10 Jun 2024

Eurex

Focus on VSTOXX® Derivatives | May 2024 recap

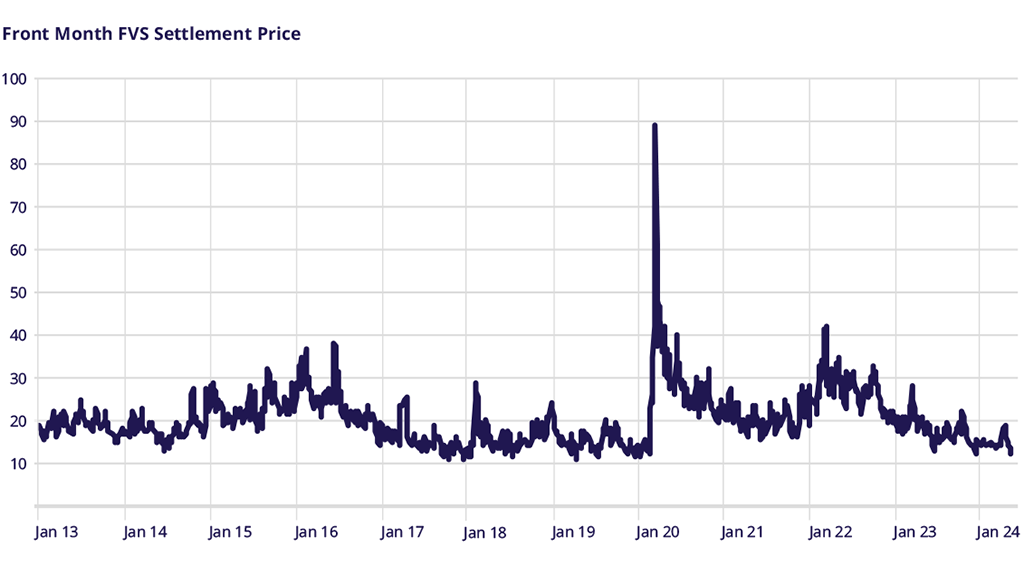

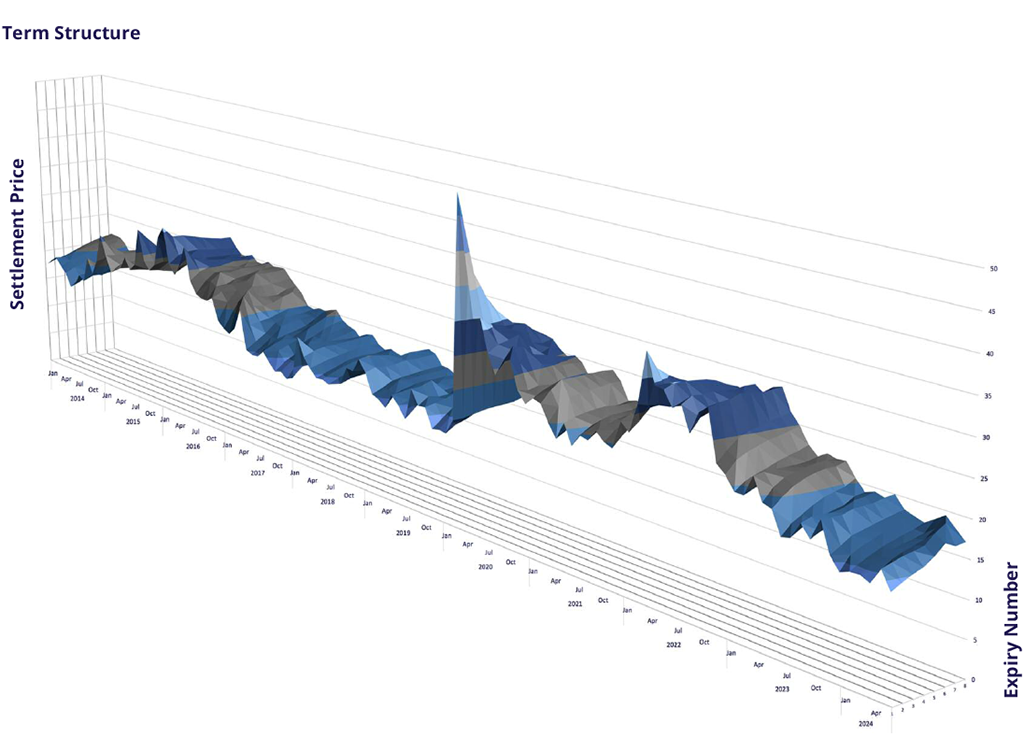

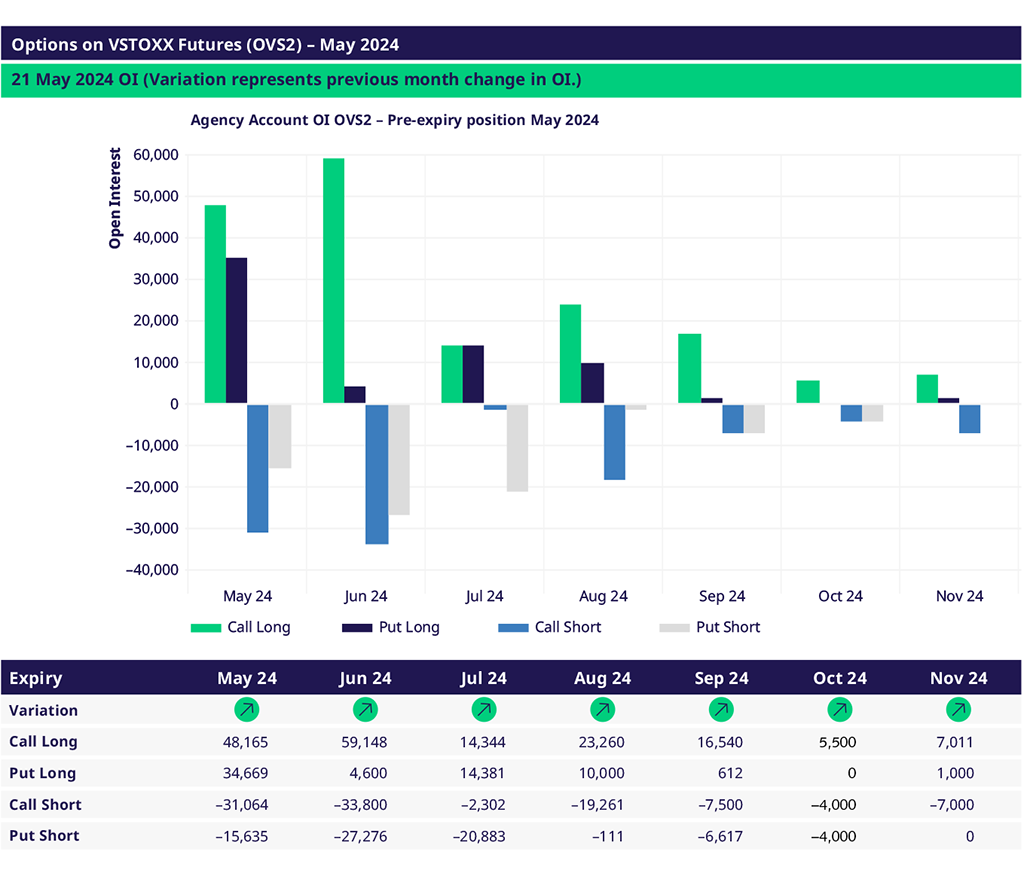

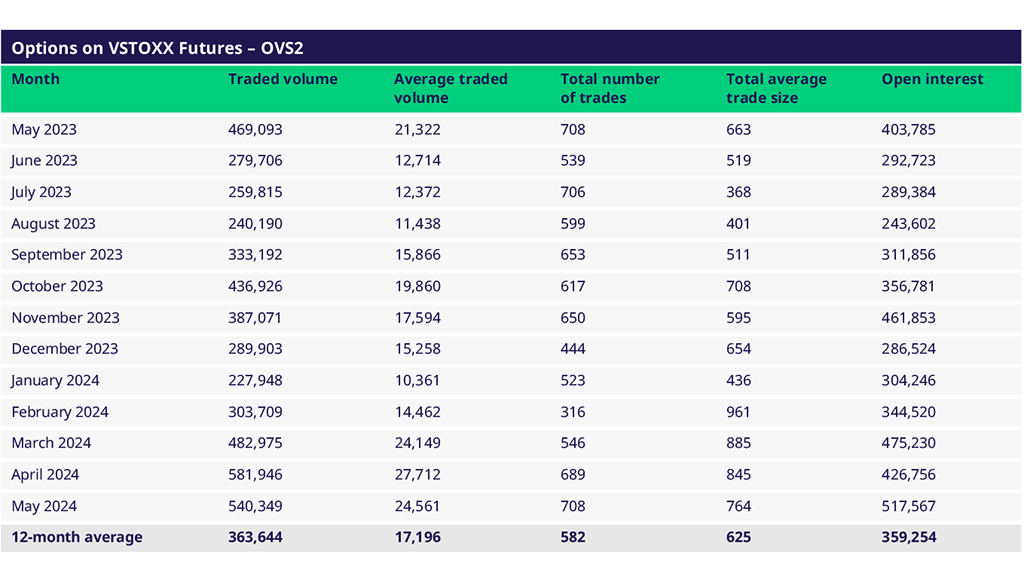

May was a relatively sleepy month for index volatility, with V2X slowly grinding to a 2024 low below 12.15 by mid-month. Regardless, VSTOXX® Options had their second most active month in at least a year, now marking three straight months with ADV north of the 2023 full-year average. Open interest closed the month at over 517,000 contracts, the highest OI at month-end in over a year. 22 May was the most active day in May, with over 50k options trading.

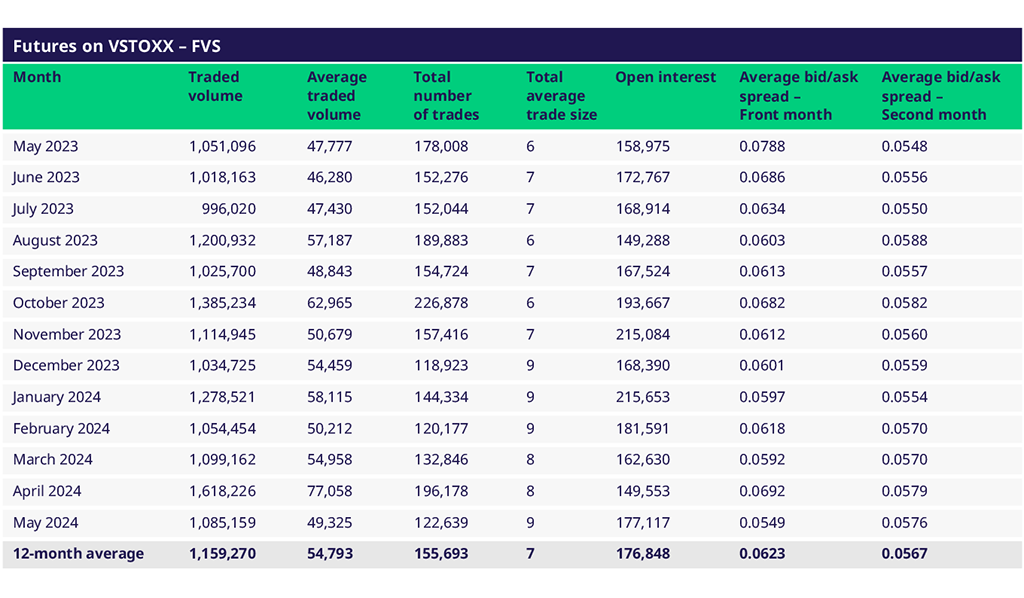

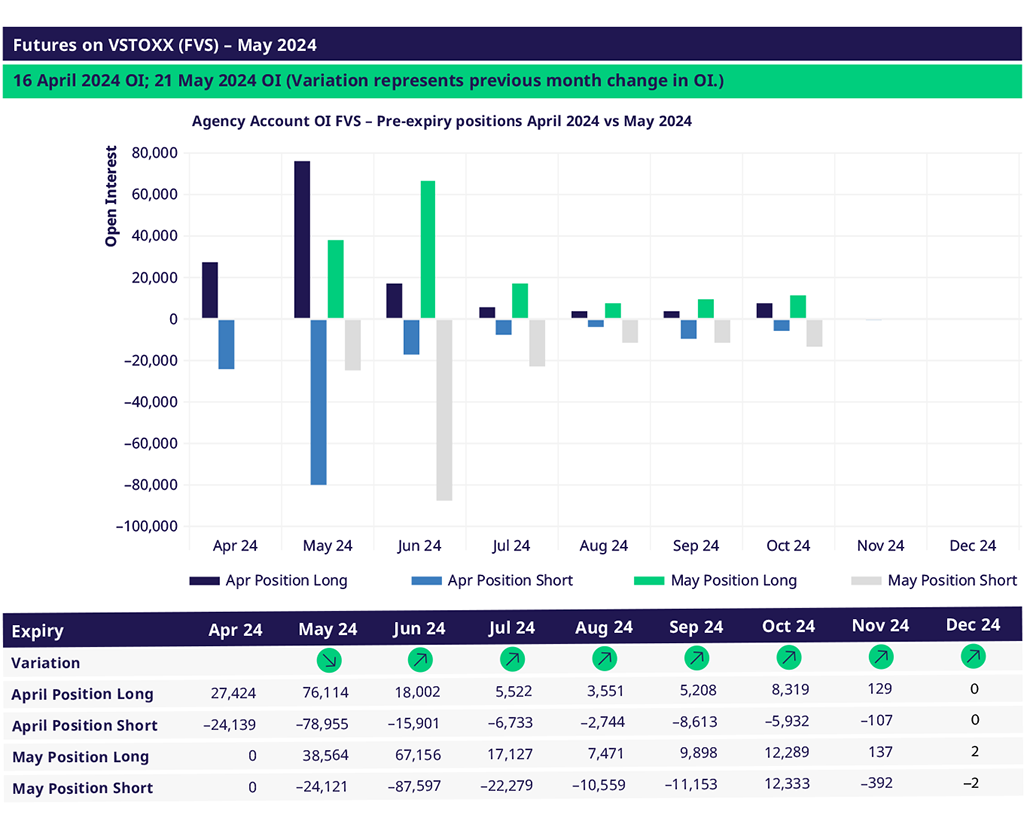

VSTOXX® Futures volumes were more muted as a result of the lower volatility, with ADV ticking below the one-year average. 21 May was the most heavily traded day of the month with over 100k contracts trading through a relatively choppy trading session. Throughout the vast majority of the month, the first and second-month contracts were quoted just one tick wide.

VSTOXX Futures (FVS)

Options on VSTOXX Futures (OVS)

Trade the European volatility benchmark

Explore this year's macro events and find an overview of dates.

Volatility Views Podcast

Listen to the newest edition of the podcast by "The Options Insider" and get more information on this week's volatility markets and the VSTOXX® review and outlook.

For more information, please visit the website or contact: