小型德国股指Mini-DAX®

为您搭建通往德国市场的桥梁

小型德国股指Mini-DAX®期货为散户量身定制,与现有的德国股指DAX®的期货合约平行设计。小型德国股指Mini-DAX®为半专业投资者提供了以合约规格显著降低的工具来对冲和交易德国基准股指的机会。

DAX®股指包括40家规模最大,交易最活跃的德国公司,其中包括戴姆勒汽车、德意志银行、大众汽车、爱迪达和SAP。

- 小型德国股指Mini-DAX®期货 (FDXM)

- 合约规范

- 高流动性,低买卖价差 (订单簿)

点击产品代码可以查询更多合约规范相关的信息。

最小变动单位 | 产品代码 | 交易时间 | 有效期 | |

点数 | 价格 | |||

1 | 5(欧元) | 01:00 – 22:00 (CET) 02:00 – 22:00 (CEST) |

| |

显示的数据延迟了15分钟 最近更新: 4月 02, 2025 9:59:47 下午

| Contract (maturity) | Quantity | Bid | Ask | Quantity | Last Price | NetChange | Cumulative Volume (QTY) | Open Interest | |

|---|---|---|---|---|---|---|---|---|---|

| Jun 2025 | n.a. | n.a. | n.a. | n.a. | 22.630,00 | -0,47% | 29.186 | 6.950 | |

| Sep 2025 | n.a. | 22.504,00 | 22.927,00 | n.a. | 22.764,00 | -0,18% | 4 | 14 | |

| Dec 2025 | n.a. | n.a. | n.a. | n.a. | 22.866,00 | -0,76% | 0 | 0 | |

| Mar 2026 | n.a. | n.a. | n.a. | n.a. | 23.015,00 | -0,75% | 0 | 0 | |

| Jun 2026 | n.a. | n.a. | n.a. | n.a. | 23.244,00 | -0,75% | 0 | 0 | |

| Sep 2026 | n.a. | n.a. | n.a. | n.a. | 23.394,00 | -0,74% | 0 | 0 | |

| Dec 2026 | n.a. | n.a. | n.a. | n.a. | 23.533,00 | -0,74% | 0 | 0 | |

| Mar 2027 | n.a. | n.a. | n.a. | n.a. | 23.699,00 | -0,73% | 0 | 0 | |

| Jun 2027 | n.a. | n.a. | n.a. | n.a. | 23.938,00 | -0,73% | 0 | 0 | |

| Sep 2027 | n.a. | n.a. | n.a. | n.a. | 24.116,00 | -0,72% | 0 | 0 | |

| Dec 2027 | n.a. | n.a. | n.a. | n.a. | 24.276,00 | -0,72% | 0 | 0 | |

| Mar 2028 | n.a. | n.a. | n.a. | n.a. | 24.436,00 | -0,71% | 0 | 0 |

- 优势一览

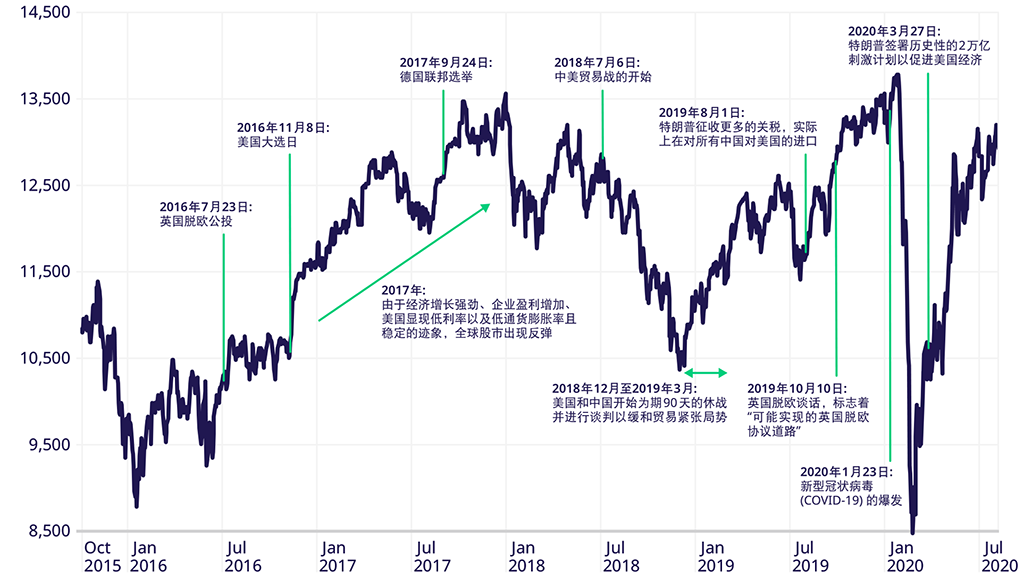

- 历史价格线图

- Mini-DAX®期货vs.ETF的优势

- Mini-DAX®期货vs.CFD /权证的优势

- 价格透明度

由于价格透明性优势而成为场外交易市场的引人注目的替代品

- 高流动性基准产品

自2015年10月上市以来,Mini-DAX®的名义交易量超过1.58万亿欧元

- 无缝衔接德国市场

以较低的合约价值获得德国40强股票的敞口

- 欧交所交易优势

主要交易,清算和风险管理功能有助于降低交易对手风险并提高保证金效率

- 24/5 工作日全天候交易

延长交易时间为市场参与者创造了更多交易和对冲机会从新加坡/香港时间08:15开始交易

在几乎每个交易情况下,Mini-DAX®期货能够在ETF上提供更经济有效的方法来管理德国股指DAX 40®的曝险:

| 1) 无需管理费用 | 交易FDXM期货享受零管理费用,而这在交易DAX 40®ETF时是不同的 |

| 2) 资本有效性 | Mini-DAX® 期货保证金相比于对DAX 40® ETF的直接投资更具有资本有效性 |

| 3) 24/5 交易权限 | 近24/5工作全天候交易权限意味着您在特殊时期(如英国脱欧、德国大选等)也可享有交易和对冲机会 |

| 4) 战术性交易工具 | 根据市场走势预测进行战略性交易 |

| 5) 最低追踪失误 | FDXM期货能够非常准确地追踪相关股指 |

Mini-DAX®期货较早的德国DAX 40®股指的CFD /认股权证拥有多种优势:

| 1) 交易型开放式产品 | Mini-DAX®期货在拥有独立交易监管的交易平台(欧交所)进行交易 |

2) 透明定价 | 欧交所提供的透明交易和清算业务,包括一个低对手方风险的中央对手方系统 |

| 3) 高流动性,利差小 | Mini-DAX®期货在所有交易时间内均提供更高的流动性和最小利差 |