T7/FX Migration

Eurex has decided to transfer its FX derivatives from the T7/FX trading system to its standard T7 trading system. Please note this initiative does not affect the clearing layer on C7, there is no impact on existing positions. Features, changes and enhancements are related to Migration of FX Derivatives to T7.

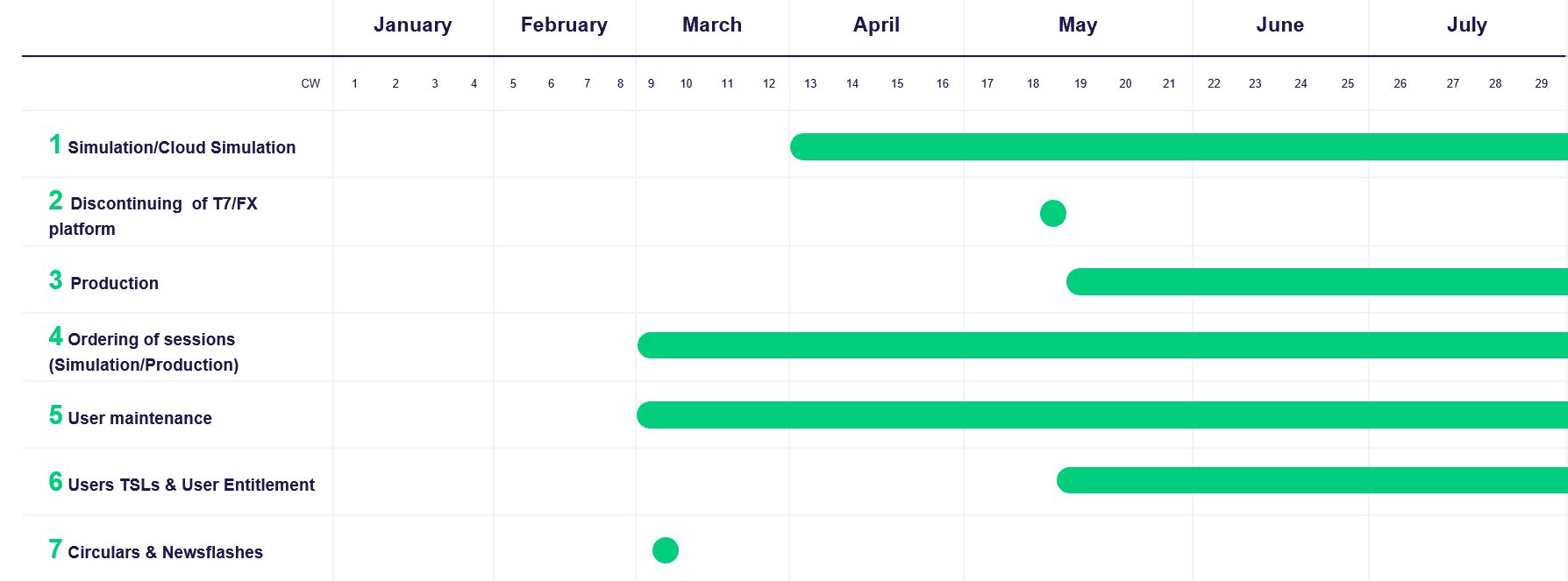

Simulation start: 01 April 2021

Production start: 17 May 2021

System Documentation

- T7 Release 9.0: Participant and User Maintenance Manual

Publication date: 07 Sep 2020

This manual is intended to assist service administrators who are responsible for maintaining participant and user related data in T7.

Circulars

Readiness Videos

Items/ Participants Requirements

Feature/Enhancement | Details | Action Item |

Maintenance of Users | With the decommissioning of T7/FX, Eurex will not transfer any existing users to the standard T7 environment. Trading Participants need to adjust their user setup. | Trading Participants currently trading Eurex FX Products on T7/FX need to adjust their setup (technical sessions, users, TSLs) due to changed trading environment. For details, please refer to the Participant and User Maintenance Manual. |

Trading Hours | The Trading Hours for FX Futures (Classic FX Futures and Rolling Spot Futures) and Options on FX Futures will be amended effective May 17th. I.e., Opening trading is pushed by an hour from 12 AM CET to 1 AM CET. | Please note the change in the time (trading window). Additional information is available here: Eurex Circular 04/21. |

Reporting | The current T7/FX Reports with environment ID “70” (production) and “75” (simulation) will be decommissioned. The FX products will be fully integrated into the standard T7 Reports with the environment IDs: “90” for the production environment and “95” for the simulation environment. | Trading Participants should consider potential changes for the reports. Please refer to the Report Reference Manual for additional information. |

Technical | The FX derivatives will be located on the existing Partition 1 in the simulation environment and on the new Partition 11 in the production environment. | Trading Participants that would like to us HF sessions can already order new sessions (simulation/production) via the Member Section. Sessions for production will be billed if ordered now. Please also note, that GUI keys for subnet can be uploaded. |

In case of any questions or your require further information, please contact us at client.services@eurex.com.