Compression

Eurex introduced an infrastructure for compression service providers to offer compression services for listed derivatives to Exchange Participants as of 29 March 2021. Features, changes and enhancements are related to Compression Services for listed derivatives.

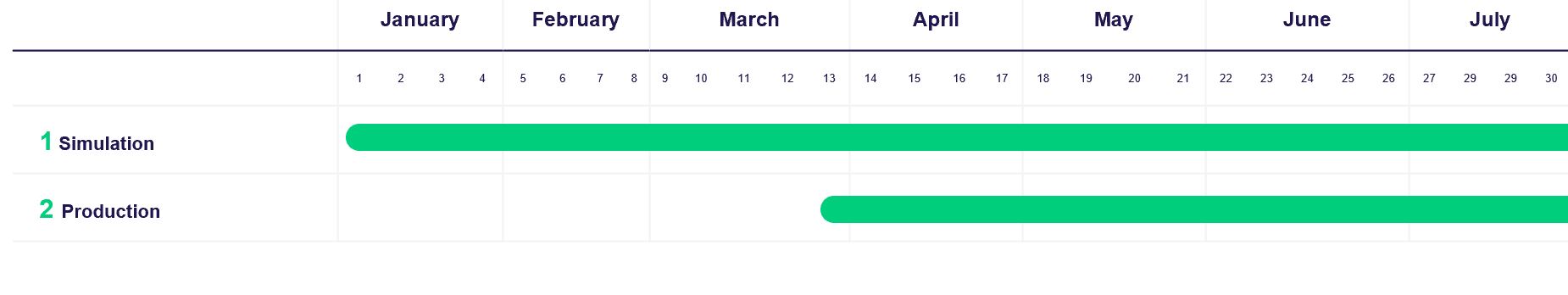

Simulation start: available

Production start: 29 March 2021

System Documentation

- Trading: The relevant system documents are under T7 Release 9.0 available.

- Clearing: The relevant system documents are under C7 Release 7.0.1 available.

Circulars

Readiness Videos

Participants Requirements

Feature/Enhancement | Details | Action Item |

Use of an admitted Compressor | Exchange Participants wishing to use compression need an agreement with an admitted Compressor. The compressor needs to be authorized to enter compression trades in the trading system. | An agreement with a compression service provider is needed. |

Compression processing | The Trade Entry Service (TES) facility will be utilized for the portfolio compression. | Trading Members wising to use compression, need to make sure their system can deal with the TES new Trade type “Compression”. |

| Compression time window | Compression trades can only be entered and released within the defined Portfolio Compression time: between 09:00 and 14:00 CET. | Compression providers need to make sure the compression is entered and released during the specified time. |

If you are interested in becoming an admitted Compressor at Eurex, please return the Portfolio Compressor form via email to your Onboarding Manager/Key Account Manager or to client.services@eurex.com.

Clearing Initiatives

Are you interested in the initiatives and releases on the Clearing side?

In case of any questions or your require further information, please contact us at client.services@eurex.com.

Are you looking for information on previous releases/projects? We have stored information about our previous releases/projects in our Archive for you!