Eurex ── 全球唯一的美元/韓圜期貨的盤後交易場所

高流動性外匯期貨

韓國交易所(Korea Exchange, 以下簡稱KRX)的美元期貨(以韓圜計價)是2020年全球交易量前十大的外匯期貨和期權合約(由全球期貨行業協會FIA統計),2020年交易約1.1億口合約,2020年12月未平倉合約超過86萬口。

韓交所盤後時段的韓圜風險管理

由於市場參與者的強烈需求,KRX和歐洲期貨交易所(以下簡稱Eurex)繼續在"Eurex/KRX 產品鏈接"上開展產品合作,自2021 年7 月26 日起在Eurex 上推出基於KRX美元期貨的一日到期的美元/韓圜期貨。

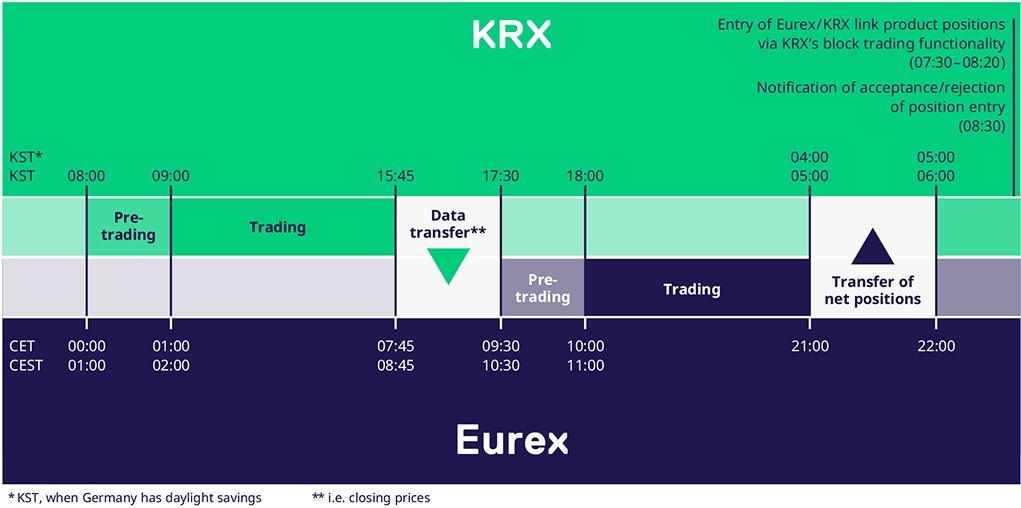

本產品規格與韓交所所掛牌的美元期貨合約相同。市場參與者可以在歐洲和美國的主要交易時間(18:00 KST 或 10:00 CET之後) 繼續交易Eurex美元/韓圜期貨。

對市場參與者的更多交易機遇

美元期貨的美元/韓圜一日到期期貨已得到美國商品期貨委員會(CFTC)的 批准,市場參與者可以在美國時區再次交易此產品。

- 主要优势

- 交易时段

- 合约规范

- 如何建立Eurex/KRX 鏈接合作

- 進入美元/韓圜期貨盤後市場

KRX美元期貨(以韓圜計價)是世界上最具有流動性的外匯衍生品之一。 Eurex/KRX 產品鏈接為市場參與者創造了一個平台,以便在歐洲和美國核心時區交易或對沖該產品

- 合約規格完全複製

Eurex一日到期的美元/韓圜期貨與相應韓交所的美元期貨可實現完全互換

- 交易所交易優勢

關鍵的交易所交易、清算和風險管理功能有助於降低交易對手風險,提高利潤率

一日到期的美元/韓圜期貨

最小變動單位 | 產品代碼 | 交易時間 | 最後交易日 | |

合約乘數 | 價格 | |||

一個一日到期的美元/韓圜期貨 | 0.1 點 (KRW 1,000) | 歐洲中部時間 10:00 - 21:00 / 11:00* – 21:00 * 歐洲中部夏令時間

| 最後交易日為最終結算日。 每天都是Eurex和KRX的交易日 | |

- Eurex基於KRX美元期貨推出了一日到期的美元/韓圜期貨

- Eurex 會員:必須與至少一名KRX會員建立業務關係,以便在美元期貨倉位上交割Eurex 一日到期的美元/韓圜期貨。 KRX會員:與至少一個 Eurex會員開立賬戶,以便接收韓國交易的Eurex一日到期的美元/韓圜期貨的訂單

- Eurex 會員在 Eurex 交易產品時,需要在訂單中明確指出 KRX 會員和最終受益人的專用ID 帳號。 KRX 會員可通過 Eurex 會員交易Eurex 一日到期的美元/韓圜期貨

- 保證金:收取Eurex的日內保證金結算貨幣之一(歐元/瑞士法郎/美元/英鎊)

- 清算:韓國結算銀行在 KST 15:00 (CET 07:00 或 08:00) 支付/接收韓圜的變動保證金

- 結算信息從Eurex清算所轉移到 KRX最終受益人

- 結算信息從 KRX 傳輸到各自的 KRX 會員

- 保證金檢查 – 通過 KRX 的 OTC 區塊交易功能將結算信息錄入 KRX 系統

- 確認結算信息錄入,合併Eurex一日到期的美元/韓圜期貨與KRX市場的美元期貨的頭寸

更多信息

Press Release | Eurex Asia

【新聞發布】歐交所和韓交所就提供韓元外匯合約進一步擴大產品連接合作

一日到期的美元/韓元期貨將於7月26日開始交易。歐交所是美元/韓元期貨的唯一盤後交易場所,同時美元/韓元期貨已獲得美國商品期貨委員會的批准並可在美國交易

聯繫我們

集中市場外匯交易商品銷售代表 Joshua Hurley 电话: +44 207 8 62-72 68 | Eurex亞洲銷售代表(外匯) Yap Hui Sze (Samantha) 电话:+65 6597 3061 |

Eurex銷售代表 (中國台灣) Chih-Chao Feng 电话:+852 2530 7802 | Eurex銷售代表(韓國) Jane Yeo (여지윤) 电话:+852 2530- 78 07 |