12 Aug 2024

Eurex

Focus on VSTOXX® Derivatives | July 2024 recap

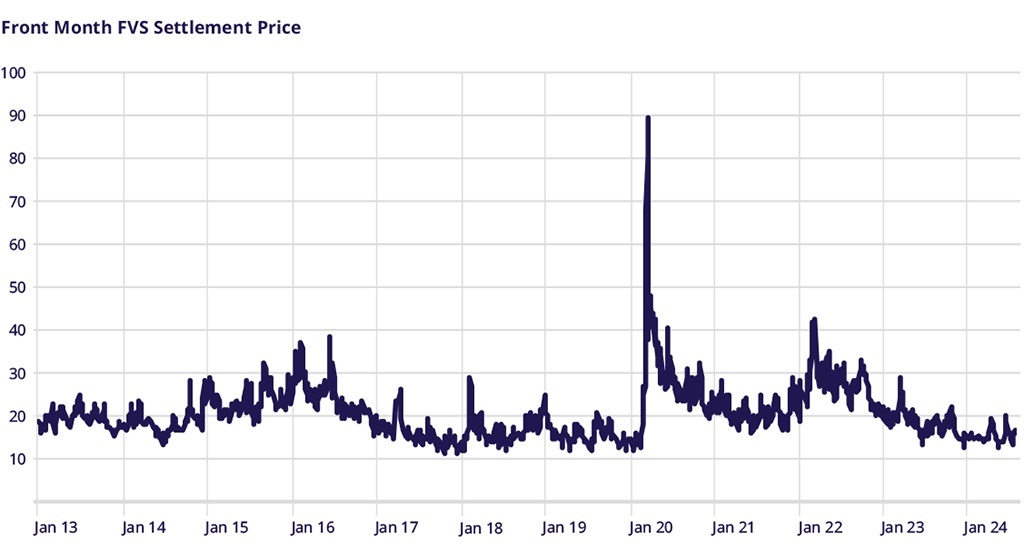

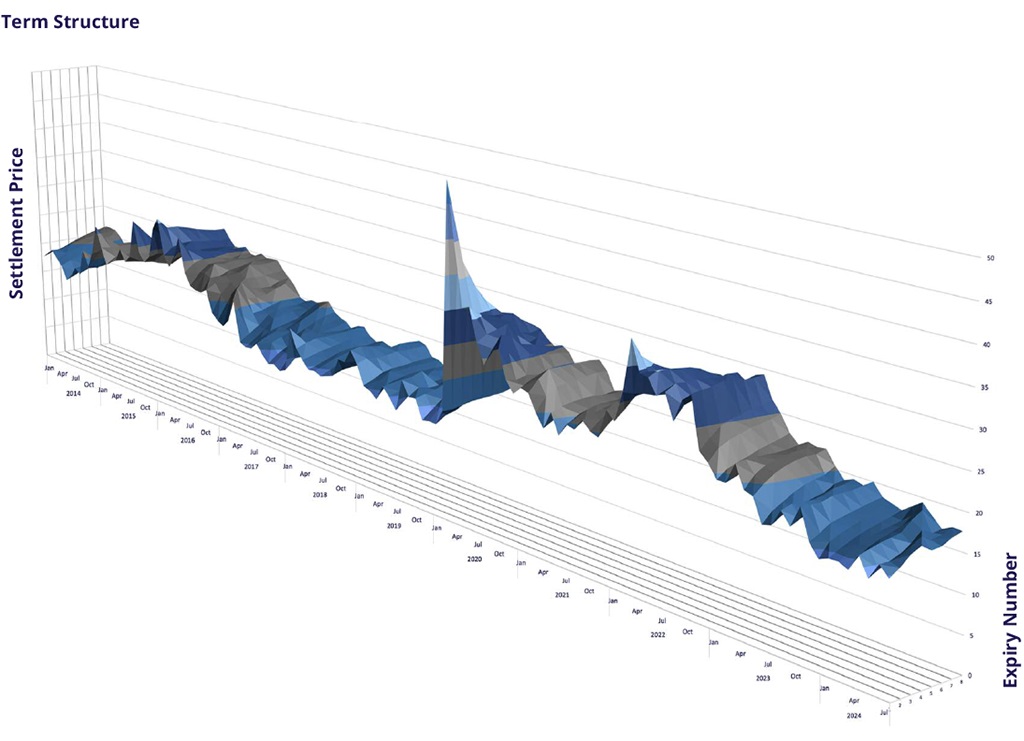

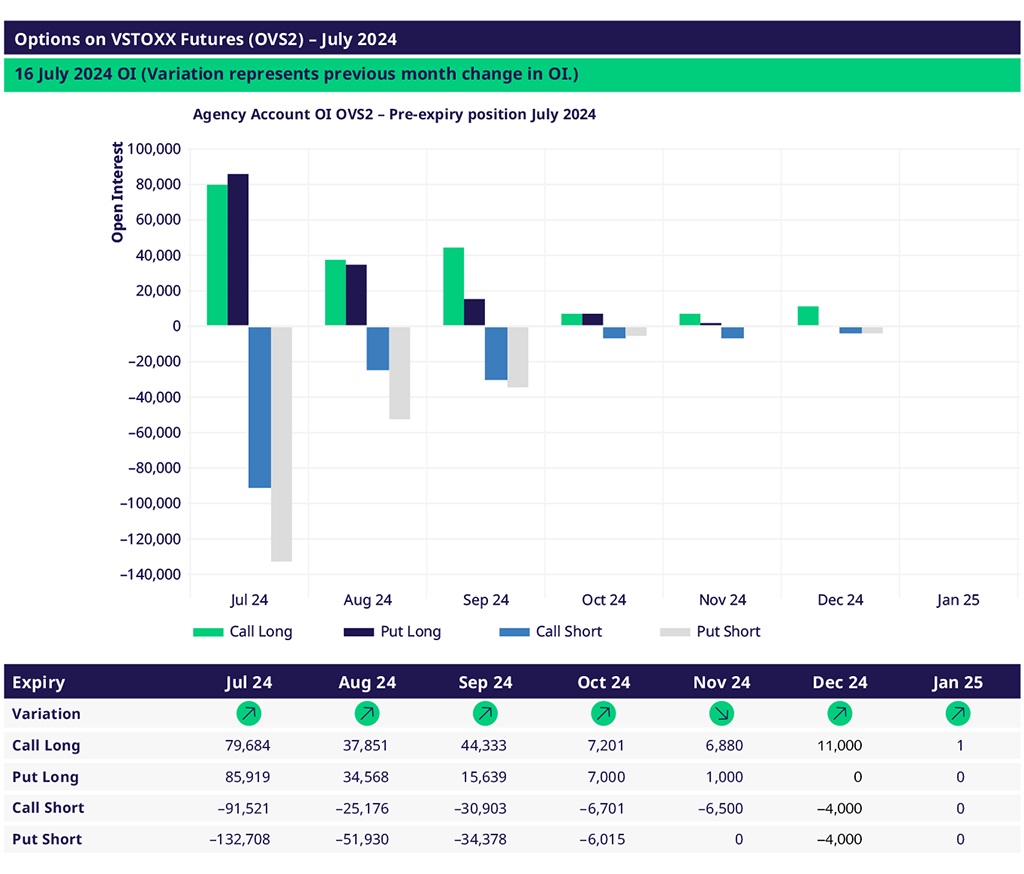

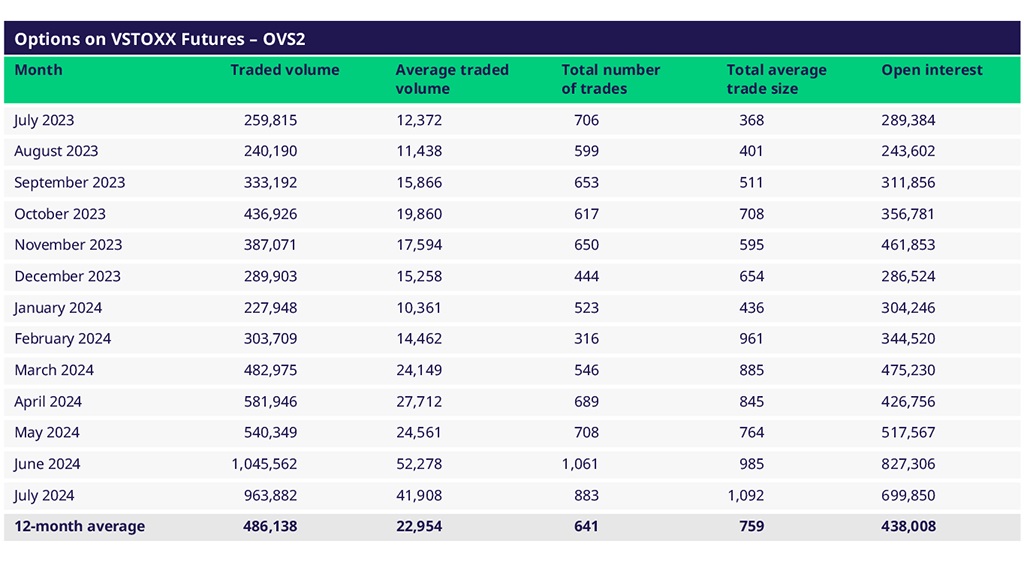

While France’s anti-climactic end of the snap elections put a damper on volatility in the early part of July, the shift towards US politics quickly put V2X back above the 2024 average. Excluding the record options ADV set in June, ADV in July was the highest since Q1 2021, with almost a million contracts traded. Interestingly, the average options trade size hit a record high (averaging 1092 contracts in July), potentially indicating greater confidence in scaling positioning. July 12th was the heaviest trading day of the month, with 109,327 contracts traded (484% of last year’s ADV).

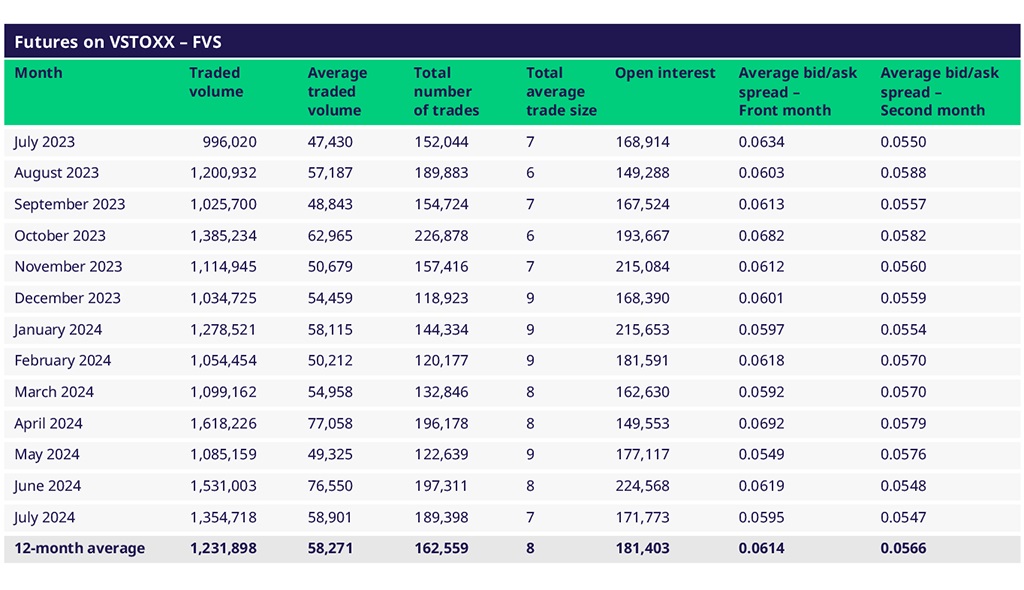

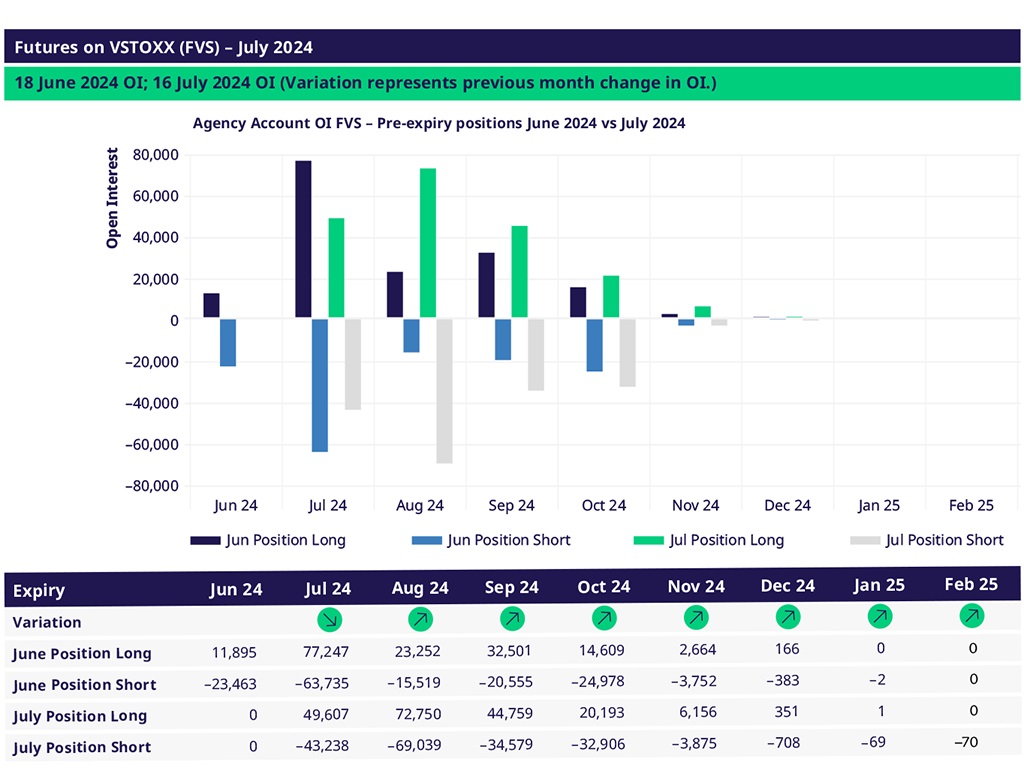

VSTOXX futures also had an above-average month, though trading was more muted than in options. 16 July was the most active day of the month, with 97,424 contracts trading (of which 63% of volumes were in non-front-month contracts). 2024 ADV is running almost 17% above full-year 2023.

Options on VSTOXX® Futures (OVS2) July Update

For more information, please visit the website or contact:

Contacts