09 Jul 2024

Eurex

Focus on VSTOXX® Derivatives | June 2024 recap

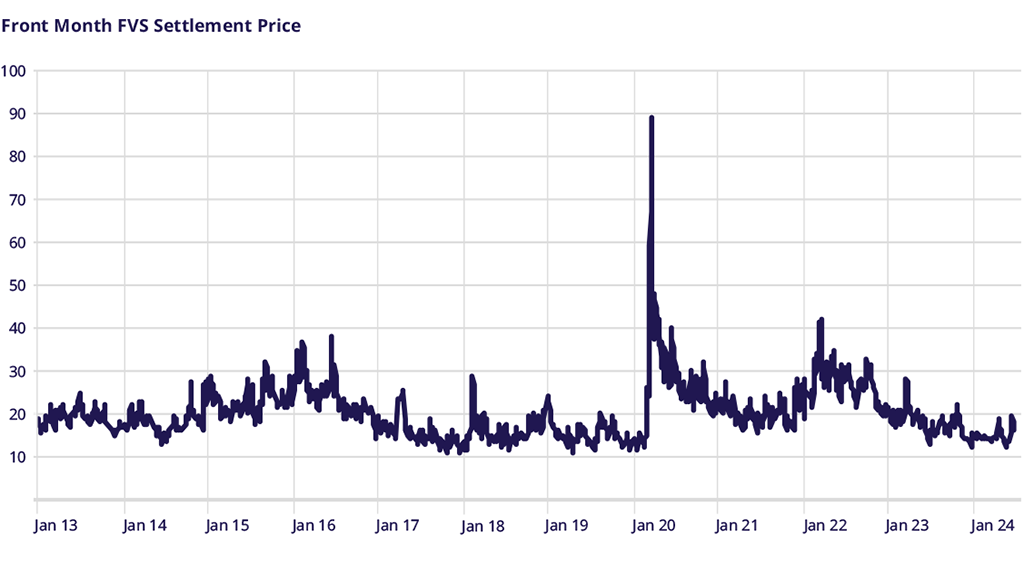

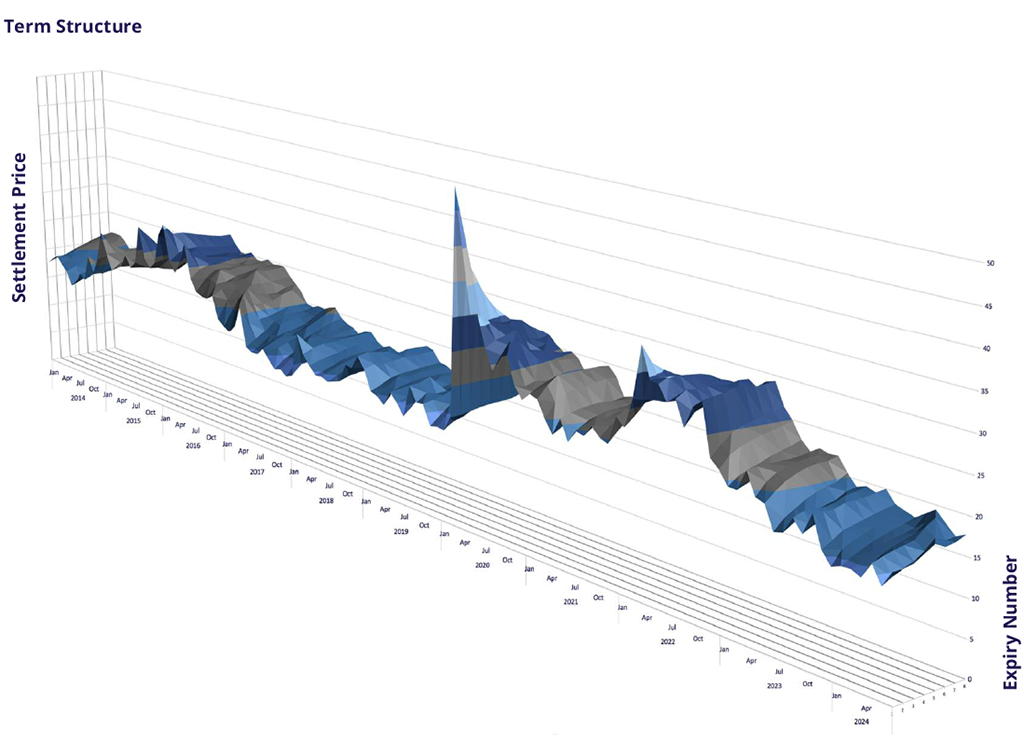

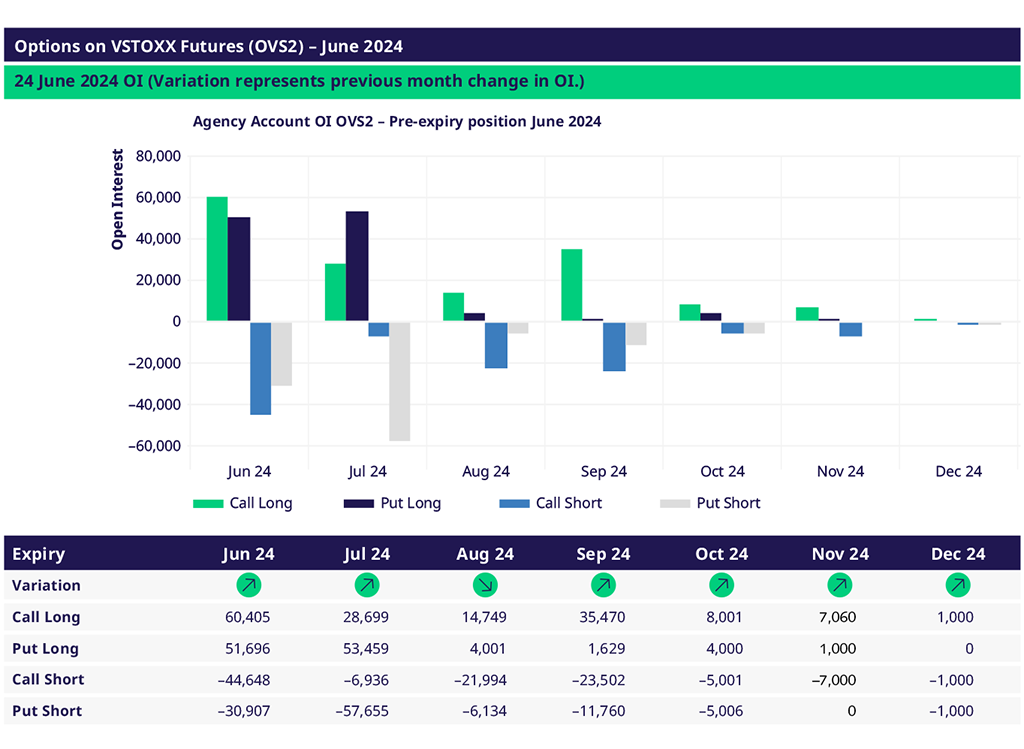

June saw a resurgence in regional volatility on the back of the call for snap elections in France, with V2X reaching 22 points by mid-month and the V2X-VIX spread reaching 7 points (the highest since the start of the Ukraine war).

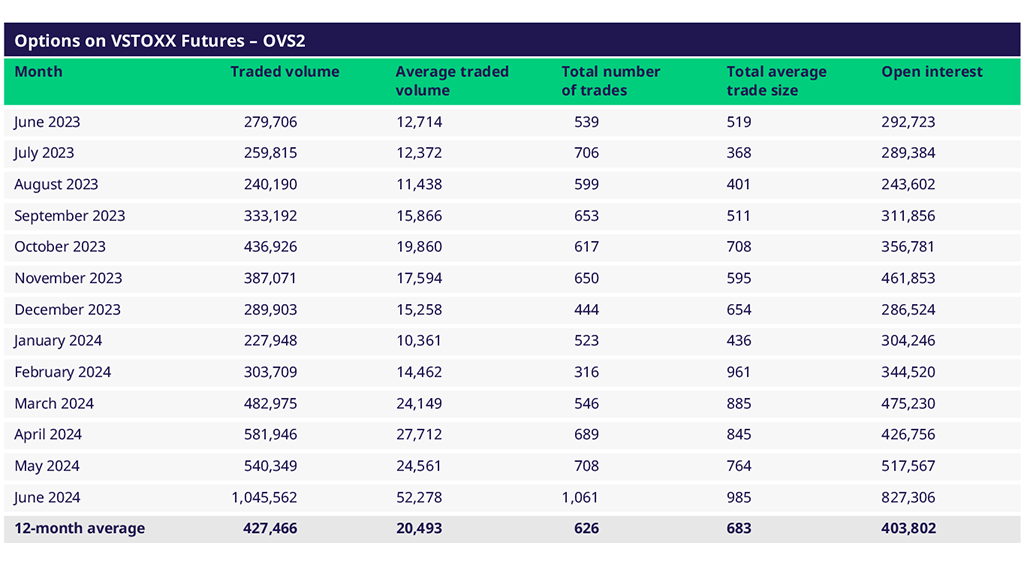

- June 2024 had the highest ADV month for VSTOXX Options ever, with an ADV of 52,278 (180% of the entire 2023 ADV).

- With over 1 million contracts trading in June, volumes were the highest since March 2020, the second-highest volume month since OVS2 was listed.

- Open Interest, as of month-end, was the highest since the Brexit related turbulence of February-April 2017.

- 14 June was the most active day for OVS2, with over 137,000 contracts trading, the most active day since the early days of the Ukraine war.

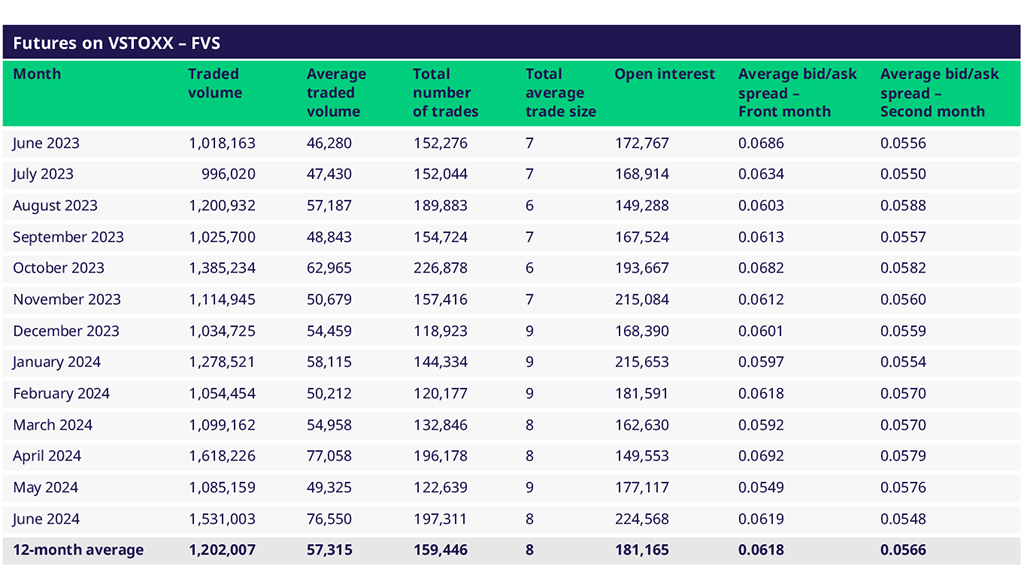

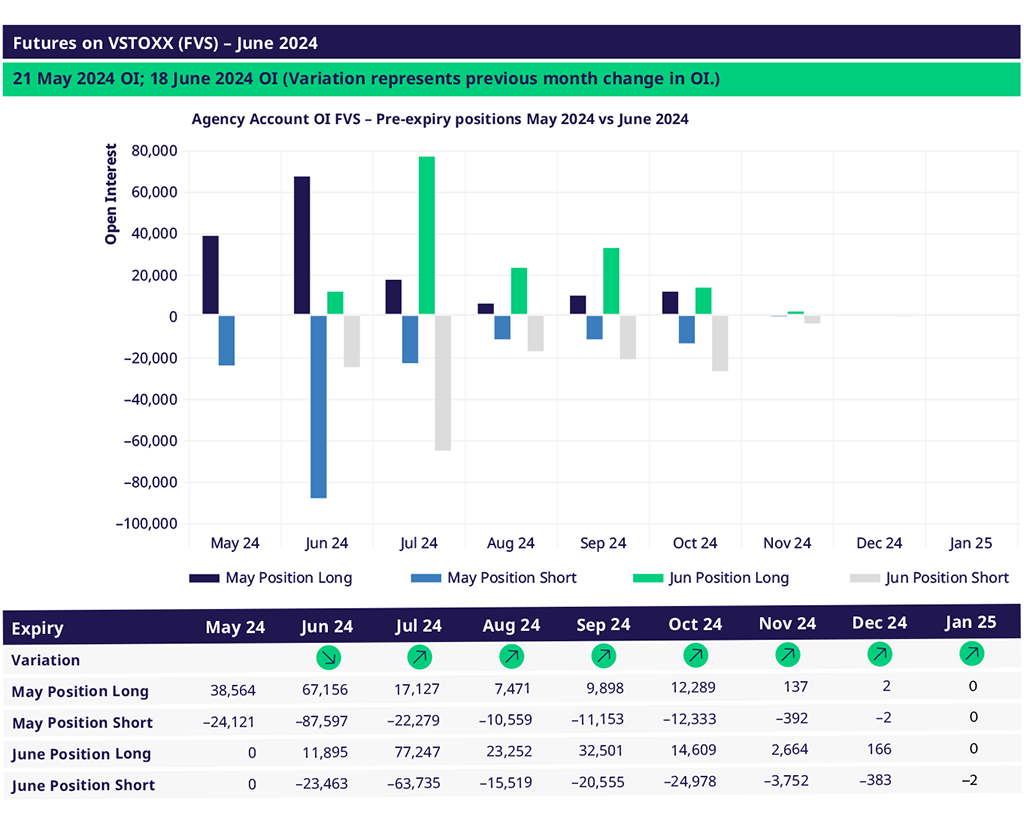

- VSTOXX Futures also had a remarkable month, with month-end Open Interest of over 224,000 contracts, the highest since the early days of the COVID market sell-off.

- 14 June was the busiest day for futures, with over 183,000 contracts trading (the most active day since the 2023 banking crisis).

Throughout most of the core trading session, the order book for both front and second-month futures remained quoted just one tick wide.

VSTOXX Futures (FVS)

Options on VSTOXX Futures (OVS)

Trade the European volatility benchmark

Explore this year's macro events and find an overview of dates.

Volatility Views Podcast

Listen to the newest edition of the podcast by "The Options Insider" and get more information on this week's volatility markets and the VSTOXX® review and outlook.

Contacts