MSCI指數

MSCI指數是全球被最廣泛追踪的的基準指數之一,與之相關的標的價值超過16.3兆美元。 近1,300支交易所交易基金(ETFs)使用MSCI指數作爲基礎。 以MSCI指數爲基準的大量資本以及通過相關ETFs産品提高的可交易性,引發了對MSCI期貨和選擇權的需求增加。MSCI衍生品可幫助基金經理促進資金流動,對沖現有股票敞口並提高投資組合績效。

180+ MSCI衍生品

Eurex是唯一一家提供全面的區域和國家MSCI指數的期貨及選擇權産品組合的交易所:目前提供156支MSCI期貨和26支MSCI選擇權、涵蓋不同指數類型(NTR、GTR 和價格指數)和不同貨幣(歐元、美元、英鎊和日元)的新興市場(EM)和發達市場(DM)。

- 優勢一覽

- 合約規範

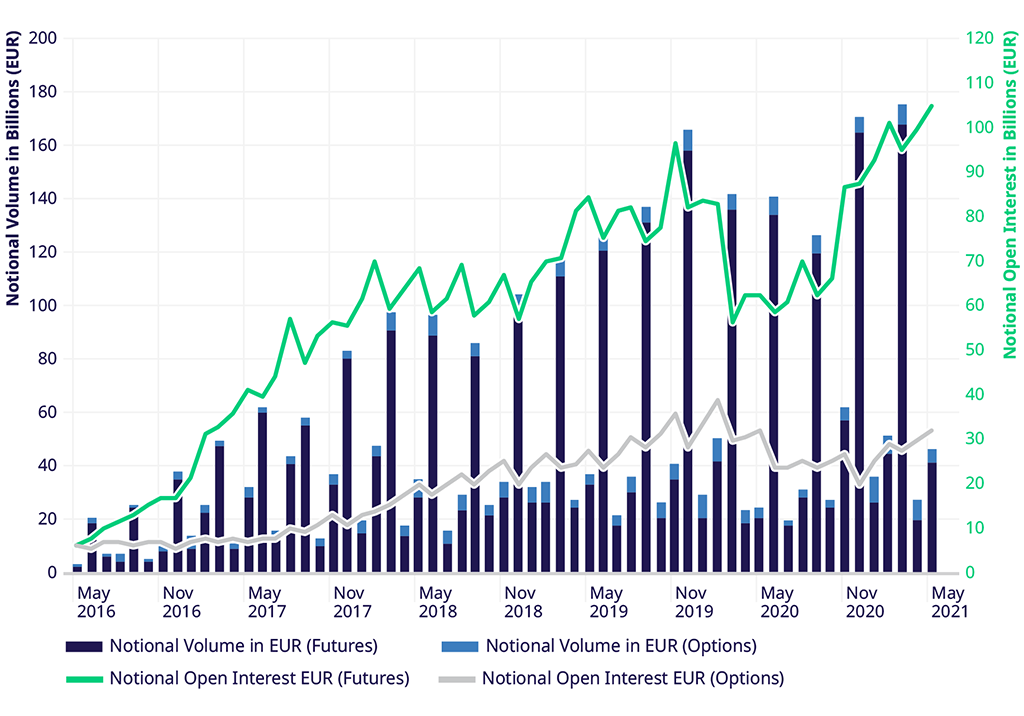

- 交易量增長趨勢

- 清算

- 直接期貨合約和展期合約的高流動性

- 産品範圍廣:156支MSCI期貨和26支MSCI選擇權

- 交易時間延長至涵蓋3個時區,幷提供完整的清算和風險管理

- 無持倉限制

- 大宗交易規模沒有限制門檻

- 投資組合保證金可與其主要股票衍生品相抵消

基于投資組合的保證金管理系統(PRISMA)最大程度地提供了股票衍生品中交叉保證金抵消

歐洲期貨交易所Eurex Exchange是歐洲最大的衍生品交易所,爲投資者提供了最廣泛的股票指數衍生品投資渠道,我們基于投資組合的保證金管理系統(PRISMA)最大程度地提供了股票衍生品中交叉保證金抵消。 如需充分利用交叉保證金系統,請翻閱我們的 Eurex Clearing Prisma手册。要獲得高度精確的模擬方案和增量風險計算,請使用我們的雲保證金估價器。

視頻與文章

切換到MSCI衍生品的全球發源地

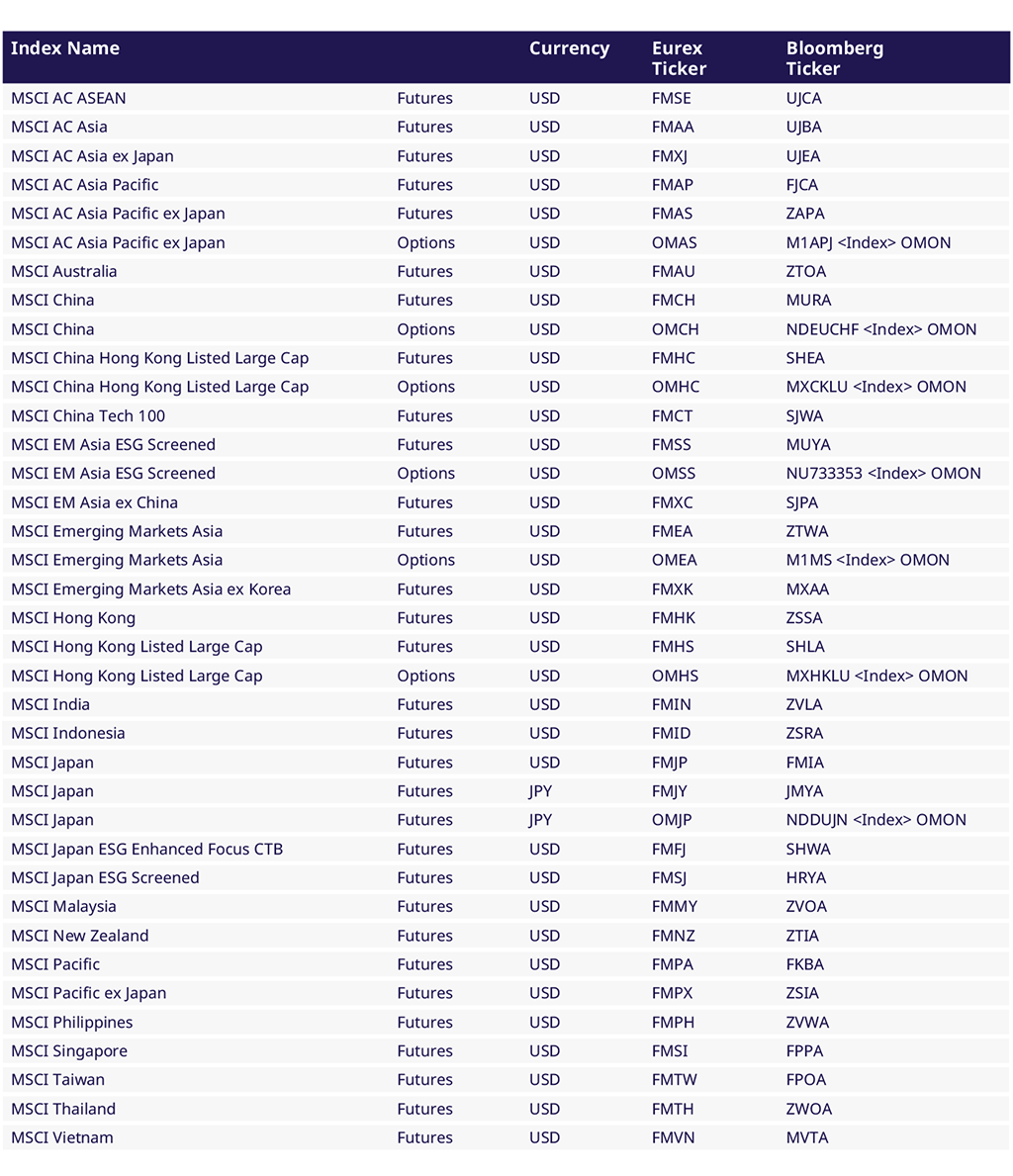

- MSCI亞洲主要基準産品

切換到MSCI衍生品的全球發源地

隨著亞洲的一個交易所宣布將MSCI衍生品退市,Eurex對其MSCI産品的興趣逐漸上升。 Eurex橫跨所有時區提供最全面的MSCI衍生品組合,包括直接可用的替代産品。如下Eurex現有合約與將要退市的MSCI合約相重合。

聯繫方式

客戶拓展主管 (亞洲) Mezhgan Qabool 歐交所新加坡辦事處 | 銷售代表 Neo Chiu 歐交所香港辦事處 |