first part of the month by 23 December. While it found support at the closing level from November, some damage was done. This can be seen in the volatility markets as implied volatility bottomed on 16 December and moved sharply higher into this 23 December low. While there was some settling around the holidays, the market still exited the year well off the single-digit implied volatility levels seen mid-month in December. Was this some noise around the holiday-shortened trading, or is the threat of tariffs by the U.S. an issue that DAX traders will contend with in early 2025, suggesting a more volatile start than a year ago? This is the key question as we look into the new year.

SXXP Index – a tale of two halves?

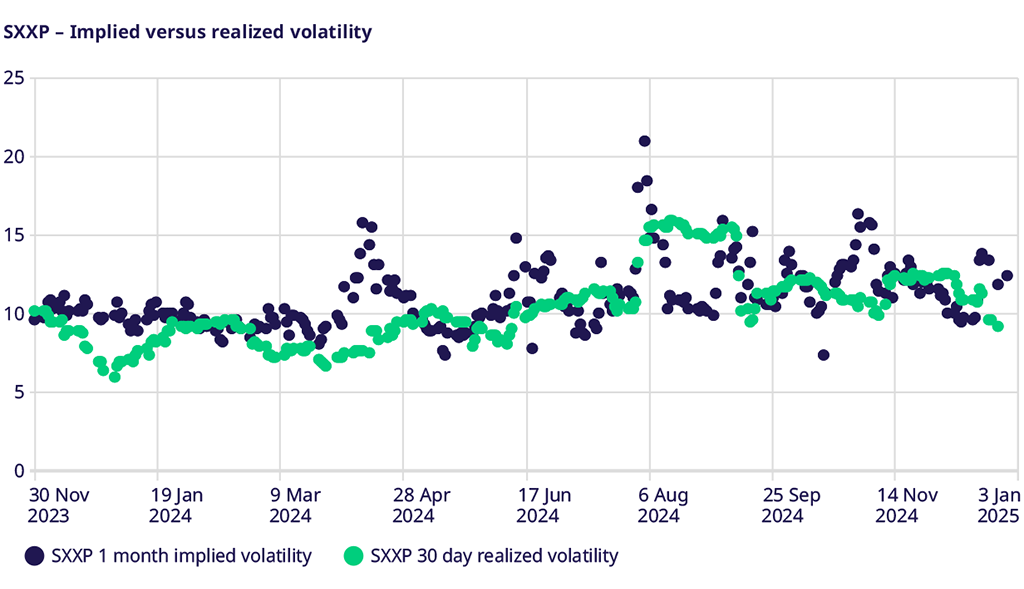

Like the SX5E and DAX, the SXXP Index had a tale of two halves, characterized by year-end Santa rally vibes in the first part of the month and a tariff-inspired sell-off into December expiration and through the Christmas holiday. Implied volatility led realized volatility lower in the first half of the month and spied higher post-expiration. While realized volatility continued to decline in shortened holiday trading, implied volatility widened its spread, and traders look set to forecast more volatile markets in 2025. The implied less realized spread is the widest seen since the U.S. election and the August de-risking event before that. While some of this spread may be indicative of end-of-year markets, it is notable that there is an expectation for volatility to rise in the new year. These risk premia expansions in the past have not been sustained, though it may be too soon to suggest an imminent compression of implied volatility.

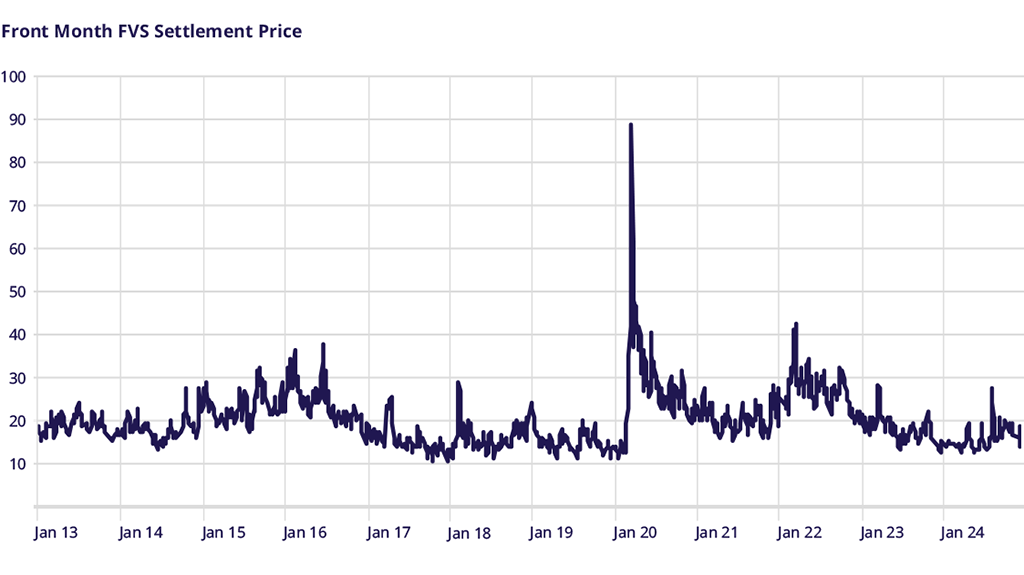

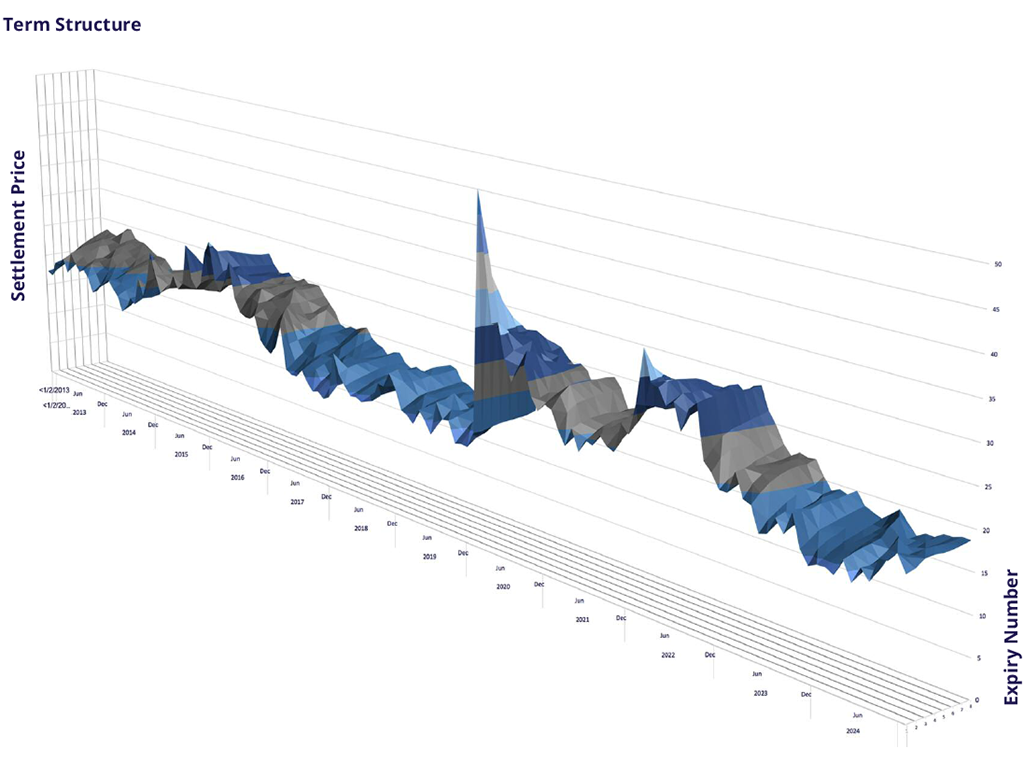

V2X Index – someone sees something

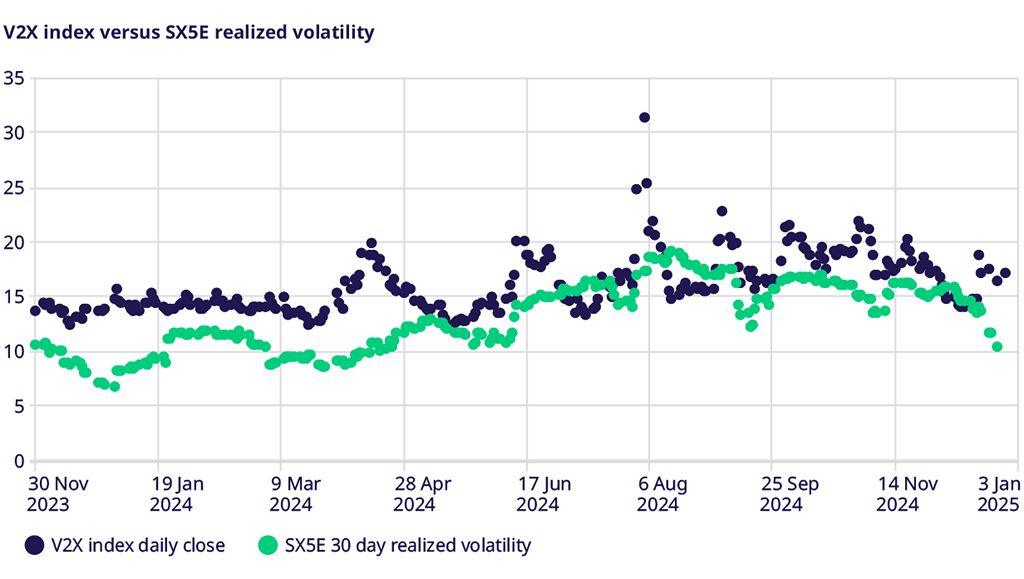

Volatility expansion and risk premium are certainly the case when digging into the V2X markets for December. The 18 December FOMC meeting proved to be a catalyst for volatility as the U.S. central bank hinted that it might be slowing, if not stopping, its easing cycle just as it was getting going. This surprised many in the markets as we can see from the spike in volatility markets. While the spikes were more severe in the U.S., as the spread between VIX and V2X moved sharply in favor of the VIX, volatility rose everywhere, and V2X was no different. Implied volatility also rose sharply relative to realized volatility, which continued to collapse into back-to-back shortened holiday weeks. The combination of rising implied volatility and falling realized volatility is not common in markets but was the hallmark of the back half of December in V2X. Geopolitical risk with central banks that may not be as supportive as hoped could set the tone for more implied (and realized) volatility in 2025.

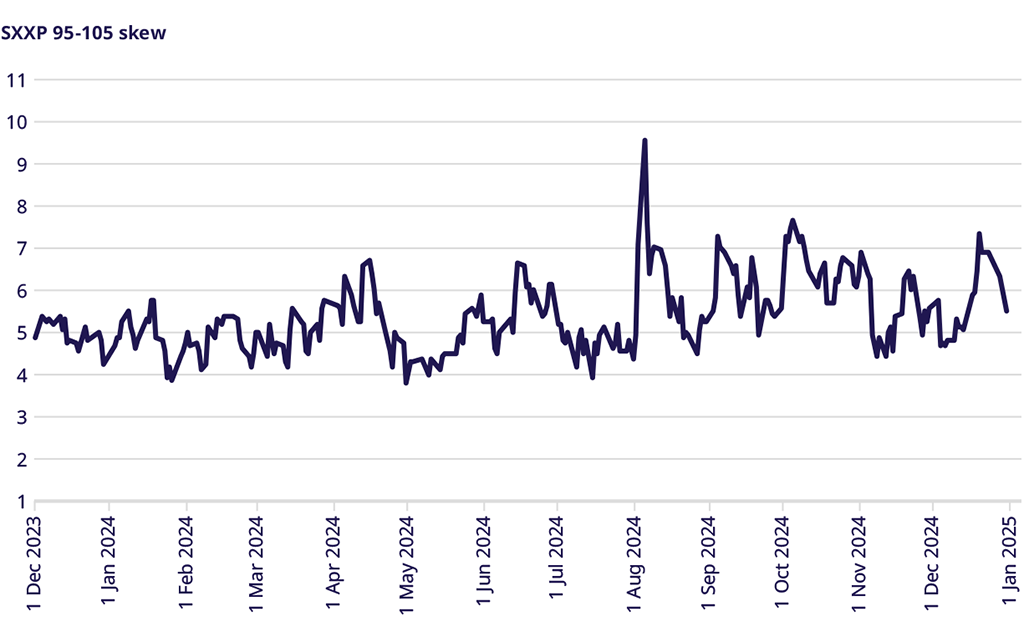

SXXP Index Skew – not what I would expect

Trends seen in the other parts of the volatility market were clearly present in Skew as well. Early December seemed to be risk-on, as not only were Index levels rising, but implied volatility fell and Skew fell to below-average levels. This price action suggests traders/investors took downside protection off early in December. The volatility shock after the FOMC meeting saw not only a move higher in implied volatility but also a widening of Skew and falling Index prices, suggesting those hedges were put right back on barely a week after they were taken off. Perhaps there was some legging off and on of these hedges. Perhaps investors got a stark reminder of why those hedges were needed in the first place. Perhaps the risk-on/Santa rally vibes have left the building. Heading into 2025, Skew levels of 5.52 are very close to the mean of the past twelve months of 5.32, indicating no strong view on the direction of markets as we head into 2025.

Trade the European volatility benchmark

Explore this year's macro events and find an overview of dates.

Volatility Views Podcast

Listen to the newest edition of the podcast by "The Options Insider" and get more information on this week's volatility markets and the VSTOXX® review and outlook.

For more information, please visit the website or contact: