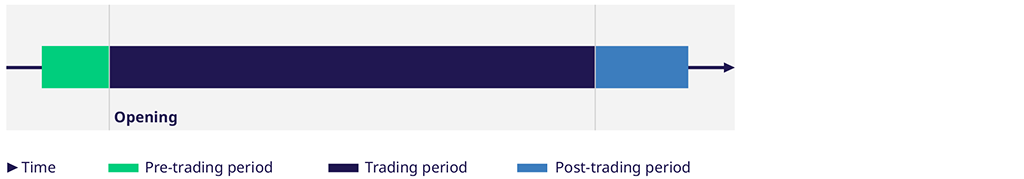

The opening period consists of several steps taken to uncross the order books and to start the continuous trading phase. Uncrossing is performed through an auction process during which matchable orders are executed, thereby creating an opening price for those contracts where a "crossed book" situation exists at the time of netting. It is not necessary, however, to actually determine opening prices for every product. The pre-opening period is characterized by the availability of potential opening prices, allowing traders to assess supply and demand. As in Pre-Trading Period, quotes and orders (other than for combinations and strategies) can be entered, changed or deleted, although only individually.

During the pre-opening period, Eurex can freeze the market for a particular product, allowing final review of potential opening prices by Eurex Market Supervision (which controls all trading activities at Eurex) before initiating the opening auction during the netting period. Freezing a product prevents orders or quotes from being entered, changed or deleted. Data inquiries are still permitted.

The netting process refers to the calculation of opening prices and transactions for all products, if possible. The basis for price determination is the price level that results in the maximum executable order volume (see the section on the auction principle). Existing orders and quotes are matched at that price to the extent possible. The netting period for a given product can end without an opening price being established. Once netting ends for a product, it automatically enters the trading period.