不受時區限制,享受無限交易機會

歐交所交易時間覆蓋全球各時區,為市場參與者提供更加靈活的交易選擇,便利其交易全球基準產品、更好應對市場變動。

季度交易量 - Eurex 亞洲時間 (以千為單位)

2025年2月份的交易高峰時間段為歐洲中部夏令時間上午03:00 - 07:00。

按產品分類每小時交易量(以千為單位)

2025年2月1日 至 2025年2月31日 的交易量數據。

- 優勢一覽

- 交易時段

- 交易商品

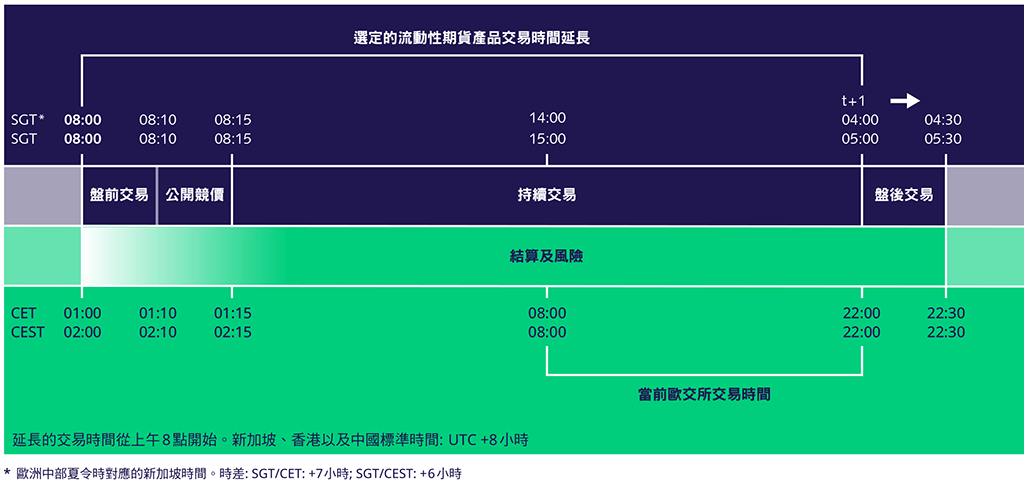

- 歐交所交易時段為市場參與者提供更多在亞洲及歐美時區的交易機會

01:00 CET - 08:00 CET (亞洲交易時段)

08:00 CET - 17:30 CET (歐洲交易時段)

17:30 CET - 22:00 CET (美國交易時段)

- 利差交易機會:

歐元10年國債 vs 日本國債

歐元10年國債 / 歐元2年國債 vs 澳洲國債 10s 及 澳洲國債 3s

以及其他的利差交易機會

- 主要的交易、清算及風險管理功能

在延長交易時間內對所有歐交所清算/非清算會員均開放,且無額外要求

包括T7系統的中央交易場外登記服務(TES)在內的核心交易、清算、風險功能將可以在延長的交易時間內正常使用。

請注意:隨著歐洲期貨交易所基準股指和固定收益產品的延長交易時間的引入,市場參與者應注意當天的訂單的有效期將從延長時間開始(時間為香港/ 新加坡/中國標準時間上午8點)到正常交易時間的結束。所有撤消前有效(GTC)和指定日期前有效(GTD)訂單在延長的交易時段內也將處於有效狀態,交易日的任何停損單也將在延長的交易時段內進行。

更多的符合亞洲市場需求的產品將隨後陸續加入我們的產品線。

| 期貨 | 產品代碼 |

| 德國藍籌DAX®指數期貨 (FDAX) 小型德國藍籌DAX®指數期貨(FDXM) 微型德國藍籌DAX®指數期貨 (FDXS) | |

| STOXX® 指數 | 歐元藍籌STOXX 50®指數期貨 (FESX) |

VSTOXX 波動率指數期貨 (FVS) | |

| 詳見產品規格 | |

| 德國10年國債期貨 Euro-Bund (FGBL) 德國5年國債期貨 Euro-Bobl (FGBM) 德國2年國債期貨 Euro-Schatz (FGBS) 德國20年國債期貨 Euro-Buxl® (FGBX) 法國10年國債期貨 Euro-OAT (FOAT) | |

富時比特幣指數期貨 (歐元) (FBTE) |

教育視頻

聯繫方式

客戶拓展主管 (亞洲) Mezhgan Qabool | 客戶拓展主管 Markus Georgi | 銷售代表 (加密貨幣衍生商品) Xing Wai Lim T: +65 91527352 |

銷售代表 Neo Chiu | 銷售代表 Neil Salter | 會員服務 服务时段:09:00 - 18:00 CET T: +49-69-211-10 333 |